Carolina Company is evaluating a possible ($150,000) investment in equipment that would increase cash flows from operations

Question:

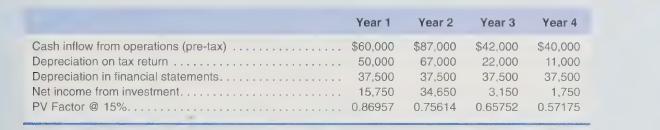

Carolina Company is evaluating a possible \($150,000\) investment in equipment that would increase cash flows from operations for four years. The equipment will have no salvage value. The income tax rate is 30%. Carolina uses a 15% hurdle rate when using net present value analysis. Other information regarding the proposal is as follows:

Required

a. What are the annual net after-tax cash inflows from this proposal?

b. Compute the net present value and indicate whether it is positive or negative (round amounts to nearest dollar).

c. Compute the cash payback period.

d. Compute the average rate of return.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial & Managerial Accounting For Undergraduates

ISBN: 9781618533104

2nd Edition

Authors: Jason Wallace, James Nelson, Karen Christensen, Theodore Hobson, Scott L. Matthews

Question Posted: