Equipment replacement, income taxes, unequal project lives, governance. (CMA, 1. Total present value adapted) Mark Hatcher, CFO,

Question:

Equipment replacement, income taxes, unequal project lives, governance. (CMA, 1. Total present value adapted) Mark Hatcher, CFO, was instrumental in convincing the board of directors of of recurring operating Modern Food Services (MFS), preparers of microwaveable frozen foods, to open the Western cash flows, $4,881,600 Plant. Now, unless significant improvements in cost control and production efficiency are achieved, the Western Plant may be sold. Hatcher is anxious to have the Western Plant continue to operate to maintain his credibility with the board and also to help Western’s production manager, a longtime friend of Hatcher.

MES is considering purchasing an automated materials-handling system (AMHS) for its Western Plant. Hatcher has asked Simon Palmer, the assistant controller, to prepare a net present value analysis for the proposal.

The AMHS could replace a number of forklift trucks, eliminate the need for a number of materials handlers, and increase the output capacity of the Western plant.

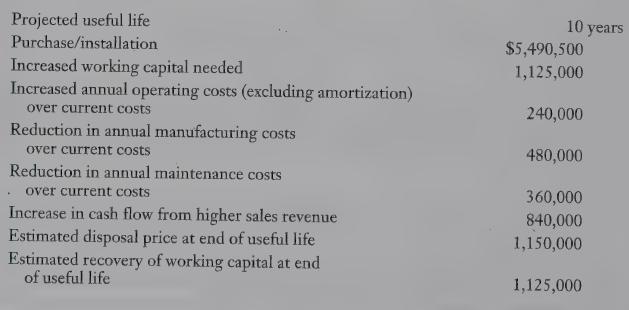

Hatcher has given Palmer the following information regarding the AMHS investment for the net present value analysis:

MES uses the straight-line method of amortization for financial reporting purposes for all its equipment assuming a zero terminal disposal price. The forklift trucks have a net book value of $576,000 with a remaining useful life of eight years and a zero terminal disposal price. If MFS purchases AMHS now, it can sell the forklift trucks for $155 ,000. ‘To make the 10-year project life of AMHS comparable to that of the forklift alternative, Palmer estimates that if MFS doesnot buy the AMHS, the company will lease new forklift trucks for the Western Plant for years 9 and 10 at a cost of $105,000 per year. MES has a 40% marginal tax rate and requires a 12% after-tax rate of return on this project. Assume that tax effects and cash flows from equipment acquisition and disposal occur at the time of the transaction and that tax effects and cash flows from operations occur at the end of each year. The equipment qualifies for a 30% declining balance capital cost allowance rate.

Hatcher was pleased with Palmer’s initial analysis. After the initial analysis was completed and additional information became available, Palmer discovered that the estimated terminal disposal price of the AMHS should be $120,000, not $1,150,000, and that the useful life of the system was expected to be 8 years, not 10 years. Palmer prepared a revised, second analysis based on this new information. On seeing the second analysis, Hatcher told Palmer to discard the revised analysis and not to discuss it with anyone at MFS or with the board of directors.

INSTRUCTIONS Assume that because the terminal disposal value is zero, there are no assets remaining in the pool.

REQUIRED 1. What is the net present value of the decision to replace forklifts with the AMHS based on the original estimates Hatcher gave to Palmer?

2. Using net present value analysis, determine whether MFS should purchase and install the AMHIS on the basis of the revised estimates that Palmer obtained.

3. Explain how Palmer, a management accountant, should evaluate Hatcher’s directives to conceal the revised analysis.

4. Identify the specific steps Palmer should take to resolve this situation.LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing