Financial performance measures with uncertainty. (CMA, adapted) The following fore- cast variable costing income statement was prepared

Question:

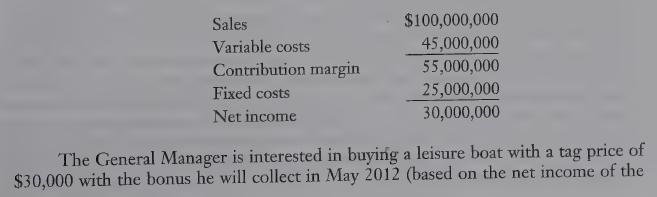

Financial performance measures with uncertainty. (CMA, adapted) The following fore- cast variable costing income statement was prepared for Electric Machines Ltd. for the year ending April 2012:

year ending in April 2012). To estimate his bonus he developed a probabilistic model for a range of possible outcomes for these financial parameters. He collected the following information from various managers within the firm:

1. The likelihood that the worst-case scenario for sales would occur (drop of 25%) was set at 15%. The likelihood that the best-case scenario for sales would occur (an increase of 25%)

was set at 10%. Finally, the likelihood that the most likely scenario would occur (sales of $100,000,000) was set at 75%.

2. The likelihood that the worst-case scenario for fixed costs would occur (increase of 20%)

was set at 20%. The likelihood that the best-case scenario for fixed costs would occur (a decrease of 20%) was set at 20%. F inally, the likelihood that the most likely scenario would occur (fixed costs of $25,000,000) was set at 60%. :

3. Variable costs will always run at 45% of sales.

The General Manager’s compensation is composed of a flat salary of $75,000 plus 1%

of net income that is in excess of the target for the year. The target for the year ending April 2012 was $26,500,000. :

REQUIRED 1. Determine if the manager will be able to buy the boat with the bonus he will collect in May 2012:

2. Suppose the owners of Electric Machines propose to change the remuneration to the General Manager and they offer a flat salary of $100,000. Explain why the General Manager would be interested in accepting the offer or not. What is more convenient in the long term for the General Manager?LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing