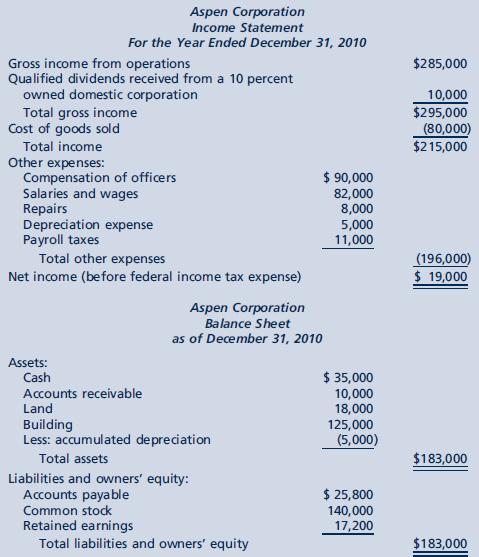

Aspen Corporation was formed and began operations on January 1, 2010. Aspen Corporation made estimated tax payments

Question:

Aspen Corporation was formed and began operations on January 1, 2010.

Aspen Corporation made estimated tax payments of $2,000.

Based on the above information, complete Form 1120 on pages 11-9 through 11-13. Assume the corporation’s federal income tax expense is equal to its 2010 federal income tax liability and that any tax overpayment is to be applied to the next year’s estimated tax. Schedule UTP is not required.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Income Tax Fundamentals 2011

ISBN: 9780538469197

29th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller

Question Posted: