The 2020 comparative balance sheet and income statement of Shock Electricity Inc. follow: Shock Electricity had no

Question:

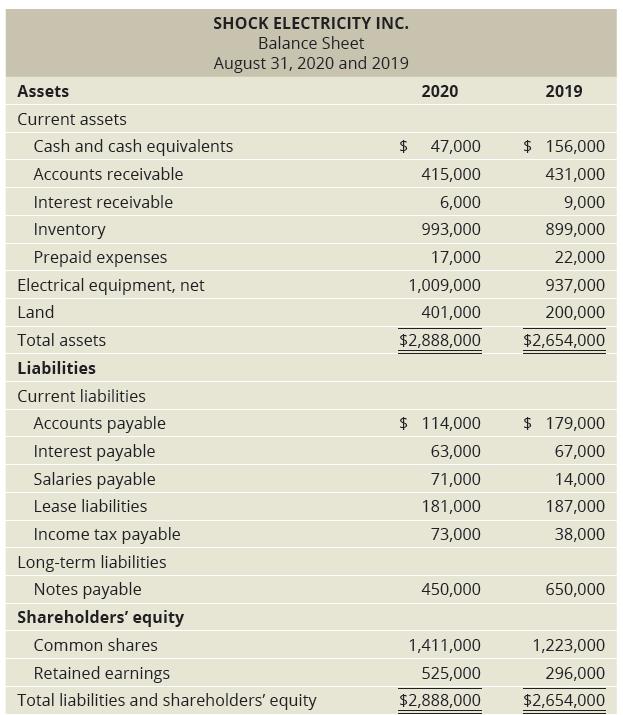

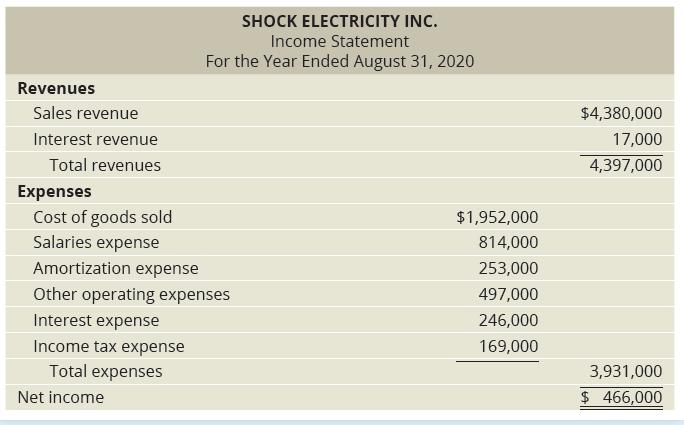

The 2020 comparative balance sheet and income statement of Shock Electricity Inc. follow:

Shock Electricity had no non-cash investing and financing transactions during 2020. During the year, there were no sales of land or electrical equipment, no issuances of notes payable, and no repurchase of common shares.

Required

1. Prepare the cash flow statement by the indirect method for 2020.

2. Evaluate the cash flow for this company.

SHOCK ELECTRICITY INC. Balance Sheet August 31, 2020 and 2019 Assets 2020 2019 Current assets Cash and cash equivalents $ 47,000 $ 156,000 Accounts receivable 415,000 431,000 Interest receivable 6,000 9,000 Inventory 993,000 899,000 Prepaid expenses 17,000 22,000 Electrical equipment, net 1,009,000 937,000 Land 401,000 200,000 Total assets $2,888,000 $2,654,000 Liabilities Current liabilities Accounts payable $ 114,000 $ 179,000 Interest payable 63,000 67,000 Salaries payable 71,000 14,000 Lease liabilities 181,000 187,000 Income tax payable 73,000 38,000 Long-term liabilities Notes payable Shareholders' equity 450,000 650,000 Common shares 1,411,000 1,223,000 Retained earnings 525,000 296,000 Total liabilities and shareholders' equity $2,888,000 $2,654,000

Step by Step Answer:

ANSWER 1 Calculation of Cash Flows from Operating Activities Net Income 466000 Add Depreciation and ...View the full answer

Horngrens Accounting

ISBN: 9780135359785

11th Canadian Edition Volume 2

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann Johnston, Peter R. Norwood

Related Video

In order to determine the amount of cash created by operating operations, the indirect technique for preparing the statement of cash flows entails adjusting net income with changes in balance sheet.

Students also viewed these Business questions

-

The 2014 comparative balance sheet and income statement of 4 Seasons Supply Corp. follow. 4 Seasons had no non-cash investing and financing transactions during 2014. During the year, there were no...

-

The 2017 comparative balance sheet and income statement of 4 Seasons Supply Corp. follow. 4 Seasons had no non-cash investing and financing transactions during 2017. During the year, there were no...

-

The 2012 comparative balance sheet and income statement of Rolling Hills, Inc., follow: Additionally, Rolling Hills purchased land of $23,600 by financing it 100% with long-term notes payable during...

-

As the marketing manager for a local shopping center, you are asked to prepare a report outlining the external influences that should be considered in the situation analysis. Describe each category...

-

You have been hired as a marketing research analyst by a major industrial marketing company in the country. Your boss, the market research manager, is a high powered statistician who does not believe...

-

Presented below are two independent transactions. (a) St. Pierre Restaurant accepted a Visa card in payment of a $150 lunch bill. The bank charges a 4% fee. What entry should St. Pierre make? (b)...

-

Access the September 24, 2011, 10-K report for Apple, Inc. (Ticker AAPL), filed on October 26, 2011, from the EDGAR filings at www.SEC.gov. Required 1. What products are manufactured by Apple? 2....

-

In the chapter, we examined the difference between white and black students in the timing of when they first tried cigarettes. In this SPSS output based upon MTF11SSDS, we examine the grade when...

-

What single payment six months from now would be economically equivalent to payments of $850 due (but not paid) four months ago and $1150 due in 12 months? Assume money can earn 2.5% compounded...

-

Carmen Dahlen opened a secretarial school called Star office Training. a. Dahlen contributed the following assets to the business: Cash ........$5,700 Computers ....... 5,000 Office Equipments ......

-

The 2020 income statement and comparative balance sheet of Mandarin Design Ltd. follow: Mandarin Design Ltd. had no non-cash financing and investing transactions during 2020. During the year, there...

-

Computer Doctor Ltd. has asked for your help in comparing the companys profit performance and financial position with the computer services industry average. The manager has given you the companys...

-

Does empirical evidence support the trade-off models?

-

inverse function of f ( x ) = 9 - 8 e ^ x

-

Let = <3,2,-1) = < 1,3 -> W=

-

1. This is a group assignment, and the lecturer will create and finalize assignment groups in week 3/4. (4-5 members in each group). 2. Identify a problem (only one problem relating to OB) in an...

-

Fromthefollowinginformation, preparejournalentriestodistributetransportationexpenses(ontheaverage rate permilepermonthmethod)andstoresexpenses. Truckmileageduringthemonth:...

-

2 Staffing at the Optimal Utilization A large theme park is attempting to staff its check-in desks. Currently, the arrival rate is A = 364.5 customers per hour, and each server can check-in p=81...

-

The Rose Co. has earnings of $3.41 per share. The benchmark PE for the company is 18. What stock price would you consider appropriate? What if the benchmark PE were 21?

-

For all of the following words, if you move the first letter to the end of the word, and then spell the result backwards, you will get the original word: banana dresser grammar potato revive uneven...

-

In 100 words or fewer, explain the difference between NPV and IRR.

-

Rocky Mountain Waterpark sells half of its tickets for the regular pnce of $75. The other half go to senior citizens and children for the discounted pnce of $35 Variable cost per guest is $15 for...

-

Gell Corporation manufactures computers. Assume that Gell: Allocates manufacturing overhead based on machine hours Estimated 12,000 machine hours and $93,000 of manufacturing overhead costs ...

-

September 1 . Purchased a new truck for $ 8 3 , 0 0 0 , paying cash. September 4 . Sold the truck purchased January 9 , Year 2 , for $ 5 3 , 6 0 0 . ( Record depreciation to date for Year 3 for the...

-

Find the NPV for the following project if the firm's WACC is 8%. Make sure to include the negative in your answer if you calculate a negative. it DOES matter for NPV answers

-

What is the value of a 10-year, $1,000 par value bond with a 12% annual coupon if its required return is 11%?

Study smarter with the SolutionInn App