ABC, product costing at banks, cross-subsidization. First International Bank (FIB) is examining the profitability of its Premier

Question:

ABC, product costing at banks, cross-subsidization. First International Bank (FIB) is examining the profitability of its Premier Account, a combined savings and chequing account. Depositors receive a 6% annual interest rate on their average deposit. FIB earns an interest rate spread of 2.5% (the difference between the rate at which it lends money and the rate it pays depositors) by lending money for residential home loan purposes at 8.5%. Thus, FIB would gain $250 on the interest spread if a depositor has an average Premier Account balance of $10,000 in 2009 ($10,000 x 2.5% = $250). The Premier Account allows depositors unlimited use of services such as deposits, withdrawals, chequing account, and foreign currency drafts. Depositors with Premier Account balances of $2,500 or more receive unlimited free use of services. Depositors with minimum balances of less than $2,500 pay a $35 monthly service fee for their Premier Account.

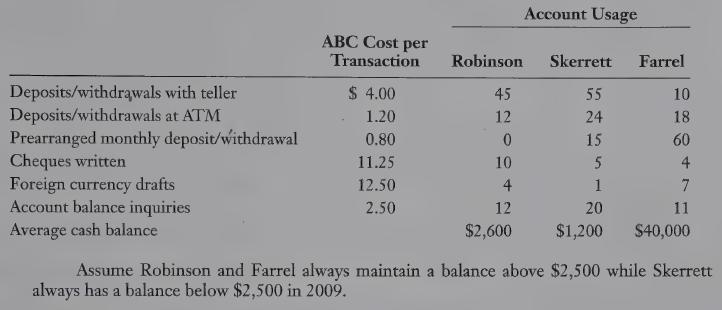

FIB recently conducted an activity-based costing study of its services. It assessed the following costs for six individual services. The use of these services in 2009 by three Premier Account customers is as follows:

REQUIRED 1. Compute the 2009 profitability of the Robinson, Skerrett, and Farrell Premier Accounts at FIB.

2. What evidence is there of cross-subsidization across Premier Accounts? Why might FIB worry about this cross-subsidization if the Premier Account product offering is profitable as a whole?

3. What changes at FIB would you recommend for its Premier Account?LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing