Mineral Waters Ltd. operates three divisions that process and bottle sparkling mineral water. The historical-cost accounting system

Question:

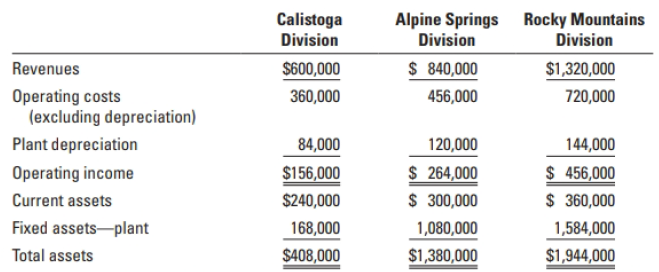

Mineral Waters Ltd. operates three divisions that process and bottle sparkling mineral water. The historical-cost accounting system reports the following data for 2018:

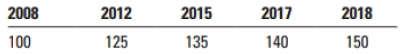

Mineral Waters estimates the useful life of each plant to be 12 years with a zero terminal disposal price. The straight-line depreciation method is used. At the end of 2018, the Calistoga plant is 10 years old, the Alpine Springs plant is 3 years old, and the Rocky Mountains plant is 1 year old. An index of construction costs of plants for mineral water production for the 10-year period that MineraI Waters has been operating (2008 year-end= 100) is

Given the high turnover of current assets, management believes that the historical-cost and current-cost measures of current assets are approximately the same.

Required

1. Compute the ROI (operating income to total assets) ratio of each division using historical-cost measures. Comment on the results.

2. Use the approach in Exhibit 22·3 to compute the ROI of each division, incorporating current-cost estimates as of 2018 for depreciation and fixed assets. Comment on the results.

3. What advantages might arise from using current-cost asset measures as compared with historicalcost measures for evaluating the performance of the managers of the three divisions?

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 978-0134453736

8th Canadian Edition

Authors: Srikant M. Datar, Madhav V. Rajan, Louis Beaubien