Prepare the operating section of Preston Media Corporations 2020 cash flow statement using the indirect method. Use

Question:

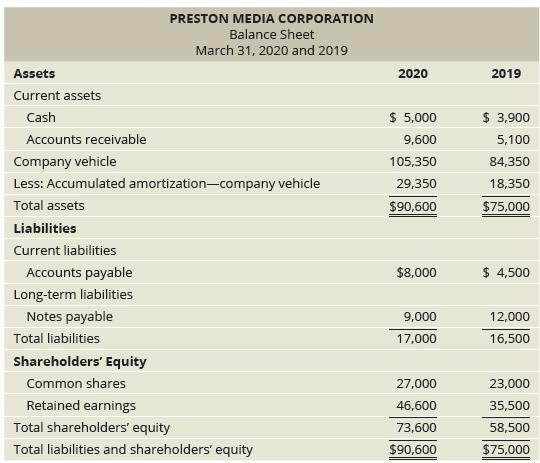

Prepare the operating section of Preston Media Corporation’s 2020 cash flow statement using the indirect method.

Use the comparative balance sheet provided and the following selected fiscal 2020 income statement information:

• Net income, $19,000

• Amortization expense, $11,000

PRESTON MEDIA CORPORATION Balance Sheet March 31, 2020 and 2019 Assets 2020 2019 Current assets Cash $ 5,000 $ 3,900 Accounts receivable 9,600 5,100 Company vehicle 105,350 84,350 Less: Accumulated amortization-company vehicle 29.350 18,350 Total assets $90,600 $75,000 Liabilities Current liabilities Accounts payable $8,000 $ 4,500 Long-term liabilities Notes payable 9,000 12,000 Total liabilities 17,000 16,500 Shareholders' Equity Common shares 27,000 23,000 Retained earnings 46,600 35,500 Total shareholders' equity 73,600 58,500 Total liabilities and shareholders' equity $90,600 $75,000

Step by Step Answer:

Horngrens Accounting

ISBN: 9780135359785

11th Canadian Edition Volume 2

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann Johnston, Peter R. Norwood

Related Video

In order to determine the amount of cash created by operating operations, the indirect technique for preparing the statement of cash flows entails adjusting net income with changes in balance sheet.

Students also viewed these Business questions

-

The following information is taken from the operating section of the statement of cash flows (direct method) of Battery Builders, Inc.: Collections from customers ............ $28,000 Payments to...

-

The operating section of the 2014 consolidated statement of cash flows for Imation Corporation, a global technology company, is excerpted in the following table (dollars in millions): REQUIRED: a....

-

Fort Inc. prepares its cash flow statement using the direct method for operating activities. Identify the section of Fort Inc.'s cash flow statement where the results of each of the following...

-

Below is the comparative income statement of Variline, Inc. Requirements 1. Prepare a horizontal analysis of the comparative income statement of Variline, Inc. Round percentage changes to the nearest...

-

Conduct the following analysis on the outdoor lifestyle data given in Internet and Computer Exercises 2 of Chapter 15. Consider only the following variables: the importance attached rotation.) to...

-

(a) Jenny Kent asks your help in understanding the term activity index. Explain the meaning and importance of this term for Jenny. (b) State the two ways that variable costs may be defined.

-

What is the difference between a product cost and a period cost? AppendixLO1

-

Martell Mining Companys ore reserves are being depleted, so its sales are falling. Also, its pit is getting deeper each year, so its costs are rising. As a result, the companys earnings and dividends...

-

10. Mega Consultancy conducts its activities from two properties, a head office in Kuala Lumpur and another property in Kajang used as a staff Property, Plant and Equipment training centre. Both...

-

In Problem 13.5 on page 493, you used the summated rating to predict the cost of a restaurant meal. Perform a residual analysis for these data (stored in Restaurants). Evaluate whether the...

-

Innisfil Ice Hunt Rentals Inc. reported a net cash flow from operating activities of $40,625 on its cash flow statement for the year ended December 31, 2020. The following information was reported in...

-

Apple Distillery Inc. accountants have assembled the following data for the year ended June 30, 2020: Prepare the operating activities section of Apple Distillery Inc.s cash flow statement for the...

-

What is GAAP? What is IFRS?

-

Solve these question in details and fully explaination. It is the pre-lab working for Capacitors. Thanks so much in advance. 1: The figure shows a circuit with a charged capacitor (left), two...

-

Exercise 10-14A (Algo) Straight-line amortization of a bond discount LO 10-4 Diaz Company issued bonds with a $112,000 face value on January 1, Year 1. The bonds had a 8 percent stated rate of...

-

1. What would we have to plot on the vertical axis? EXPLAIN YOUR ANSWER OR NO CREDIT. [Hint: Solve for k first.] F= Kx kx dala you Experi determine the K= K = F Cart SHOW ALL WORK OR NO CREDITI 2....

-

You are interested in computing the heat transfer properties of a new insulation system shown here. Tair Air Layer 1 Layer 2 T P

-

16.3 The demand function for replicas for the Statue of Liberty is given by f(p): = 500 - 2p, where f(p) is the number of statues that can be sold for p dollars. (a) What is the relative rate of...

-

An online retailer ships products from overseas with an advertised delivery date within 10 days. To test whether or not deliveries are made within the advertised time, a random sample of 10 orders is...

-

An auto-parts manufacturer is considering establishing an engineering computing center. This center will be equipped with three engineering workstations each of which would cost $25,000 and have a...

-

Identify each cost below as variable (V), fixed (F), or mixed (M), relative to units sold. Explain your reason. 100 Units Sold a. Total phone cost b. Materials cost per unit C. Manager's salary d....

-

Following is the income statement for Marsden Mufflers for the month of June 2016: MARSDEN MUFFLERS Contribution Margin Income Statement Month Ended June 30, 2016 Sales Revenue (280 units $325)...

-

This problem continues the Daniels Consulting situation from Problem P19-44 of Chapter 19. Daniels Consulting provides consulting service at an average price of $120 per hour and incurs variable cost...

-

Duncan Inc. issued 500, $1,200, 8%, 25 year bonds on January 1, 2020, at 102. Interest is payable on January 1. Duncan uses straight-line amortization for bond discounts or premiums. INSTRUCTIONS:...

-

WISE-HOLLAND CORPORATION On June 15, 2013, Marianne Wise and Dory Holland came to your office for an initial meeting. The primary purpose of the meeting was to discuss Wise-Holland Corporation's tax...

-

Stock in ABC has a beta of 0.9. The market risk premium is 8%, and T-bills are currently yielding 5%. The company's most recent dividend is $1.60 per share, and dividends are expected to grow at a 6%...

Study smarter with the SolutionInn App