On December 31, 2022, Grover Company made the following errors: a. Did not accrue interest of $7,500

Question:

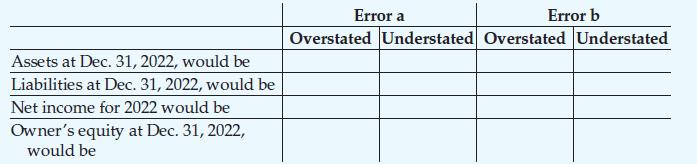

On December 31, 2022, Grover Company made the following errors:

a. Did not accrue interest of $7,500 owed on loans due next year

b. Did not accrue service revenue in the amount of $9,200.

Assuming the financial statements are prepared before the errors are discovered, state the effects of each error on the financial statement elements by completing the chart below.

Transcribed Image Text:

Assets at Dec. 31, 2022, would be Liabilities at Dec. 31, 2022, would be Net income for 2022 would be Owner's equity at Dec. 31, 2022, would be Error a Error b Overstated Understated Overstated Understated

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (8 reviews)

Error a Assets at Dec 31 2022 would be understated Liabilities at Dec 31 20...View the full answer

Answered By

Aketch Cindy Sunday

I am a certified tutor with over two years of experience tutoring . I have a passion for helping students learn and grow, and I firmly believe that every student has the potential to be successful. I have a wide range of experience working with students of all ages and abilities, and I am confident that I can help students succeed in school.

I have experience working with students who have a wide range of abilities. I have also worked with gifted and talented students, and I am familiar with a variety of enrichment and acceleration strategies.

I am a patient and supportive tutor who is dedicated to helping my students reach their full potential. Thank you for your time and consideration.

0.00

0 Reviews

10+ Question Solved

Related Book For

Horngrens Accounting Volume 1

ISBN: 9780136889373

12th Canadian Edition

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura

Question Posted:

Students also viewed these Business questions

-

On December 31, 2015, Grover Company made the following errors: a. Did not accrue interest of $7,500 owed on loans due next year b. Did not accrue service revenue in the amount of $9,200 Assuming the...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

Analyzing the Effects of Errors on Financial Statement Items Cohen & Boyd, Inc., publishers of movie and song trivia books, made the following errors in adjusting the accounts at year-end (December...

-

Neo-Darwinism believes that new species develop through (A).Continuous variations and natural selection (B) Mutation with natural selection (C) Hybridization (D) Mutation

-

Identify the types of inefficiency (allocational, operational, or informational) described below: a. The Lower Red River stock market is characterized by very high transaction costs and, due to...

-

In 1975 the price of a new house was $49,967. In 2020 the price of a new house is $177,134. How much has the price of housing increased over the entire time period in percentage terms? State your...

-

What Can We All Do to Become Great Leaders? (pp. 5456)

-

Suppose Intel wishes to raise USD1 billion and is deciding between a domestic dollar bond issue and a Eurobond issue. The U.S. bond can be issued at a 5-year maturity with a coupon of 4.50%, paid...

-

The two methods for presenting component units in the financial statements are aggregated and disaggregated. True False

-

Black Media Inc. owns and operates a large number of news-papers across Canada. On 1 October 20X5, the board of directors voted unanimously to dispose of one of those newspapers, The Daily Con. Black...

-

Blazing Software Consulting had the following accounts and account balances after adjusting entries. Assume all accounts have normal balances. Prepare the adjusted trial balance for Blazing Software...

-

Compute Yessie Financial Advisors net income for the year ended December 31, 2023, using the adjusted trial balance below. Account Title Cash Office Supplies YESSIE FINANCIAL ADVISORS Adjusted Trial...

-

As a result of tests of controls, an auditor assessed control risk too low and decreased substantive testing. This assessment occurred because the true deviation rate in the population was a. Less...

-

Assume a Poisson distribution with =5.6. Find the following probabilities. a. X=1 b. X <1 c. X>1 d. X1 a. P(X=1)= (Round to four decimal places asneeded.) b. P(X <1)= (Round to four decimal places...

-

345879 The any reported the following January purchases and sales data for its only prauct. The company uses a perpetual inventory system. REQUIRED: Determine the cost assigned to ending inventory...

-

How do changing geopolitical landscapes, such as shifting alliances and emerging power centers, influence conflict resolution strategies, and what adjustments are necessary to address new global...

-

50 21 2. Determine the inclination and period of the satellite which produced the ground trace below. Show all calculations. Suteite 17 11-140-130-120-110 tonn an 20 6058 am 50 210 0 10 20 30 50 60...

-

This activity aims to provide practical experience in preparing tax forms related to business income and depreciation. It emphasizes the importance of accurate reporting and adherence to tax...

-

What are the implications of Peak Oil on future global energy supplies?

-

An access route is being constructed across a field (Figure Q8). Apart from a relatively firm strip of ground alongside the field's longer side AB, the ground is generally marshy. The route can...

-

Review your results from preparing Safety Security Systemss bank reconciliation in Short Exercise S7-8. Journalize the companys transactions that arise from the bank reconciliation. Include an...

-

Garden Haven has excess cash of $15,000 at the end of the harvesting season. Garden Haven will need this cash in four months for normal operations. Requirements 1. What are some reasons why Garden...

-

Due to recent beef recalls, Southwest Steakhouse is considering incorporating. Bob, the owner, wants to protect his personal assets in the event the restaurant is sued. Requirements 1. Which...

-

The payroll register of Ruggerio Co. indicates $13,800 of social security withheld and $3,450 of Medicare tax withheld on total salaries of $230,000 for the period. Federal withholding for the period...

-

All of the following are included on Form 1040, page 1, EXCEPT: The determination of filing status. The Presidential Election Campaign check box. The income section. The paid preparer signature line.

-

Question One: (25 marks) (X) Inc. purchased 80% of the outstanding voting shares of (Y) for $360,000 on July 1, 2017. On that date, (Y) had common shares and retained earnings worth $180,000 and...

Study smarter with the SolutionInn App