Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jodie is to commence trading on 6th April 2020 as an architect. It is anticipated that her profits for his first year of trading

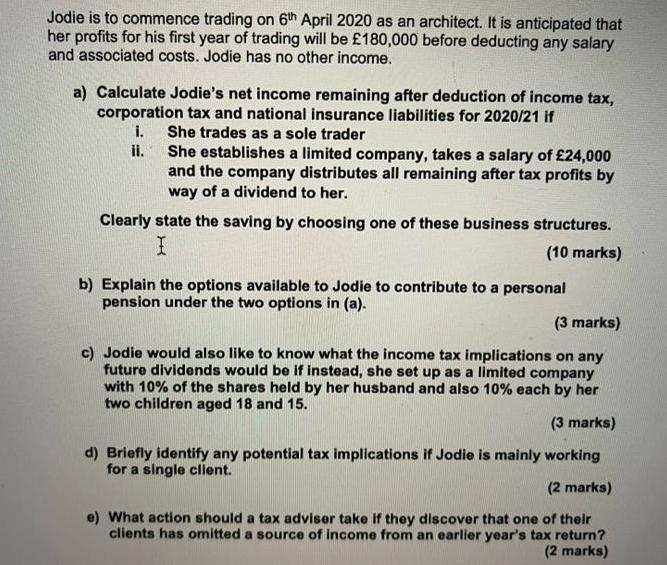

Jodie is to commence trading on 6th April 2020 as an architect. It is anticipated that her profits for his first year of trading will be 180,000 before deducting any salary and associated costs. Jodie has no other income. a) Calculate Jodie's net income remaining after deduction of income tax, corporation tax and national insurance liabilities for 2020/21 if i. ii. She trades as a sole trader She establishes a limited company, takes a salary of 24,000 and the company distributes all remaining after tax profits by way of a dividend to her. Clearly state the saving by choosing one of these business structures. I (10 marks) b) Explain the options available to Jodie to contribute to a personal pension under the two options in (a). (3 marks) c) Jodie would also like to know what the income tax implications on any future dividends would be if instead, she set up as a limited company with 10% of the shares held by her husband and also 10% each by her two children aged 18 and 15. (3 marks) d) Briefly identify any potential tax implications if Jodie is mainly working for a single client. (2 marks) e) What action should a tax adviser take if they discover that one of their clients has omitted a source of income from an earlier year's tax return? (2 marks)

Step by Step Solution

★★★★★

3.45 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate Jodies net income remaining after deduction of income tax corporation tax and national insurance liabilities for 202021 if i She trades as a sole trader ANSWER Jodies net income after dedu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started