Environmental Business Consultants (EBC) is deciding whether to purchase an office building. EBC has found a three-story

Question:

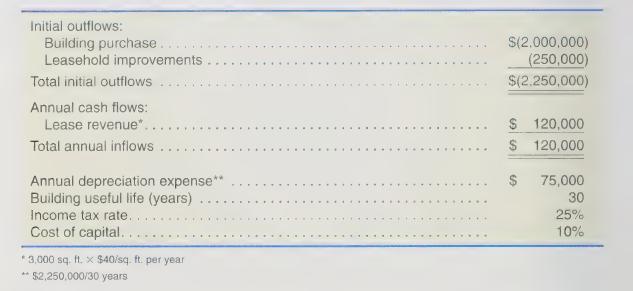

Environmental Business Consultants (EBC) is deciding whether to purchase an office building. EBC has found a three-story Class A office building in San Jose, California, with a purchase price of \($2,000,000.\) Only two stories are needed to operate, and as such EBC can lease out the lower story, which consists of 3,000 square feet of floor space. The average full-service market lease rate for Class A office buildings in San Jose is \($40\) per square foot per year. In order to prepare the lower floor for lease, EBC will need to spend \($250,000\) on leasehold improvements. The building will be useful for 30 years and will be depreciated on a straight-line basis. EBC’s income tax rate is 25% and its cost of capital is 10%. The following table summarizes the cash flows from purchasing the building and leasing out the lower floor:

Required

Perform a capital expenditure analysis to decide whether EBC should purchase the building, analyzing the net present value as well as payback period and average rate of return.

Step by Step Answer:

Financial & Managerial Accounting For Undergraduates

ISBN: 9781618533104

2nd Edition

Authors: Jason Wallace, James Nelson, Karen Christensen, Theodore Hobson, Scott L. Matthews