New equipment purchase, income taxes. Innovation Inc. is considering the purchase of a new industrial electric motor

Question:

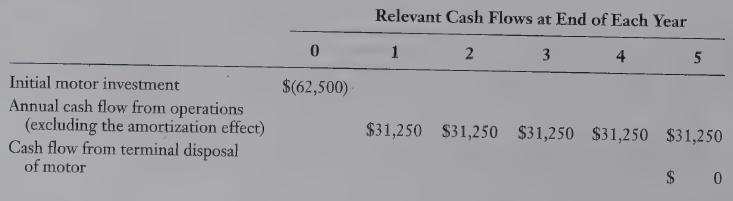

New equipment purchase, income taxes. Innovation Inc. is considering the purchase of a new industrial electric motor to improve efficiency at its Fremont plant. The motor has an estimated useful life of five years. The estimated pretax cash flows for the motor are shown in the table that follows, with no anticipated change in working capital. Innovation has a 12% after-tax required rate of return and a 40% income tax rate. Assume amortization is calculated on a straight-line basis for tax purposes. Assume all cash flows occur at year-end except for initial investment amounts. Equipment is subject to 20% CCA rate declining balance for income tax purposes.

REQUIRED , 1. Calculate

(a) net present value,

(b) payback period, and

(c) internal rate of return.

2. Compare and contrast the capital budgeting methods in requirement 1.LO1

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 9780135004937

5th Canadian Edition

Authors: Charles T. Horngren, Foster George, Srikand M. Datar, Maureen P. Gowing