The adjusted trial balance of Rocket Real Estate Appraisal at June 30, 2023, follows: Required 1. Journalize

Question:

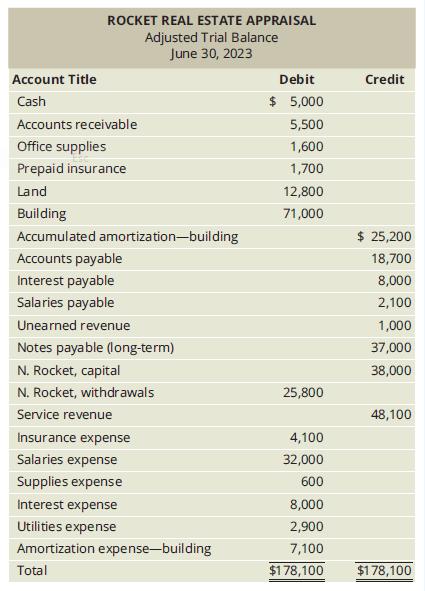

The adjusted trial balance of Rocket Real Estate Appraisal at June 30, 2023, follows:

Required

1. Journalize the closing entries.

2. Open the T-accounts using the balances from the adjusted trial balance and post the closing entries to the T-accounts.

3. Prepare the company’s post-closing trial balance at June 30, 2023.

Account Title Cash ROCKET REAL ESTATE APPRAISAL Adjusted Trial Balance June 30, 2023 Accounts receivable Office supplies Prepaid insurance Land Building Accumulated amortization-building Accounts payable Interest payable Salaries payable Unearned revenue Notes payable (long-term) N. Rocket, capital N. Rocket, withdrawals Service revenue Insurance expense Salaries expense Supplies expense Interest expense Utilities expense Amortization expense-building Total Debit $ 5,000 5,500 1,600 1,700 12,800 71,000 25,800 4,100 32,000 600 Credit $ 25,200 18,700 8,000 2,100 1,000 37,000 38,000 48,100 8,000 2,900 7,100 $178,100 $178,100

Step by Step Answer:

Journalize the closing entries The closing entries are used to transfer the temporary account balances to the permanent capital account and to prepare the accounts for the next accounting period The c...View the full answer

Horngrens Accounting Volume 1

ISBN: 9780136889373

12th Canadian Edition

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

The adjusted trial balance of Rocket Real Estate Appraisal at June 30, 2018, follows: Requirements 1. Prepare the company's income statement for the year ended June 30, 2018. 2. Prepare the company's...

-

The adjusted trial balance of Rocket Real Estate Appraisal at June 30, 2024, follows: Requirements 1. Prepare the companys income statement for the year ended June 30, 2024. 2. Prepare the companys...

-

The adjusted trial balance of Estella Real Estate Appraisal at June 30, 2016, follows: Requirements 1. Prepare the companys income statement for the year ended June 30, 2016. 2. Prepare the companys...

-

Review the media landscape and system in The Bahamas. Which theories/typologies would fit the nation's media best? Explain your answer thoroughly using "Normative Theories of The Media Journalism and...

-

Study the following Excel regression output for an analysis attempting to predict the number of union members in the United States by the size of the labor force for selected years over a 30-year...

-

In this discussion question you will describe cost-volume-profit (CVP) analysis. How would a business use cost-volume-profit (CVP) analysis? What are the assumptions of CVP analysis? Are these...

-

What is the organization's safety record?

-

Sam, Richard, and Tom are partners. They share income and losses in the ratio of 3:2:1. Toms Capital account has a $240,000 balance. Sam and Richard have agreed to let Tom take $320,000 of the...

-

Draw up a cash budget for AmBen Ltd showing the balance at the end of each month from the following information for the six months ended 3 1 December 2 0 2 4 a . Opening cash balance ( including bank...

-

The exponential function of best fit is of the form y = Cerx, where y is the suggested retail value of the car and x is the age of the car (in years). What does the value of C represent? What does...

-

Accountants for Jones Street Transcription Services encountered the following situations while adjusting and closing the books at December 31. Consider each situation independently. a. The office...

-

The adjusted trial balance of Erickson Real Estate Appraisal at June 30, 2023, follows: Required 1. Journalize the closing entries. 2. Open the T-accounts using the balances from the adjusted trial...

-

In a globalized economy with many business complexities, speculate the major ways that these complexities might impact a business and suggest two (2) actions that a business can take in order to...

-

What is the discount rate? PV = 7 0 0 ; t = 5 year period; FV = 1 0 0 0

-

How is planning illustrated in this case story? How is strategic management illustrated in this case story? The new CEO stated that the CEO's job is to give employees a point of view. Explain what...

-

Explain the Following Questions: 1. What essential characteristics exist in a proper understanding of "personal mastery," so that as an individual achieves greater progress in this discipline, they...

-

Few people want to eat discolored french fries. Potatoes are kept refrigerated before being cut for french fries to prevent spoiling and preserve flavor. But immediate processing of cold potatoes...

-

Part 3 of 4 Points: 0.49 of 1 Compute P(X) using the binomial probability formula. Then determine whether the normal distribution can be used to estimate this probability. If so, approximate P(X)...

-

Using simple linear production possibilities frontiers in a simple two-good, two-country model, comparative advantage is evident when a. One country can make more of both goods than the other. b. The...

-

Data on weekday exercise time for 20 females, consistent with summary quantities given in the paper An Ecological Momentary Assessment of the Physical Activity and Sedentary Behaviour Patterns of...

-

Trail Equipment is a partnership owned by three individuals. The partners share profits and losses in the ratio of 30 percent to Karen Tenne, 40 percent to Frank Durn, and 30 percent to Erin Hana. At...

-

On January 1, 2019, Chris Hunts and Carol Lo formed the Chris and Carol Partnership by investing the following assets and liabilities in the business: An independent appraiser was hired to provide...

-

Pineridge Consulting Associates is a partnership, and its owners are considering admitting Helen Fluery as a new partner. On March 31, 2020, the Capital accounts of the three existing partners and...

-

business law A partner may actively compete with the partnership True False

-

A company provided the following data: Selling price per unit $80 Variable cost per unit $45 Total fixed costs $490,000 How many units must be sold to earn a profit of $122,500?

-

Suppose a 10-year, 10%, semiannual coupon bond with a par value of $1,000 is currently selling for $1,365.20, producing a nominal yield to maturity of 7.5%. However, it can be called after 4 years...

Study smarter with the SolutionInn App