Prepare Camilia Communications multi-step income statement for the year ended July 31, 2024. Camilia Communications reported the

Question:

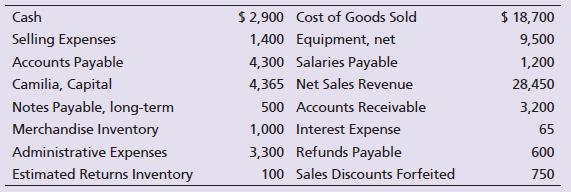

Prepare Camilia Communications’ multi-step income statement for the year ended July 31, 2024.

Camilia Communications reported the following figures from its adjusted trial balance for its first year of business, which ended on July 31, 2024:

Transcribed Image Text:

Cash Selling Expenses Accounts Payable Camilia, Capital Notes Payable, long-term Merchandise Inventory Administrative Expenses Estimated Returns Inventory $2,900 Cost of Goods Sold 1,400 Equipment, net 4,300 Salaries Payable 4,365 Net Sales Revenue 500 Accounts Receivable 1,000 Interest Expense 3,300 Refunds Payable 100 Sales Discounts Forfeited $ 18,700 9,500 1,200 28,450 3,200 65 600 750

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (6 reviews)

CAMILIA COMMUNICATIONS Income Statement Year Ended July 31 2024 Net Sales Re...View the full answer

Answered By

Gilbert Chesire

I am a diligent writer who understands the writing conventions used in the industry and with the expertise to produce high quality papers at all times. I love to write plagiarism free work with which the grammar flows perfectly. I write both academics and articles with a lot of enthusiasm. I am always determined to put the interests of my customers before mine so as to build a cohesive environment where we can benefit from each other. I value all my clients and I pay them back by delivering the quality of work they yearn to get.

4.80+

14+ Reviews

49+ Question Solved

Related Book For

Horngrens Accounting The Financial Chapters

ISBN: 9780136162186

13th Edition

Authors: Tracie Miller Nobles, Brenda Mattison

Question Posted:

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

Prepare Honeyglazed Hams, Inc's income statement for the year ended December 31 2012 and its balance sheet on that date. Let's start with the income statement. Honeyglazed Hams, Inc. Adjusted Trial...

-

The condensed single-step income statement for the year ended December 31, 2014, of Conti Chemical Company, a distributor of farm fertilizers and herbicides, follows. Selected accounts from Conti...

-

The condensed single-step income statement for the year ended December 31, 20Ã9, of Sunderland Chemical Company, a distributor of farm fertilizers and herbicides, appears as follows: Selected...

-

How does MacKinnon analyze cases of sexual harassment where the woman complies with the sexual advance? She suggests that these cases are therefore not wrongful. She suggests that these cases are too...

-

The relationship between the strength and fineness of cotton fibers was the subject of a study that produced the data below. a. Draw a scatter diagram. b. Find the 99% confidence interval for the...

-

When first issued, a stock provides funds for a company. Is the same true of a stock option? Discuss.

-

21. For a stock index, S = $100, = 30%, r = 5%, = 3%, and T = 3. Let n = 3. a. What is the price of a European call option with a strike of $95? b. What is the price of a European put option with a...

-

For each of the following products, suggest three measures of quality: a. Television set b. University course c. Meal in an exclusive restaurant d. Carryout meal from a restaurant e. Container of...

-

Introductory Financial Accounting Individual Assignnent 2 Question 1 Ready-Set-Go. Ltd distributes suitcases to retail stores. At the end of November, Ready-Ser Go's inventory consisted of suitcases...

-

Prepare a Consolidated Balance Sheet for Big Lake Bakeries which owns 100% of Marble Falls Orchards. The fair value of Marble Falls net fixed assets are $2,675,000. Big Lake aquired 100% of Marble...

-

1. Prepare Camilia Communications statement of owners equity for the year ended July 31, 2024. Assume that there were no contributions or withdrawals during the year and that the business began on...

-

M Wholesale Company began the year with merchandise inventory of $12,000. During the year, M purchased $92,000 of goods, had purchase discounts of $100, and returned $6,000 due to damage. M also paid...

-

How can zoning affect location for a home-based business?

-

Test - LOG 2060 Intermediate Systems Sustainment Management T07.E02 Describe DoD's Depot Maintenance Enterprise and How Core, 50-50, and Partnering Initiatives Question 30 of 31. In depot...

-

Assuming that StickerGiant plans to expand its business to overseas markets, what are the top 3 environmental factors (economic, political/legal, demographic, social, competitive, global, and...

-

Selina is an avid sky diver. How would an insurer rate the severity/probability of the risks to which Selina is exposed? a) minor/low b) critical/high c) material/medium d) critical/low

-

Primare Corporation has provided the following data concerning last month's manufacturing operations. Purchases of raw materials Indirect materials used in production Direct labor Manufacturing...

-

Perpendicular Offset Practice Problem Find the perpendicular offset and station of Point K relative to line JL. Point K N 2423.58 Point L. Point J N 2537.19 N 2399.34 E 1774.94 E 2223.41 E 2445.15

-

Give pseudocode for an efficient multithreaded algorithm that transposes an n n matrix in place by using divide-and-conquer to divide the matrix recursively into four n/2 n/2 submatrices. Analyze...

-

The domain of the variable in the expression x 3/x + 4 is________.

-

Describe the operating cycle of a merchandiser.

-

What is an invoice?

-

What account is debited when recording a purchase of inventory when using the perpetual inventory system?

-

Which of the following programs covers custodial care? A HMOs B Medicare Part B C PPOs D Medicare Part A E Medicaid

-

uppose a taxpayer has exhausted his lifetime exclusion amount and has $14 million. a. Assuming a flat 40% gift tax rate, what is the maximum amount a taxpayer can transfer to her daughter (and still...

-

Physical Units Method, Relative Sales Value Method Farleigh Petroleum, Inc., is a small company that acquires high - grade crude oil from low - volume production wells owned by individuals and small...

Study smarter with the SolutionInn App