Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Each scenario in this question is independent. Please read them carefully and answer each part. (a) Big Green Limited is a producer of apples.

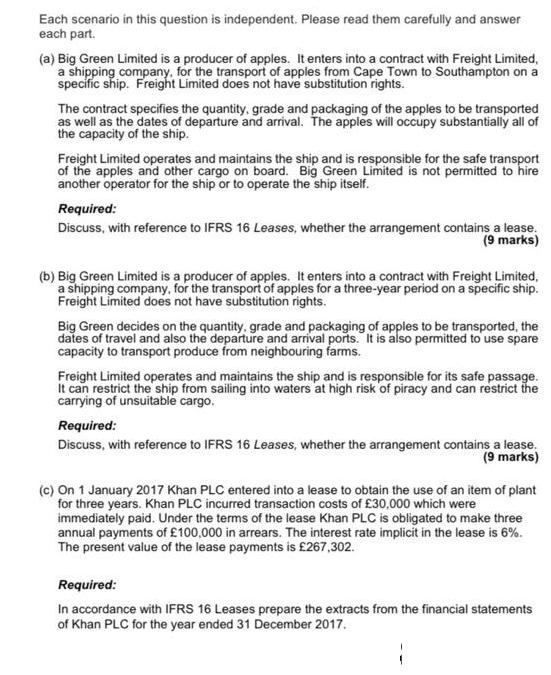

Each scenario in this question is independent. Please read them carefully and answer each part. (a) Big Green Limited is a producer of apples. It enters into a contract with Freight Limited, a shipping company, for the transport of apples from Cape Town to Southampton on a specific ship. Freight Limited does not have substitution rights. The contract specifies the quantity, grade and packaging of the apples to be transported as well as the dates of departure and arrival. The apples will occupy substantially all of the capacity of the ship. Freight Limited operates and maintains the ship and is responsible for the safe transport of the apples and other cargo on board. Big Green Limited is not permitted to hire another operator for the ship or to operate the ship itself. Required: Discuss, with reference to IFRS 16 Leases, whether the arrangement contains a lease. (9 marks) (b) Big Green Limited is a producer of apples. It enters into a contract with Freight Limited, a shipping company, for the transport of apples for a three-year period on a specific ship. Freight Limited does not have substitution rights. Big Green decides on the quantity, grade and packaging of apples to be transported, the dates of travel and also the departure and arrival ports. It is also permitted to use spare capacity to transport produce from neighbouring farms. Freight Limited operates and maintains the ship and is responsible for its safe passage. It can restrict the ship from sailing into waters at high risk of piracy and can restrict the carrying of unsuitable cargo. Required: Discuss, with reference to IFRS 16 Leases, whether the arrangement contains a lease. (9 marks) (c) On 1 January 2017 Khan PLC entered into a lease to obtain the use of an item of plant for three years. Khan PLC incurred transaction costs of 30,000 which were immediately paid. Under the terms of the lease Khan PLC is obligated to make three annual payments of 100,000 in arrears. The interest rate implicit in the lease is 6%. The present value of the lease payments is 267,302. Required: In accordance with IFRS 16 Leases prepare the extracts from the financial statements of Khan PLC for the year ended 31 December 2017.

Step by Step Solution

★★★★★

3.55 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

aYes the arrangement contains a lease Under IFRS 16 Leases a lease is defined as an agreement between two parties in which one party conveys the right to use an asset to the other party for an agreed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started