Question: Bryan Eubank began his accounting career as an auditor for a Big 4 CPA firm. He focused on clients in the high-technology sector, becoming an

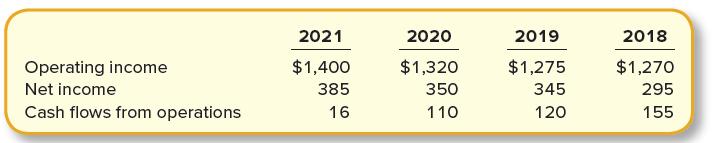

Bryan Eubank began his accounting career as an auditor for a Big 4 CPA firm. He focused on clients in the high-technology sector, becoming an expert on topics such as inventory write-downs, stock options, and business acquisitions. Impressed with his technical skills and experience, General Electronics, a large consumer electronics chain, hired Bryan as the company controller responsible for all of the accounting functions within the corporation. Bryan was excited about his new position. To better understand the company’s financial position, he began by making the following comparison over time ($ in millions):

Bryan also noticed a couple of other items:

a. The company’s credit policy has been loosened, credit terms relaxed, and payment periods lengthened. This has resulted in a large increase in accounts receivable.

b. Several of the company’s salary arrangements, including that of the CEO and CFO, are based on reported net income.

Required:

1. What effect does relaxing credit terms and lengthening payment periods likely have on the balance of accounts receivable? Does the change in accounts receivable affect net income differently than operating cash flows?

2. Do salary arrangements for officers, such as the CEO and CFO, increase the risk of earnings management?

3. What trend in the information could be a source of concern for Bryan?

2021 2020 2019 2018 Operating income $1,400 $1,320 $1,275 $1,270 Net income 385 350 345 295 Cash flows from operations 16 110 120 155

Step by Step Solution

3.37 Rating (169 Votes )

There are 3 Steps involved in it

answer 1 Relaxing credit terms and lengthening payment periods will likely increase the bal... View full answer

Get step-by-step solutions from verified subject matter experts