Trudel Department Store uses a periodic inventory system. The adjusted trial balance of Trudel Department Store at

Question:

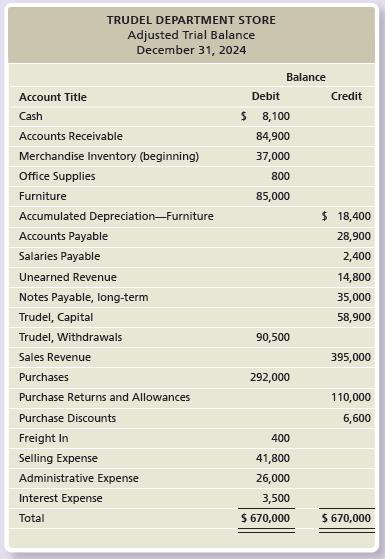

Trudel Department Store uses a periodic inventory system. The adjusted trial balance of Trudel Department Store at December 31, 2024, follows:

Requirements

1. Prepare Trudel Department Store’s multi-step income statement for the year ended December 31, 2024. Assume ending Merchandise Inventory is $36,200.

2. Journalize Trudel Department Store’s closing entries.

3. Prepare a post-closing trial balance as of December 31, 2024.

TRUDEL DEPARTMENT STORE Adjusted Trial Balance December 31, 2024 Account Title Cash Accounts Receivable Merchandise Inventory (beginning) Office Supplies Furniture Accumulated Depreciation-Furniture Accounts Payable Salaries Payable Unearned Revenue Notes Payable, long-term Trudel, Capital Trudel, Withdrawals Sales Revenue Purchases Purchase Returns and Allowances Purchase Discounts Freight In Selling Expense Administrative Expense Interest Expense Total Balance Debit $ 8,100 84,900 37,000 800 85,000 90,500 292,000 400 41,800 26,000 3,500 $ 670,000 Credit $ 18,400 28,900 2,400 14,800 35,000 58,900 395,000 110,000 6,600 $ 670,000

Step by Step Answer:

1 2 3 Net Sales Revenue Cost of Goods Sold Beginning Merchandise In...View the full answer

Horngrens Accounting The Financial Chapters

ISBN: 9780136162186

13th Edition

Authors: Tracie Miller Nobles, Brenda Mattison

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

The adjusted trial balance of Boston Irrigation System at December 31, 2018, follows: Requirements 1. Prepare the company's income statement for the year ended December 31, 2018. 2. Prepare the...

-

The adjusted trial balance of Bertrand Irrigation System at December 31, 2016, follows: Requirements 1. Prepare the companys income statement for the year ended December 31, 2016. 2. Prepare the...

-

The adjusted trial balance of Elite Realty, Inc., at December 31, 2012, follows: Requirements 1. Prepare Elite Realtys income statement and statement of retained earnings for the year ending December...

-

Describe a setting (either real or fictitious) that you have been in where either your emotions or the emotions of someone else had more impact on what was being communicated than it should have had....

-

An article in Geology gives the following equation relating pressure, P, and total aluminum content, AL, for 12 Horn blende rims: P_ - 3.46(+ 0.24) + 4.23( + 0.13)AL The quantities shown in...

-

Identify the five core objectives of the customer perspective? lop4

-

9. Repeat the option price calculation in the previous question for stock prices of $80, $90, $110, $120, and $130, keeping everything else fixed. What happens to the initial put as the stock price...

-

The common stock of Escapist Films sells for $25 a share and offers the following payoffs next year: Calculate the expected return and standard deviation of Escapist. All three scenarios are equally...

-

Wendys company analysis: (Please refer any of the balance sheet and income statement from website I'm unable to post them herea) Find the Modified Du Pont Equation, FY 2019: Net Profit Margin ____...

-

Nick is so excited! According to George, the contract is worth $2,482,400-assuming receipt of all possible bonuses. After rereading the email twice and calling his family, Nick called you to review...

-

Journalize the following transactions that occurred in January 2024 for Jills Water World. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or...

-

The records of Farm Quality Steak Company list the following selected accounts for the quarter ended April 30, 2024: Requirements 1. Prepare a single-step income statement. 2. Prepare a multi-step...

-

From the general journal in Figure, record to the accounts payable subsidiary ledger and post to general ledger accounts asappropriate. GENERAL JOURNAL Page 2 Date 201X Jun. 3 Purchases PRI Dr...

-

Fineas Co. use the Job Order Costing system to determine product costs. Before entering 2020, the company has created a production budget, with an estimated total manufacturing overhead of $...

-

Define what a market value is? What are three major principles of investing funds? How does the federal government control the money supply? An investor purchases a 10-year U.S. Treasury note and...

-

1. Suppose we have two alternative designs, each of which yields a different present value of the total lifetime cost: the first is $1604 and the second is $1595. Verify that the present value of the...

-

Sometimes when we are asked for a linear model, the information that we are given is data about a scenario. In these cases we have to use Excel to generate a trendline. There is a video in this...

-

1. Purpose Explain 3 points from the Introduction section as to why this study is important. How did this study build on the existing literature in this area? 2. Participants Outline at least 2...

-

Consider the following multithreaded algorithm for performing pairwise addition on n-element arrays A[1 . . n] and B[1. . n], storing the sums in C[1. . n]. SUM-ARRAYS (A, B, C) a. Rewrite the...

-

Using (1) or (2), find L(f) if f(t) if equals: t cos 4t

-

Where is the current portion of notes payable reported on the balance sheet?

-

What is an amortization schedule?

-

What is a mortgage payable?

-

Domino is 4 0 years old and is married out of community of property with the exclusion of the accrual system to Dolly ( 3 5 ) . They have one child, Domonique, who is 1 1 years old. Domino resigned...

-

YOU ARE CREATING AN INVESTMENT POLICY STATEMENT FOR JANE DOE General: 60 years old, 3 grown children that are living on their own and supporting themselves. She is in a very low tax rate so we don't...

-

firm purchased a new piece of equipment with an estimated useful life of eight years. The cost of the equipment was $65,000. The salvage value was estimated to be $10,000 at the end of year 8. Using...

Study smarter with the SolutionInn App