Effect of alternative transfer-pricing methods on divisional operating profit. (CMA, adapted) (30 minutes) Escuelas, SA, has two

Question:

Effect of alternative transfer-pricing methods on divisional operating profit. (CMA, adapted) (30 minutes) Escuelas, SA, has two divisions. The Mining Division makes toldine, which is then transferred to the Metals Division. The toldine is further processed by the Metals Division and is sold to customers at a price of EUR 150 per unit. The Mining Division is currently required by Escuelas to transfer its total yearly output of 400,000 units of toldine to the Metals Division at 110% of full manufacturing cost. Unlimited quantities of toldine can be purchased and sold on the outside market at EUR 90 per unit. To sell the toldine it produces at EUR 90 per unit on the outside market, the Mining Division would have to incur variable marketing and distribution costs of EUR 5 per unit. Similarly, if the Metals Division purchased toldine from the outside market, it would have to incur variable purchasing costs of EUR 3 per unit.

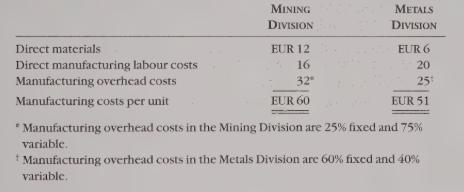

The following table gives the manufacturing costs per unit in the Mining and Metals Divisions for the year 1999: jiuy58

REQUIRED 1.

3.

Calculate the operating profits for the Mining and Metals Divisions for the 400,000 units of toldine transferred under each of the following transferpricing methods:

(a) market price,and

(b) 110% of full manufacturing costs.

Suppose Escuelas rewards each division manager with a bonus, calculated as 1% of divisional operating profit (if positive). What is the amount of bonus that will be paid to each division manager under each of the transfer-pricing methods in requirement 1? Which transfer-pricing method will each division manager prefer to use?

What arguments would Arturo Tuzon, manager of the Mining Division, make to support the transfer-pricing method that he prefers?

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780130805478

1st Edition

Authors: Charles T. Horngren, Alnoor Bhimani, Srikant M. Datar, George Foster