Activity-based costing, product cross-subsidization. Gideon Ltd. manufactures desktop DNA machines that use glass and silicon chips in

Question:

Activity-based costing, product cross-subsidization. Gideon Ltd. manufactures desktop DNA machines that use glass and silicon chips in PCR testing. PCR is "polymerase chain reac- tion" and is used in DNA profiling. Until recently, existing DNA testing required a laboratory, but advances in technology have resulted in the production of these new chips that can be used in portable DNA-testing equipment. This "lab on a chip" technology can be used outside the laboratory in agricultural settings, in doctors' offices, and at crime scenes. Gideon specializes in manufacturing two models of the desktop DNA machine, The Diagnostic and The Profiler. The Diagnostic model is used primarily in agricultural and medical applications, while The Profiler is used for crime-scene analysis. Gideon uses the same production facilities for both machines. Each model requires different direct materials, and the production machinery must be retooled for each model. The same assembly line is used to manufacture both models, and the production processes are similar with respect to direct labour.

Gideon currently uses a normal job-costing system with a single overhead cost pool and direct labour-hours as the driver. The company is considering a switch to activity-based costing

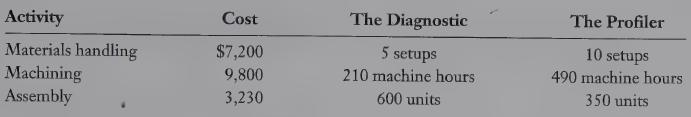

(ABC) and has gathered the following information from October’s production records:

In addition, the company has a quality-control process. The company tests 5% of The Diagnostic units produced and 10% of The Profiler produced. The company has no beginning or ending work-in-process inventory. Quality testing costs for October were $1,820.

Direct labour costs for October totalled $39,200 at an average wage rate of $28 per hour.

Direct labour costs were split equally between the two product models. The direct materials costs for October were $5.50 per unit for the 600 units produced of The Diagnostic and $26.50 per unit for the 350 units produced of The Profiler.

REQUIRED 1. Calculate the overhead rate used by Gideon under its current normal job-costing system.

2. Calculate the total manufacturing costs and the unit manufacturing cost of each product under the current costing system.

3. Calculate the activity rate for each cost pool.

4. Calculate the total manufacturing costs and the unit manufacturing cost of each product if the company switches to activity-based costing.

5. Do you recommend the company should switch to activity-based costing? Why or why not?LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing