Woodechucks manufactures, among other things, jerseys for the girls football teams in two high schools in Australia.

Question:

Woodechuck’s manufactures, among other things, jerseys for the girls’ football teams in two high schools in Australia. The company uses fabric to create the jerseys and sews on a logo patch purchased from a licensed store. The teams are as follows:

■ Olympique, with red jerseys and the Olympique logo

■ Victoria Aces, with blue jerseys and the Victoria logo

Also, the blue jerseys are slightly longer than the red jerseys.

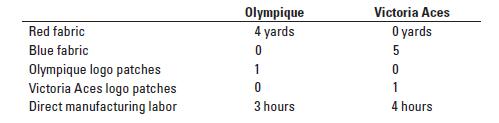

The budgeted direct-cost inputs for each product in 2020 are as follows:

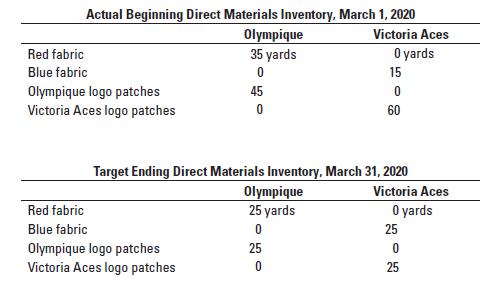

Data pertaining to the direct materials for March 2020 are as follows:

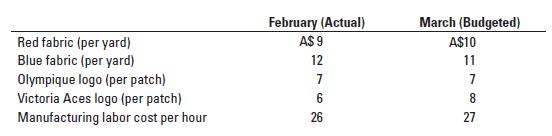

Unit cost data for direct-cost inputs pertaining to February 2020 and March 2020 are as follows:

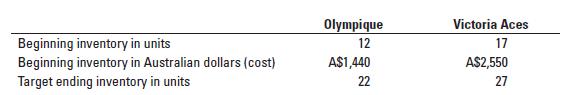

Manufacturing overhead (both variable and fixed) is allocated to each jersey based on budgeted direct manufacturing labor-hours per jersey. The budgeted variable manufacturing overhead rate for March 2020 is A$16 per direct manufacturing labor-hour. The budgeted fixed manufacturing overhead for March 2020 is A$14,640. Both variable and fixed manufacturing overhead costs are allocated to each unit of finished goods. Data relating to finished-goods inventory for March 2020 are as follows:

Budgeted sales for March 2020 are 130 units of the Olympique jerseys and 190 units of the Victoria Aces jerseys. The budgeted selling prices per unit in March 2020 are A$229 for the Olympique jerseys and A$296 for the Victoria Aces jerseys. Assume the following in your answer:

■ Work-in-process inventories are negligible and ignored.

■ Direct materials inventory and finished-goods inventory are costed using the FIFO method.

■ Unit costs of direct materials purchased and finished goods are constant in March 2020.

Required

1. Prepare the following budgets for March 2020:

a. Revenues budget

b. Production budget in units

c. Direct material usage budget and direct materials purchases budget

d. Direct manufacturing labor costs budget

e. Manufacturing overhead costs budget

f. Ending inventories budget (direct materials and finished goods)

g. Cost of goods sold budget

2. Suppose Woodechuck’s decides to incorporate continuous improvement into its budgeting process.

Describe two areas where it could incorporate continuous improvement into the budget schedules in requirement 1.

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9780135628478

17th Edition

Authors: Srikant M. Datar, Madhav V. Rajan