Effect of alternative transfer pricing methods on division operating income. (CMA, adapted) Liuanha Chemical Co. has two

Question:

Effect of alternative transfer pricing methods on division operating income. (CMA, adapted) Liuanha Chemical Co. has two divisions. The Raw Chemicals Division makes zinc oxide 99%, which is then transferred to the Medicinal Division. The zinc oxide is further processed by the Medicinal Division and is sold to customers at a price of $2,800 per tonne. The Raw Chemical Division is currently required by Liuanha to transfer its total yearly _1.a. Revenues, Raw output of 2,000 tonnes of zinc oxide 99% to the Medicinal Division at 1 10% of full manufac- —_“hemicals Division, turing cost. Unlimited quantities of zinc oxide can be purchased and sold on the outside — *#960,000 market at $2,330 per tonne. To sell the zinc oxide it produces at $2,000 per tonne on the outside market, the Medicinal Division would have to incur variable marketing and distribution costs of $70 per unit. Similarly, if the Medicinal Division purchased zinc oxide from the outside market, it would have to incur variable purchasing costs of $35 per tonne.

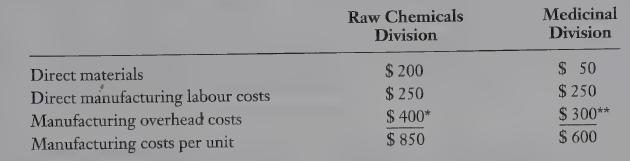

The following table gives the manufacturing costs per tonne in the Raw Chemical and Medicinal Divisions for the year 2010:

REQUIRED 1. Calculate the operating incomes for the Raw Chemicals and Medicinal Divisions for the 2,000 tonnes of zinc oxide transferred under each of the following transfer pricing methods:

(a) market price and

(b) 110% of full manufacturing costs.

2. Suppose Liuanha rewards each division manager with a bonus, calculated as 1% of division operating income (if positive). What is the amount of bonus that will be paid to each division manager under each of the transfer pricing methods in requirement 1? Which transfer pricing method will each division manager prefer to use?

3. What arguments would the manager of the Raw Chemicals Division make to support the transfer pricing method that he prefers?LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing