Multinational transfer pricing, global tax minimization. Kasba Inc. manufactures silicon waffles in its Oran factory. The company

Question:

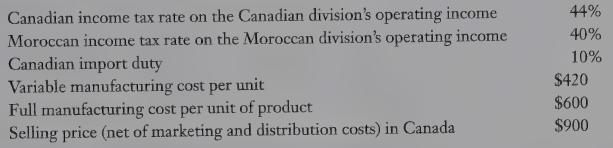

Multinational transfer pricing, global tax minimization. Kasba Inc. manufactures silicon waffles in its Oran factory. The company has marketing divisions throughout the world. The {.ganadian division Canadian marketing division of Kasba imports 1,000 units from Morocco of a special type of operating income, silicon waffle. The following information is available:

Suppose the Canadian and Moroccan tax authorities only allow transfer prices that are between the full manufacturing cost per unit and a market price of $780 based on comparable imports into Canada. The Canadian import duty 1s charged on the price at which the product is transferred into Canada. Any import duty paid to the Canadian authorities is a deductible expense for calculating Moroccan income taxes due.

REQUIRED 1. Calculate the after-tax operating income earned. by the Canadian and Moroccan divisions from transferring 1,000 units at

(a) full manufacturing cost per unit and

(b) market price of comparable imports. (Income taxes are not included in the computation of the cost-based transfer prices.)

2. Which transfer price should Kasba Inc. select to minimize the total company import duties and income taxes? Recall that the transfer price must be between the full manufacturing cost per unit of $600 and the market price of $780 based on comparable imports into Canada. Explain your reasoning.LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing