35. (Activity-based costing) Williams Components Company manufactures two products. Following is a production and cost analysis for

Question:

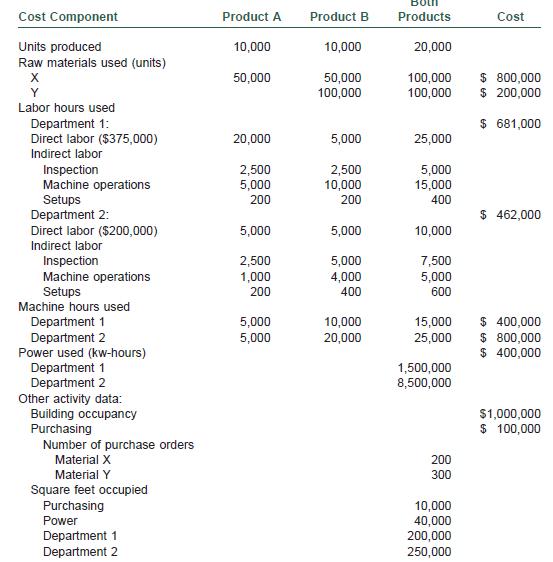

35. (Activity-based costing) Williams Components Company manufactures two products. Following is a production and cost analysis for each product for the year 2000.

Roberto Lopez, the firm’s cost accountant, has just returned from a seminar on activity-based costing. To apply the concepts he has learned, he decides to analyze the costs incurred for Products A and B from an activity basis. In doing so, he specifies the following first and second allocation processes:

FIRST STAGE: ALLOCATIONS TO DEPARTMENTS Cost Pool Cost Object Activity Allocation Base Power Departments Kilowatt-hours Purchasing Materials Number of purchase orders Building occupancy Departments Square feet occupied SECOND STAGE: ALLOCATIONS TO PRODUCTS Cost Pool Cost Object Activity Allocation Base Departments:

Indirect labor Products Hours worked Power Products Machine hours Machinery-related Products Machine hours Building occupancy Products Machine hours Materials:

Purchasing Products Materials used

a. Determine the total overhead for Williams Components Company.

b. Determine the plantwide overhead rate for the company, assuming the use of direct labor hours.

c. Determine the cost per unit of Product A and Product B, using the overhead application rate found in part (b).

d. Using the step-down approach, determine the cost allocations to departments (first-stage allocations). Allocate in the following order: building occupancy, purchasing, and power.

e. Using the allocations found in part (d), determine the cost allocations to products (second-stage allocations).

f. Determine the cost per unit of Product A and Product B using the overhead allocations found in part (e).

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780324180909

5th Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney