Question:

Dennis and Lynne have a 5-year-old child. Dennis has a salary of $16,200.

Lynne is self-employed with a loss of $400 from her business. Dennis and Lynne receive $100 of taxable interest income during the year. Their earned income for the year is $15,800 and their adjusted gross income is $15,900

($16,200 $400 þ $100).

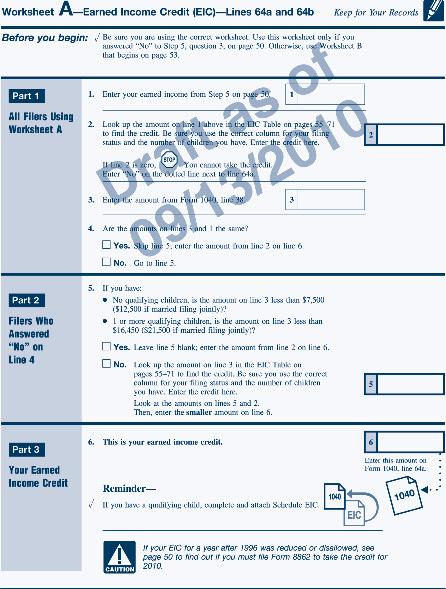

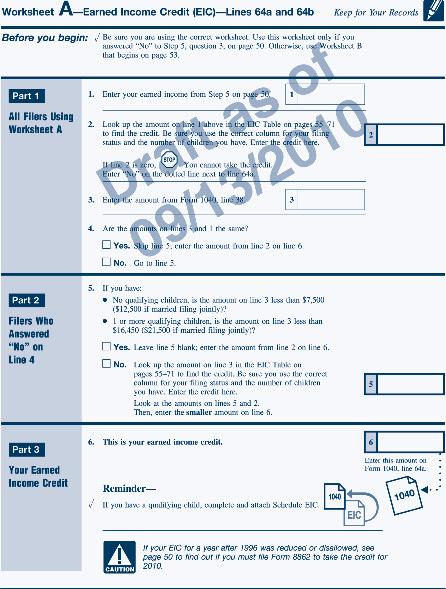

Use Worksheet A and calculate their earned income credit from the EIC table in Appendix B.

Transcribed Image Text:

Worksheet A-Earned Income Credit (EIC)-Lines 64a and 64b Keep for Your Records Before you begin: Be sure you are using the curree, workshoot. Use this worksheet only if you Part 1 ausweral "No" to Step 5, question 3. ou pige 50 Otherwise, that begins on page 53. 1. Enter your earned income from Step 5 on page 50 All Filers Using Worksheet A 2. Look up the amount online Part 2 Filers Who Answered "No" on Line 4 Workslust B Draft as of above the EC Table to find the credit. De sure you use the currect column for your filing status and the number of children you have. Enter the credit here. Yon cannot Enter "No" the coal line next to line 6 09/13/2010 3. Enter the oval 4. Are the same? Yes. Skip line 5. enter the amount from line 2 on line 6. No. Gu u line 3. 5. If you have: No qualifying children, is the amount on line 3 less than $7,500 (512,500 if married filing jointly! Lur more qualifying children, is the amount on line 3 less than $16,450 ($21.500 if married filing jointly?? Yes. Leave line blank; enter the amount fram line 2 on line 6. No. Look up the amount on line 3 in the EIC Trible on ps 55-71 to find the cadit. Be sure you use the correc column for your filing stars and the number of children you have. Enter the credit here. Look at the amounts on lines 5 and 2. Then, enter the smaller amount on line 6. Part 3 Your Earned Income Credit 6. This is your earned income credit. Reminder- If you have a qualifying child, complete and attach Schedule BIC 6 Litter this amount o Ferm 1040, line 64. 1040 1040. EIC A If your EIC for a year after 1996 was reduced or dissilowed, see pege 50 to find out if you must ne Form 8562 to take the credit for CAUTION 2010