(Absorption costing versus variable costing) Anderson Manufacturing builds engines for light airplane manufacturers. Company sales have increased...

Question:

(Absorption costing versus variable costing) Anderson Manufacturing builds engines for light airplane manufacturers. Company sales have increased yearly as the company gains a reputation for reliable and quality products.

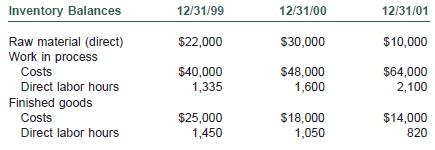

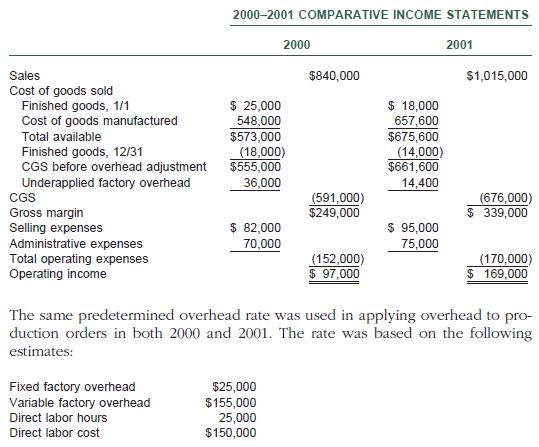

The company manufactures engines to customer specifications and it uses a job order cost system. Factory overhead is applied to the jobs based on direct labor hours, using the absorption costing method. Under- or overapplied overhead is treated as an adjustment to Cost of Goods Sold. The company’s inventory balances and income statements for the last two years are presented below.

In 2000 and 2001, actual direct labor hours expended were 20,000 and 23,000, respectively. The cost of raw material put into production was $292,000 in 2000 and $370,000 in 2001. Actual fixed overhead was $37,400 for 2000 and $42,300 for 2001, and the planned direct labor rate was equal to the actual direct labor rate.

For both years, all of the reported administrative costs were fixed. The variable portion of the reported selling expenses results from a commission of 5 percent of sales revenue.

a. For the year ended December 31, 2001, prepare a revised income statement using the variable costing method.

b. Prepare a numerical reconciliation of the difference in operating income between the 2001 absorption and variable costing statements.

c. Describe both the advantages and disadvantages of using variable costing.

(CMA adapted)

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780324180909

5th Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney