The Delta Company started business on January 1, 2020. The company adopted a standard absorption costing system

Question:

The Delta Company started business on January 1, 2020. The company adopted a standard absorption costing system to produce ergonomic backpacks. Delta chose direct labor as the application base for overhead and decided to use the proration method to account for variances at the end of the year.

In 2020, Delta expected to make and sell 180,000 backpacks; each was budgeted to use 2 yards of fabric and require 0.5 hours of direct labor work. The company expected to pay $3 per yard for fabric and compensate workers at an hourly wage of $18. Delta has no variable overhead costs but expected to spend $400,000 on fixed manufacturing overhead in 2020.

In 2020, Delta made 200,000 backpacks and sold 160,000 of them for a total revenue of $4,000,000.

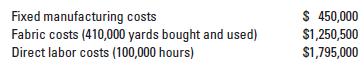

The costs incurred were as follows:

Required

1. Calculate the following variances for 2020, and indicate whether each is favorable (F) or unfavorable (U):

a. Direct materials efficiency variance

b. Direct materials price variance

c. Direct labor efficiency variance

d. Direct labor price variance

e. Total manufacturing overhead spending variance

f. Fixed overhead flexible budget variance

g. Fixed overhead production-volume variance

2. Compute Delta Company’s gross margin for its first year of operation.

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9780135628478

17th Edition

Authors: Srikant M. Datar, Madhav V. Rajan