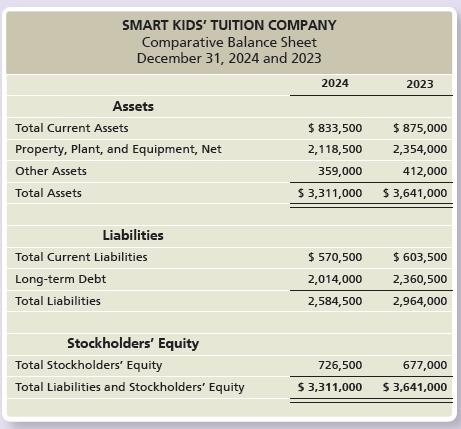

Smart Kids Tuition Company has the following data: Perform a vertical analysis of Smart Kids Tuition Companys

Question:

Smart Kids’ Tuition Company has the following data:

Perform a vertical analysis of Smart Kids’ Tuition Company’s balance sheet for each year.

Transcribed Image Text:

SMART KIDS' TUITION COMPANY Comparative Balance Sheet December 31, 2024 and 2023 Assets Total Current Assets Property, Plant, and Equipment, Net Other Assets Total Assets Liabilities Total Current Liabilities Long-term Debt Total Liabilities Stockholders' Equity Total Stockholders' Equity Total Liabilities and Stockholders' Equity 2024 $ 833,500 2,118,500 359,000 $ 3,311,000 $570,500 2,014,000 2,584,500 726,500 $ 3,311,000 2023 $ 875,000 2,354,000 412,000 $ 3,641,000 $ 603,500 2,360,500 2,964,000 677,000 $ 3,641,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

A vertical analysis is performed on a financial statement to show each line item as a percentage of a base figure within the statement In the case of ...View the full answer

Answered By

Muhammad Mahtab

everyone looks that their work be perfect. I have more than a five year experience as a lecture in reputable institution, national and international. I provide perfect solution in marketing, case study, finance problems, blog writing, article writing, business plans, strategic management, human resource, operation management, power point presentation and lot of clients need. Here is right mentor who help clients in their multi-disciplinary needs.

5.00+

3+ Reviews

14+ Question Solved

Related Book For

Horngrens Financial And Managerial Accounting The Managerial Chapters

ISBN: 9781292412337

7th Global Edition

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura

Question Posted:

Students also viewed these Business questions

-

Perform a vertical analysis of Gamma Gamma Designs' balance sheet for each year. Gamma Designs, Inc. has the following data: (Click the icon to view the data.) Perform a vertical analysis of Gamma...

-

A $5200 payment due 1 1/2 years ago has not been paid. If money can earn 3.35% compounded annually, what amount paid 2 1/2 years from now would be the economic equivalent of the missed payment?

-

Drive Golf Company has requested that you perform a vertical analysis of its balance sheet to determine the component percentages of its assets, liabilities, and stockholdersequity. Drive Golf...

-

What is your debt payments-to-income ratio if your debt payments total $684 and your net income is $2,000 per month?

-

(a) Derive Eq. (9.12) by combining Eqs. (9.7) and (9.11) to eliminate f (b) The angular velocity of an airplane propeller increases from 12.0 rad/s to 16.0 rad/s while turning through 7.00 rad. What...

-

Consider the fraction of defective items in a batch of manufactured parts. Say that the prior distribution of is a beta distribution with parameters i = 5 and ct2 = 10 (see Section 7.6.2 for a...

-

A 2-for-1 stock split __________ the firms assets, the firms liabilities, and __________ the firms equity.

-

1. What are the biggest challenges to long-term success and profitability for Loblaws, Sobeys, and Metro? 2. The three main players in the Canadian grocery market each operate under various brands....

-

please correct my errors ! Required information Problem 13-33A (Algo) Comprehensive problem: single cycle LO 13-1, 13-2, 13-3, 13-4 [The following information applies to the questions displayed...

-

Data for Fun Travel Company follows: Compute the euro amount of change and the percentage of change in Fun Travel Companys working capital each year during 2025 and 2024. What do the calculated...

-

Mary Brown Cookies income statement appears as follows (amounts in thousands): Use the following ratio data to complete Mary Brown Cookies income statement: a. Inventory turnover is 4.0 (beginning...

-

Why are price ceilings during a hyperinflation problematic? What generalizations do you draw from Venezuelas economic collapse? Would a Venezuelan-style economic collapse be less likely in the United...

-

Based on the following information, calculate the sustainable growth rate for Kaleb's Welding Supply: Profit margin Capital intensity ratio Debt-equity ratio Net income Dividends 7.5% 0.65 0.60...

-

Waterway Inc. uses LIFO inventory costing. At January 1, 2025, inventory was $216,014 at both cost and market value. At December 31, 2025, the inventory was $283,252 at cost and $262,660 at market...

-

What is the 32-bit version of: 0000 0000 0001 0101

-

1. Let A = 2 1 4 3 Find AT, A-1, (A-1) and (AT)-1. 2. Let A = = [ -1 -1 2 22 (a) Find (AB), BT AT and AT BT. (b) (AB)-1, B-1A-1 and A-B-1. ] 1-5 and B = 1

-

Xavier Ltd. paid out cash dividends at the end of each year as follows: Year Dividend Paid 2018 $250,000 2019 $325,000 2020 $400,000 Assume that Xavier had 100,000 common shares and 5,000, $4,...

-

It is proposed to run a thermoelectric generator in conjunction with a solar pond that can supply heat at a rate of 7 106 kJ/h at 90oC. The waste heat is to be rejected to the environment at 22oC....

-

Lopez Company expects to incur $600,000 in overhead costs this coming year$100,000 in the Cutting department, $300,000 in the Assembly department, and $200,000 in the Finishing department. Direct...

-

Lopez Company expects to incur $600,000 in overhead costs this coming year$100,000 in the Cutting department, $300,000 in the Assembly department, and $200,000 in the Finishing department. Direct...

-

Ralston Company identified the following activities, estimated costs for each activity, and identified cost drivers for each activity for this coming year. (These are the first three steps of...

-

you are analyzing the cost of debt for a firm. Do you know that the firms 14 year maturity, 7.8 Percent coupon bonds are selling at a price of $834. The Barnes pay interest semi annually. If these...

-

***Please answer the following using excel and showcasing the formulas/calculations used*** thank you so much Financial information on AAA Ltd. is shown below. AAA Ltd. Income Statement For the Year...

-

2. In an account Anh Paglinawan currently has $216,670.00. At a rate of 8.00% how long will it take for them to have $298,390.00 assuming semi-annually compounding? (Hint: compute the exact years, do...

Study smarter with the SolutionInn App