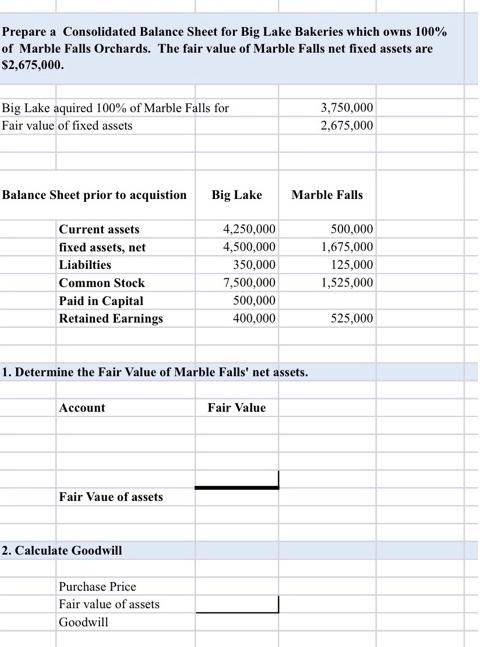

Prepare a Consolidated Balance Sheet for Big Lake Bakeries which owns 100% of Marble Falls Orchards. The fair value of Marble Falls net fixed

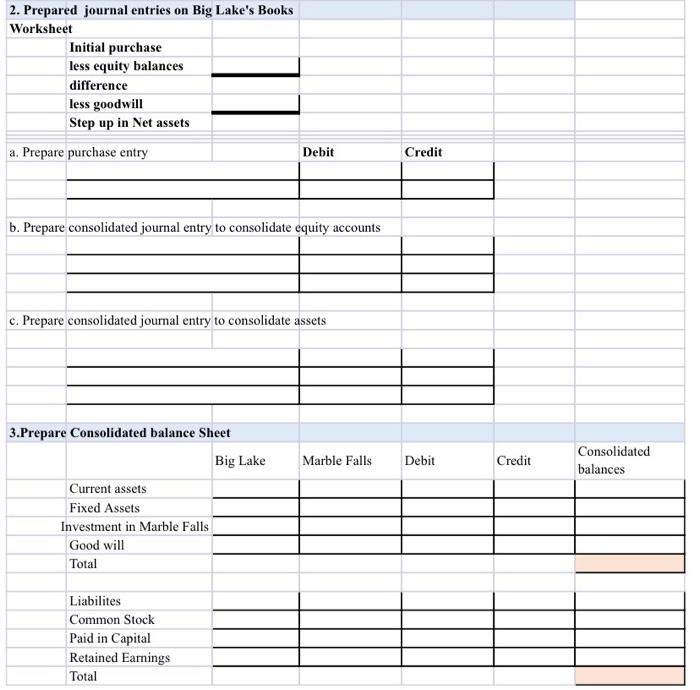

Prepare a Consolidated Balance Sheet for Big Lake Bakeries which owns 100% of Marble Falls Orchards. The fair value of Marble Falls net fixed assets are $2,675,000. Big Lake aquired 100% of Marble Falls for Fair value of fixed assets Balance Sheet prior to acquistion Current assets fixed assets, net Liabilties Common Stock Paid in Capital Retained Earnings Account Fair Vaue of assets 1. Determine the Fair Value of Marble Falls' net assets. 2. Calculate Goodwill Big Lake Purchase Price Fair value of assets Goodwill 4,250,000 4,500,000 350,000 7,500,000 500,000 400,000 Fair Value 3,750,000 2,675,000 Marble Falls 500,000 1,675,000 125,000 1,525,000 525,000 2. Prepared journal entries on Big Lake's Books Worksheet Initial purchase less equity balances difference less goodwill Step up in Net assets a. Prepare purchase entry b. Prepare consolidated journal entry to consolidate equity accounts c. Prepare consolidated journal entry to consolidate assets 3.Prepare Consolidated balance Sheet Current assets Fixed Assets Investment in Marble Falls Good will Total Debit Liabilites Common Stock Paid in Capital Retained Earnings Total Big Lake Marble Falls Credit Debit Credit Consolidated balances

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Determine the Fair Value of Marble Falls net assets Account Current Assets ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started