New equipment purchase, income taxes. Innovation, Inc. is considering the purchase of a new industrial electric motor

Question:

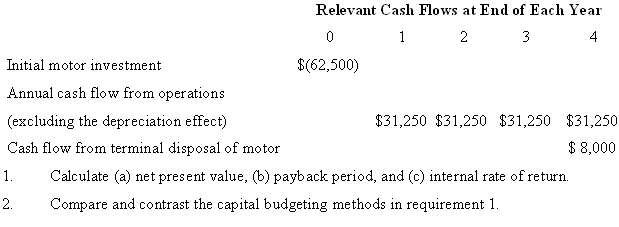

New equipment purchase, income taxes. Innovation, Inc. is considering the purchase of a new industrial electric motor to improve efficiency at its Fremont plant The motor has an estimated useful life of 5 years. The estimated pretax cash flows for the motor are shown in the table that follows, with no anticipated change in working capital. Innovation has a 12% after-tax required rate of return and a 40% income tax rate. Assume depreciation is calculated on a straight-line basis for tax purposes. Assume all cash flows occur at year-end except for initial investmentamounts.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav

Question Posted: