Elaine wants to know how much she and Archie need to contribute over the next 15 years for Kelsey's education. Their first contribution will be in ine year, and they will invest in a portfolio that is split equally between S&P 500 index and 5-year treasury bonds. This allocation will be maintained by rebalancing the account every 12 months. Assume any tax on earningns will be paid from their income, and not from the education funds. (all info in pictures)

(This is the only one that didnt look readable)

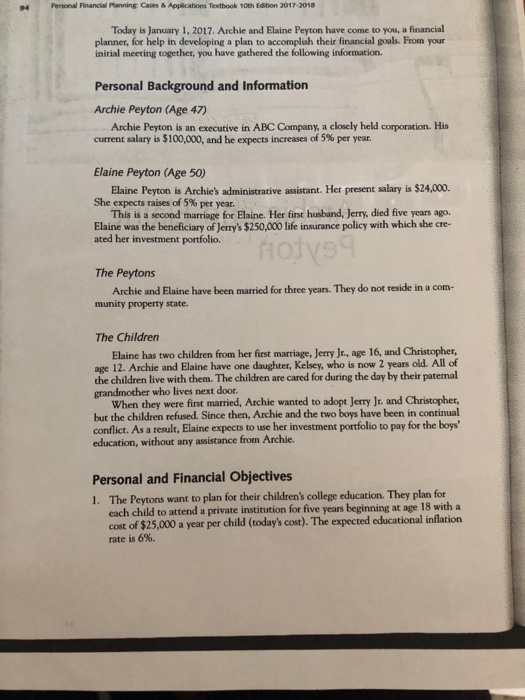

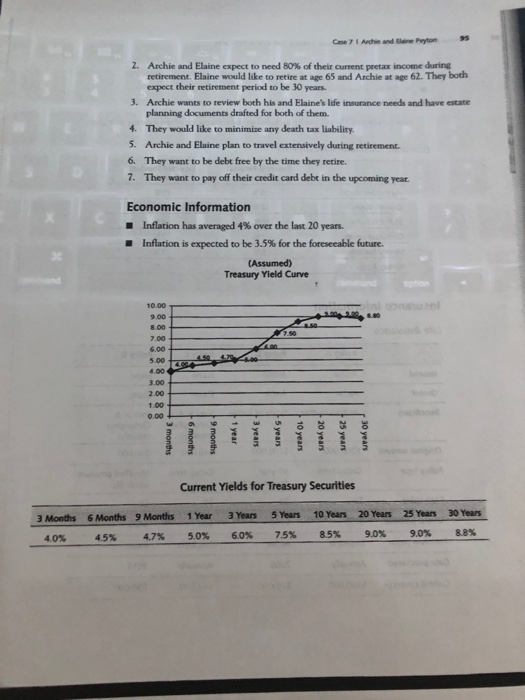

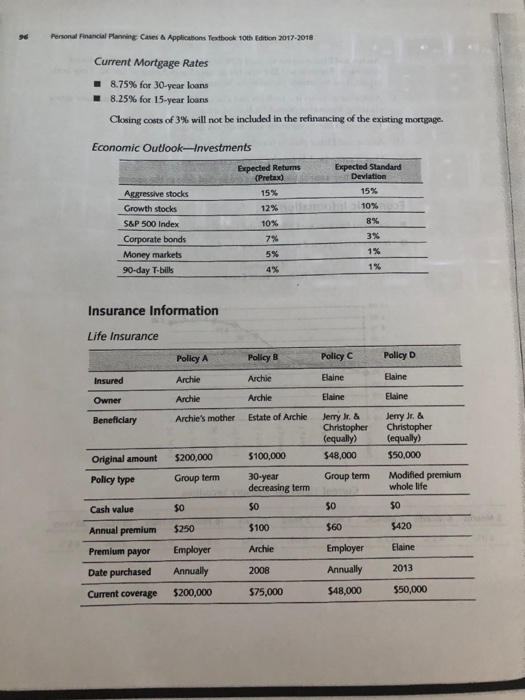

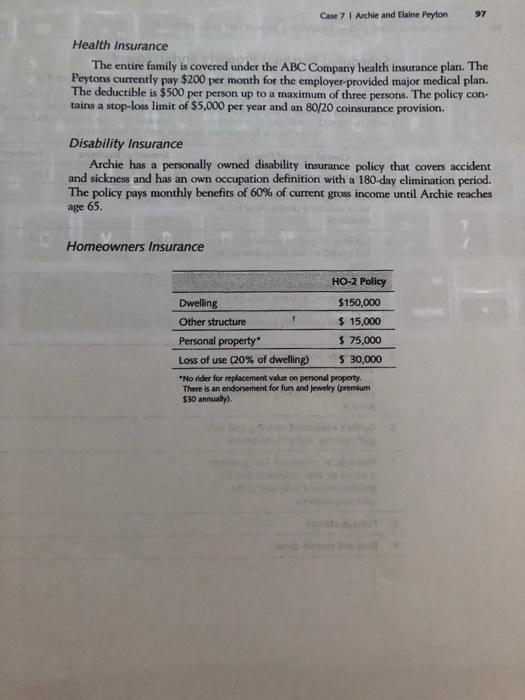

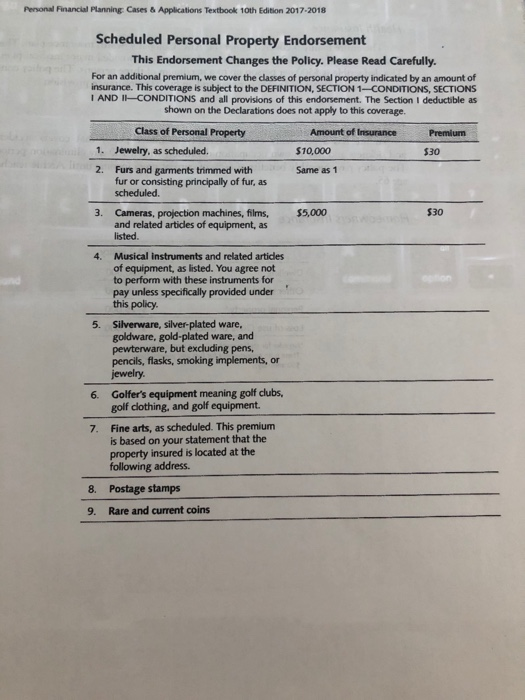

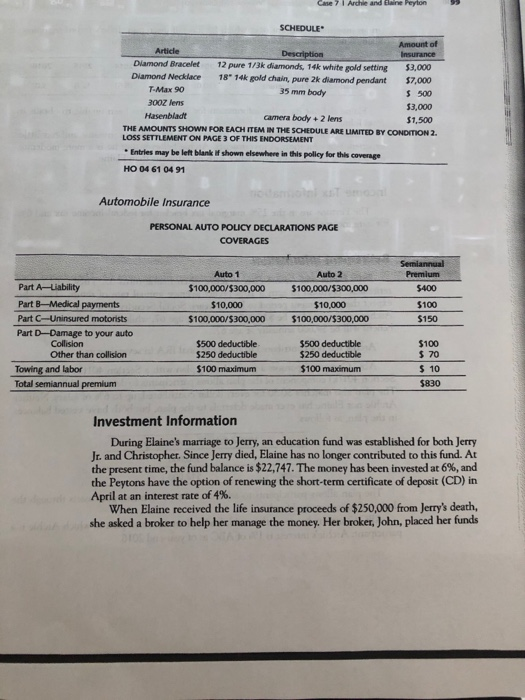

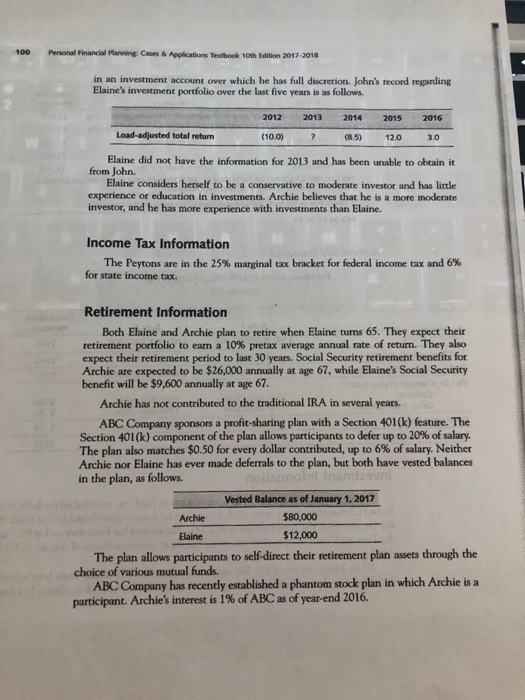

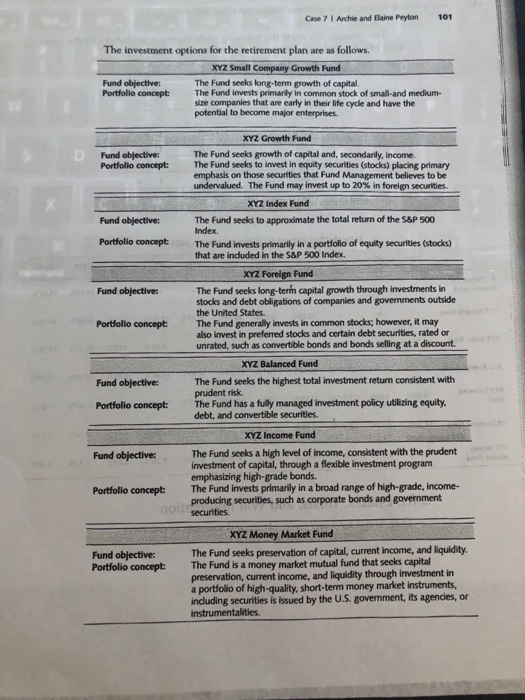

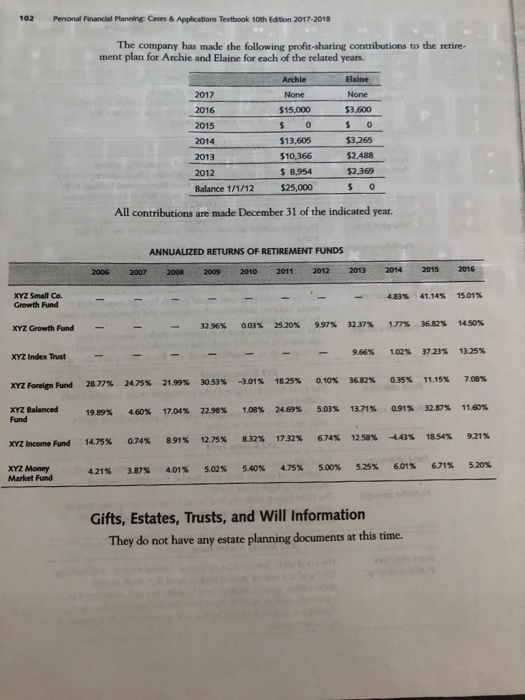

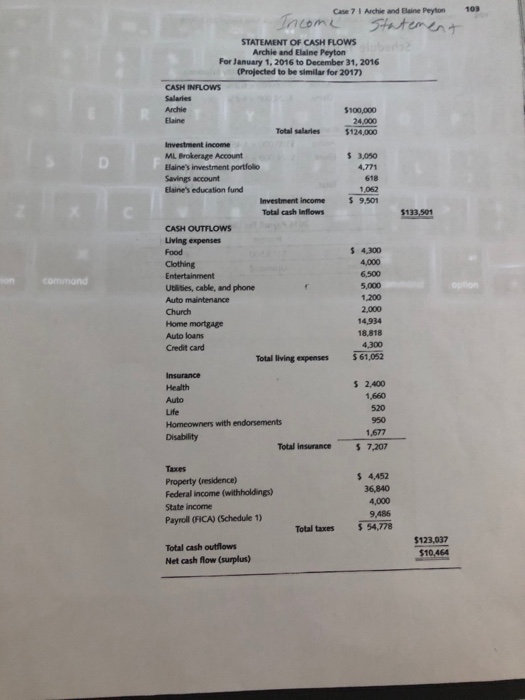

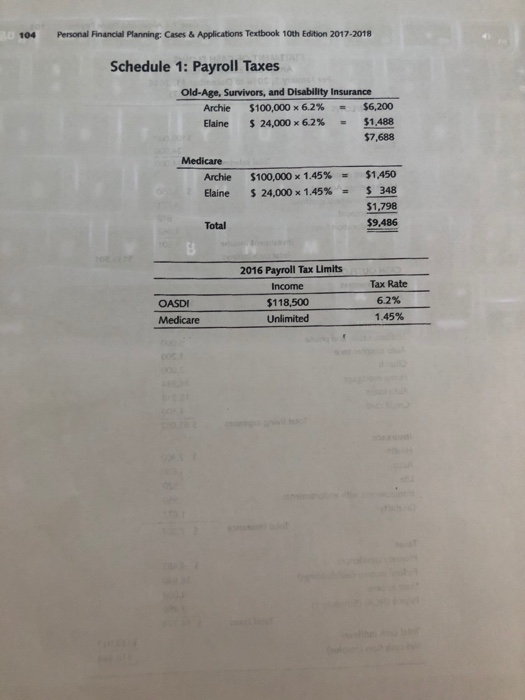

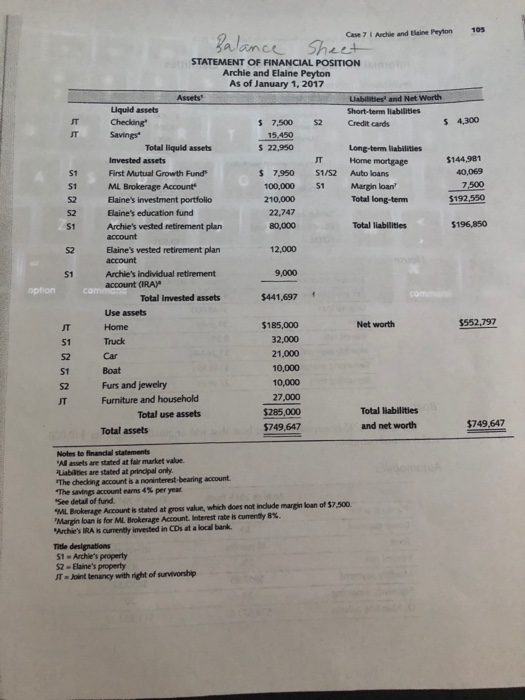

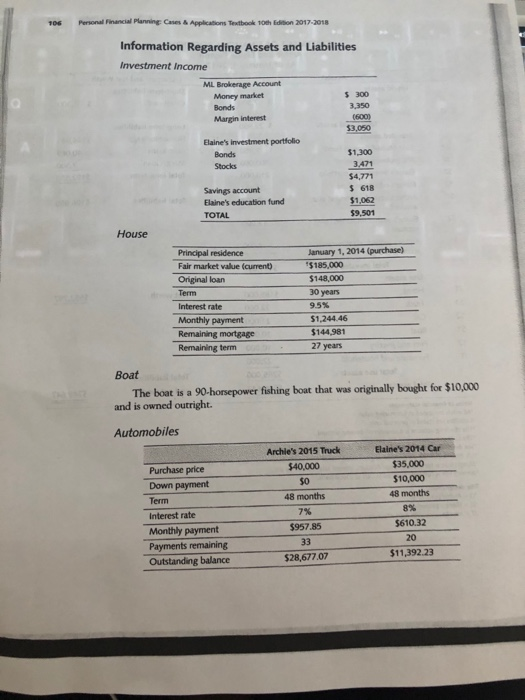

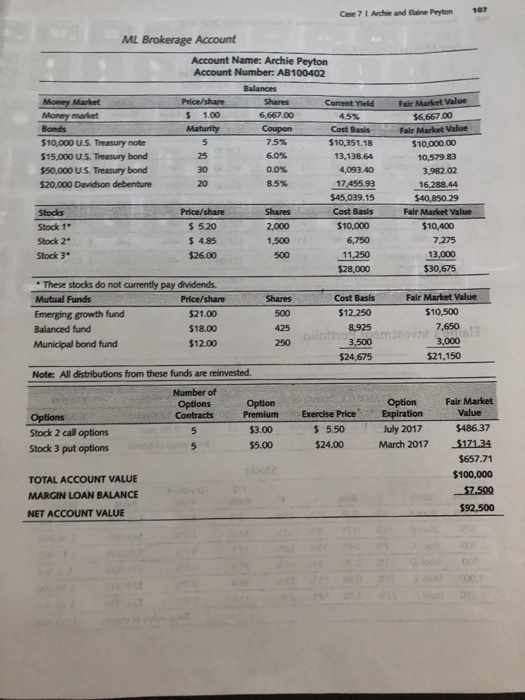

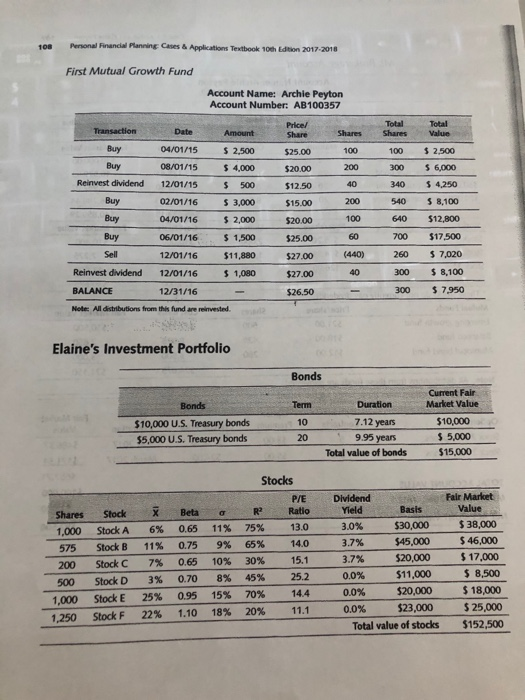

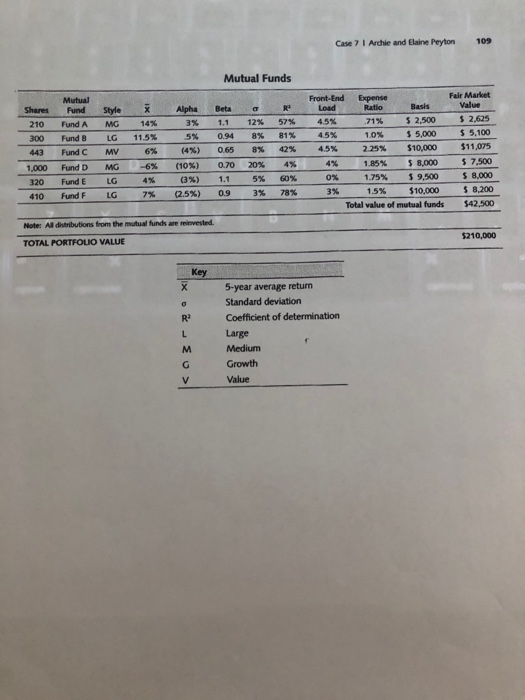

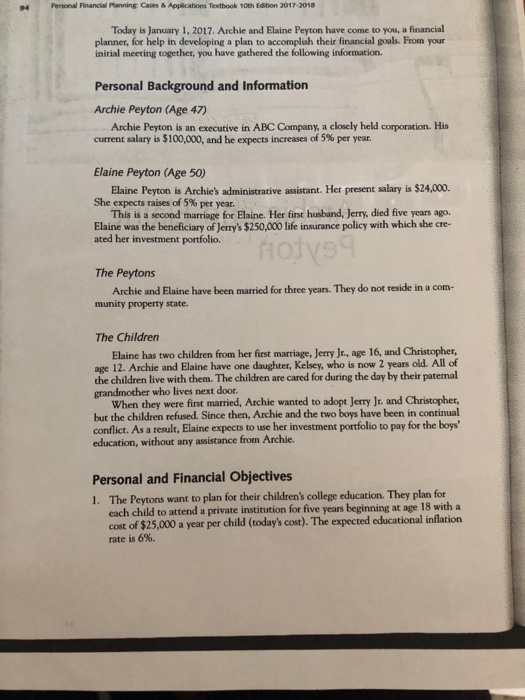

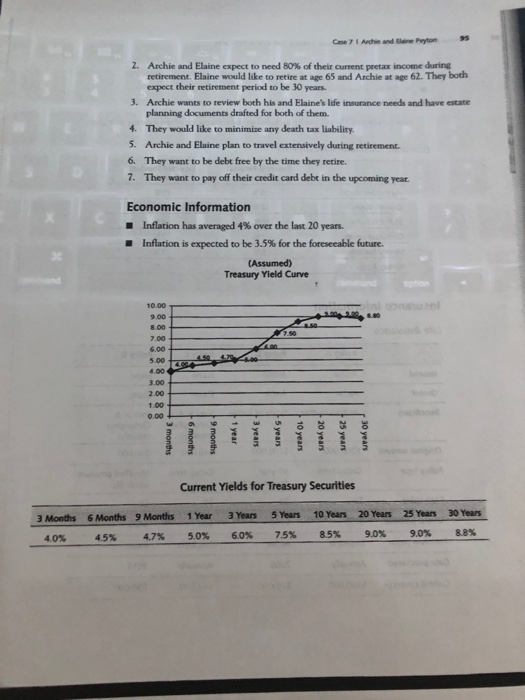

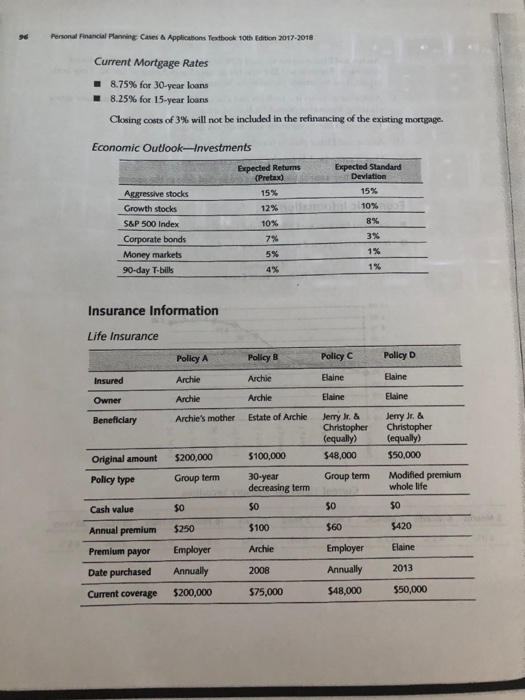

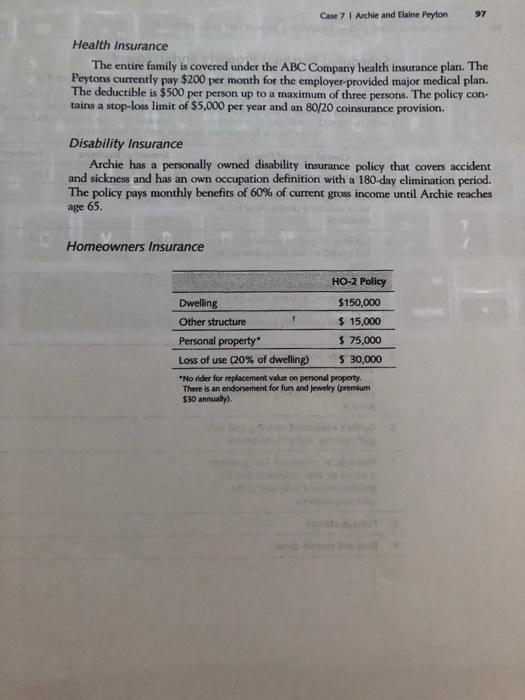

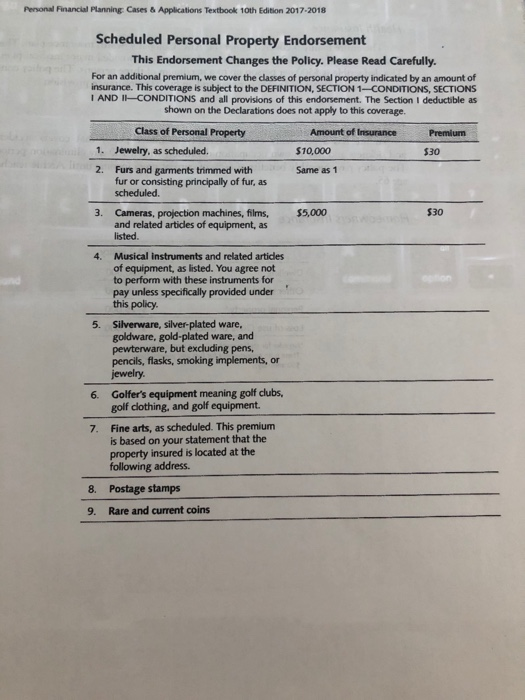

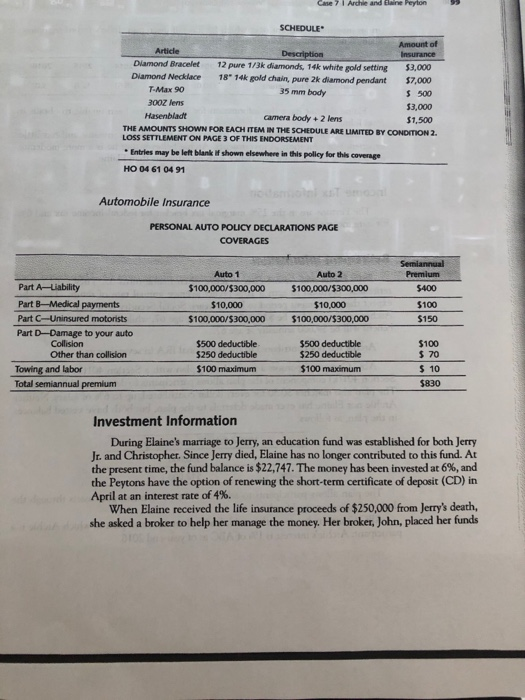

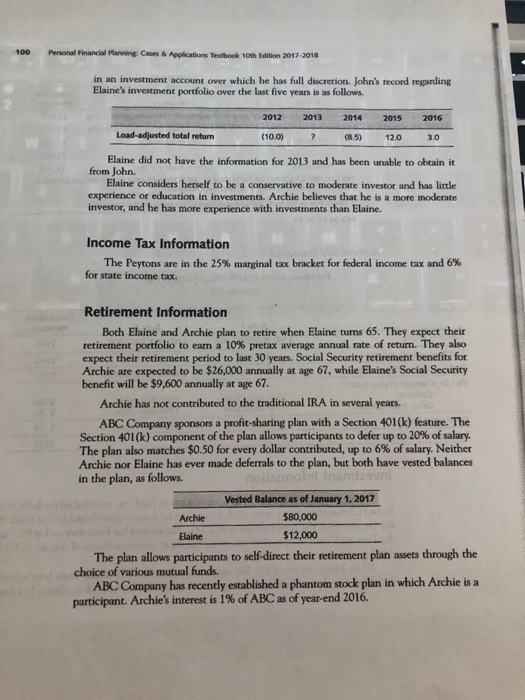

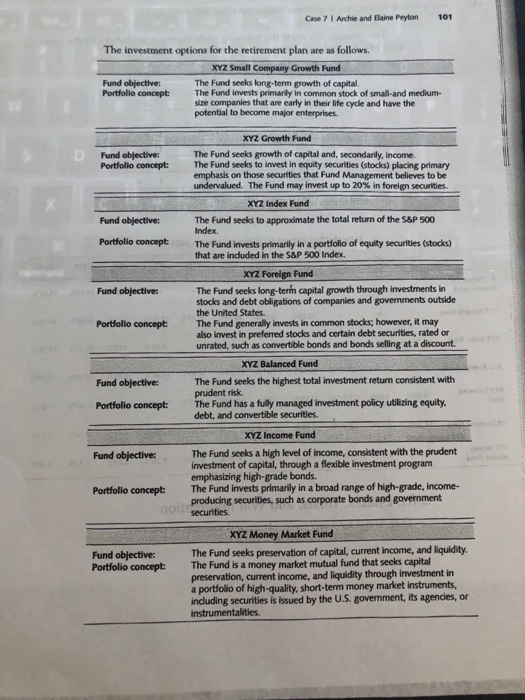

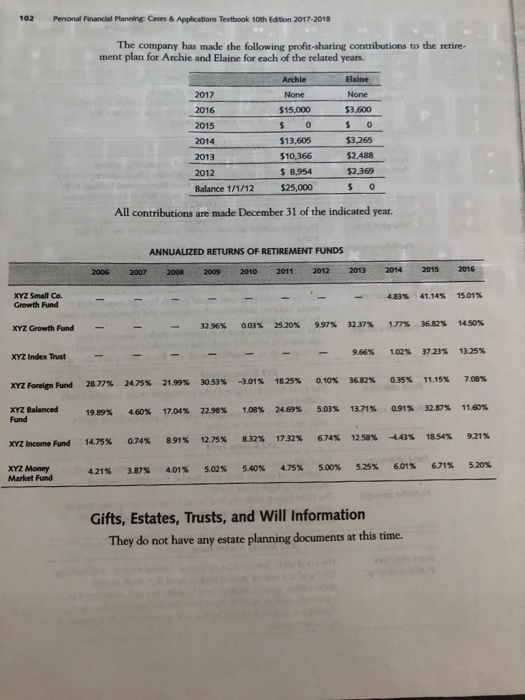

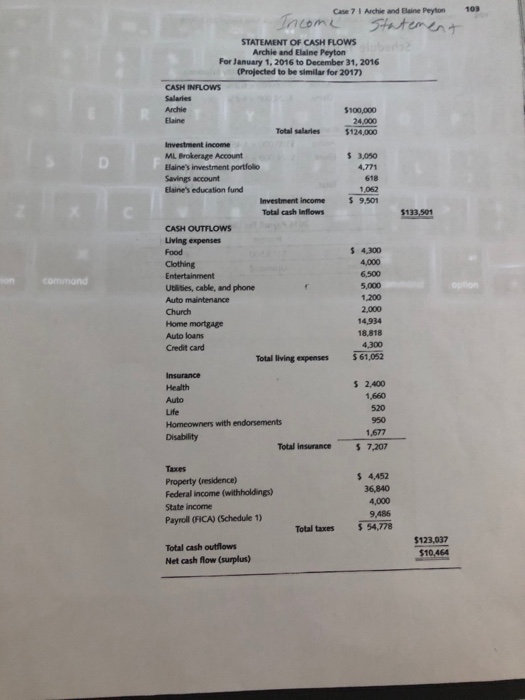

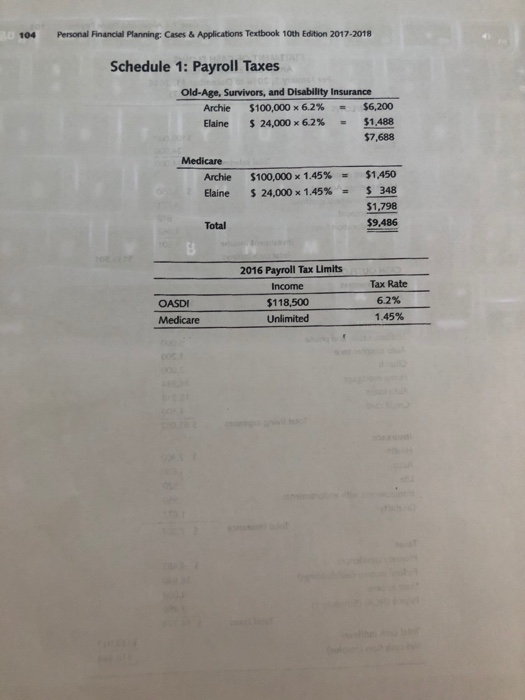

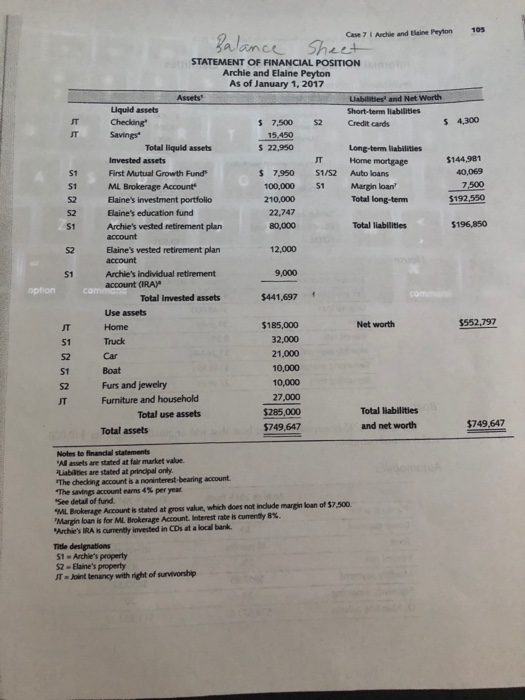

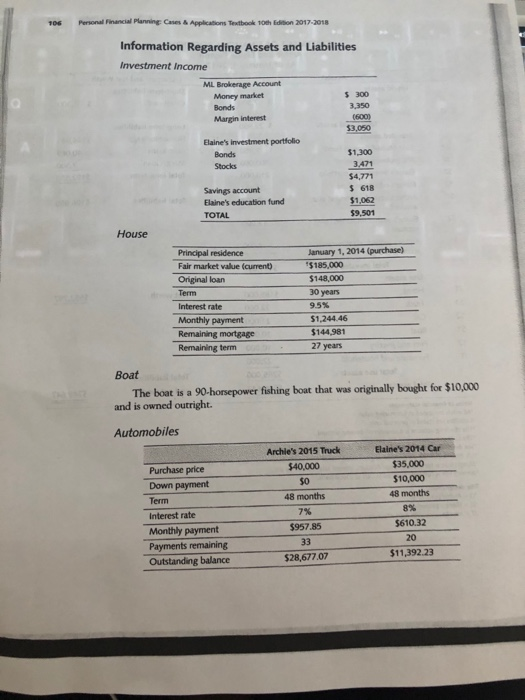

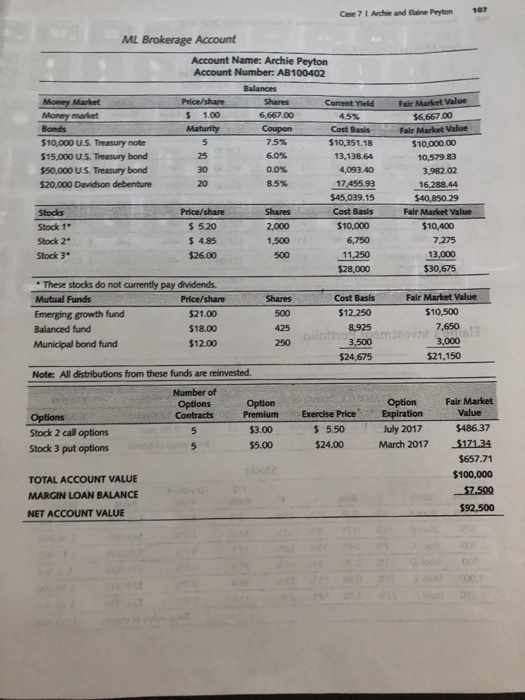

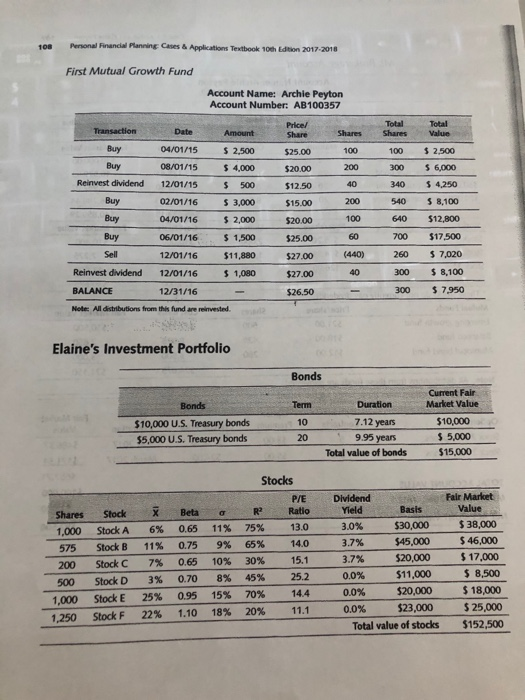

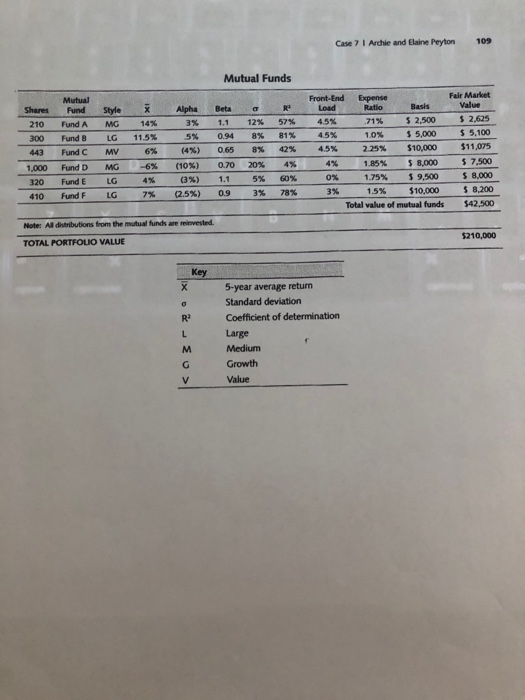

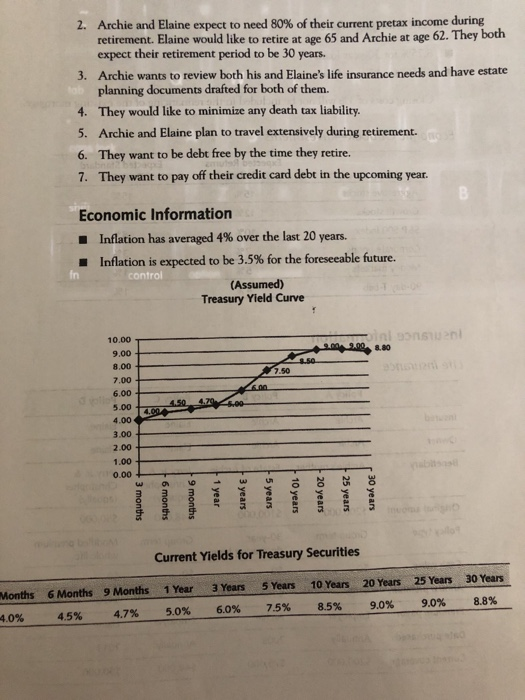

Person Financial Planning Cams & Applications Tet to dion 01.2018 Today is January 1, 2017 Archie and Elaine Peyton have come to you, a financial planner, for help in developing a plan to accomplish their financial goals. From your initial meeting together, you have gathered the following information. Personal Background and Information Archie Peyton (Age 47) Archie Peyton is an executive in ABC Company, a closely held corporation. His current salary is $100,000, and he expects increases of 5% per year. Elaine Peyton (Age 50) Elaine Peyton is Archie's administrative assistant. Her present salary is $24,000. She expects raises of 5% per year. This is a second marriage for Elaine. Her first husband, Jerry, died five years ago Elaine was the beneficiary of Jerry's $250.000 life insurance policy with which she cre- ated her investment portfolio Hoy99 The Peytons Archie and Elaine have been married for three years. They do not reside in a com munity property state. The Children Elaine has two children from her first marriage, Jerry Jr., age 16, and Christopher, ape 12. Archie and Elaine have one daughter, Kelsey, who is now 2 years old. All of the children live with them. The children are cared for during the day by their paternal grandmother who lives next door When they were first married, Archie wanted to adopt Jerry Jr. and Christopher, but the children refused. Since then, Archie and the two boys have been in continual conflict. As a result, Elaine expects to use her investment portfolio to pay for the boys' education, without any assistance from Archie. Personal and Financial Objectives 1. The Peytons want to plan for their children's college education. They plan for each child to attend a private institution for five years beginning at age 18 with a cost of $25,000 a year per child (today's cost). The expected educational inflation rate is 6%. Case 7 Ardhi and bone Peyton 95 2. Archie and Elaine expect to need 80% of their current pretax income during retirement. Elaine would like to retire at age 65 and Archie at age 62. They both expect their retirement period to be 30 years. 3. Archie wants to review both his and Elaine's life insurance needs and have estate planning documents drafted for both of them 4. They would like to minimize any death tax liability 5. Archie and Elaine plan to travel extensively during retirement 6. They want to be debt free by the time they retire. 7. They want to pay off their credit card debt in the upcoming year. Economic Information Inflation has averaged 4% over the last 20 years. Inflation is expected to be 3.5% for the foreseeable future. (Assumed) Treasury Yield Curve 10.00 9.00 8.00 7.00 6.00 5.00 3.00 1.00 0.00 + 3 months 6 months 9 months 1 year 3 years 5 years 10 years 20 years 25 years 30 years Current Yields for Treasury Securities 3 Months 4.0% 6 Months 9 Months 4,5% 4,7% 1 Year 5.0% 3 Years 6.0% 5 Years 75% 10 Years 8.5% 20 Years 9.0% 25 Years 0.0% 30 Years 8.8% Perso n l ig ass Applications Textbook to Edition 2017-2018 Current Mortgage Rates 8.75% for 30 year loans 8.25% for 15-year loans Closing costs of 3% will not be included in the refinancing of the existing more Expected Standard Deviation 15% Economic Outlook-Investments Expected Returns (Parta) Arressive stocks 15% Growth stocks S&P 500 Index 10% Corporate bonds 7% Money markets 5% 90-day T-bills 12% 10% Insurance Information Life Insurance Policy A Policy B Policy C Policy D Insured Archie Elaine Elaine Archie Archie Owner Archie Elaine Elaine Beneficiary Archie's mother Estate of Archie Jerry J. & Jerry Ir & Christopher (equally) $48,000 Christopher (equally) $50.000 $200,000 Original amount Policy type Group term $100,000 30-year decreasing term Group term Modified premium whole life 50 $0 50 5420 $100 $60 Cash value Annual premium Premium payor Date purchased Current coverage $0 $250 Employer Annually $200,000 Archie 2008 $75,000 Employer Annually 548,000 Elaine 2013 $50,000 Case 7 Archie and Elaine Peyton 97 Health Insurance The entire family is covered under the ABC Company health insurance plan. The Peytons currently pay $200 per month for the employer-provided major medical plan. The deductible is $500 per person up to a maximum of three persons. The policy con- tains a stop-loss limit of $5,000 per year and an 80/20 coinsurance provision Disability Insurance Archie has a personally owned disability insurance policy that covers accident and sickness and has an own occupation definition with a 180-day elimination period. The policy pays monthly benefits of 60% of current gross income until Archie reaches age 65. Homeowners Insurance HO-2 Policy Dwelling $150,000 Other structure $15,000 Personal property* $ 75,000 Loss of use (20% of dwelling) $ 30,000 "No rider for replacement value on personal property. There is an endorsement for furs and jewelry (premium $30 annually). Personal Financial Planning Cases & Applications Textbook 10th Edition 2017-2018 Scheduled Personal Property Endorsement This Endorsement Changes the Policy. Please Read Carefully. For an additional premium, we cover the classes of personal property indicated by an amount of insurance. This coverage is subject to the DEFINITION, SECTION 1 CONDITIONS, SECTIONS I AND E CONDITIONS and all provisions of this endorsement. The Section 1 deductible as shown on the Declarations does not apply to this coverage. Class of Personal Property Amount of Insurance Premium 1. Jewelry, as scheduled. $10,000 $30 2. Furs and garments trimmed with Same as 1 fur or consisting principally of fur, as scheduled 3. Cameras, projection machines, films, $5,000 and related artides of equipment, as listed. 4. Musical instruments and related articles of equipment, as listed. You agree not to perform with these instruments for pay unless specifically provided under this policy. Silverware, silver-plated ware, goldware, gold-plated ware, and pewterware, but excluding pens, pencils, flasks, smoking implements, or jewelry. Golfer's equipment meaning golf clubs, golf clothing, and golf equipment. 7. Fine arts, as scheduled. This premium is based on your statement that the property insured is located at the following address. 8. Postage stamps 9. Rare and current coins Case 7 Archie and Elaine Peylon SCHEDULE Amount of Article Description Insurance Diamond Bracelet 12 pure 1/3k diamonds, 14k white gold setting 53,000 Diamond Necklace 18" 14k gold chain, pure 2k diamond pendant 57,000 T-Max 90 35 mm body $ 500 300Z leres 53,000 Hasenbladt Gamera body +2 lens $1,500 THE AMOUNTS SHOWN FOR EACH ITEM IN THE SCHEDULE ARE LIMITED BY CONDITION 2. LOSS SETTLEMENT ON PAGE 3 OF THIS ENDORSEMENT Entries may be left blank shown elsewhere in this policy for this coverage HO 04 61 04 91 Automobile Insurance PERSONAL AUTO POLICY DECLARATIONS PAGE COVERAGES Auto 1 $100,000/$300,000 $10,000 $100,000/$300,000 Auto 2 $100,000/$300,000 $10,000 $100,000/$300,000 Semiannual Premium $400 $100 $150 Part A-Liability Part Medical payments Part C-Uninsured motorists Part D-Damage to your auto Collision Other than collision Towing and labor Total semiannual premium $500 deductible $250 deductible $100 maximum $500 deductible $250 deductible 100 maximum $100 $70 $ 10 $830 Investment Information During Elaine's marriage to Jerry, an education fund was established for both Jerry Jr. and Christopher. Since Jerry died, Elaine has no longer contributed to this fund. At the present time, the fund balance is $22,747. The money has been invested at 6%, and the Peytons have the option of renewing the short-term certificate of deposit (CD) in April at an interest rate of 4%. When Elaine received the life insurance proceeds of $250,000 from Jerry's death, she asked a broker to help her manage the money. Her broker, John, placed her funds 100 Personal Financial Planning Cases & Applications Textbook 10th Edition 2017-2018 in an investment account over which he has full discretion. John's record regarding Elaine's investment portfolio over the last five years is as follows. 2013 2014 2015 2016 2012 (10,0) Load-adjusted total return ? (8.5) 12.0 3.0 Elaine did not have the information for 2013 and has been unable to obtain it from John. Elaine considers herself to be a conservative to moderate investor and has little experience or education in investments. Archie believes that he is a more moderate investor, and he has more experience with investments than Elaine. Income Tax Information The Peytons are in the 25% marginal tax bracket for federal income tax and 6% for state income tax. Retirement Information Both Elaine and Archie plan to retire when Elaine turns 65. They expect their retirement portfolio to earn a 10% pretax average annual rate of return. They also expect their retirement period to last 30 years. Social Security retirement benefits for Archie are expected to be $26,000 annually at age 67, while Elaine's Social Security benefit will be $9,600 annually at age 67. Archie has not contributed to the traditional IRA in several years. ABC Company sponsors a profit-sharing plan with a Section 401(k) feature. The Section 401(k) component of the plan allows participants to defer up to 20% of salary. The plan also matches $0.50 for every dollar contributed, up to 6% of salary. Neither Archie nor Elaine has ever made deferrals to the plan, but both have vested balances in the plan, as follows. Vested Balance as of January 1, 2017 Archie SB0,000 Elaine $12,000 The plan allows participants to self-direct their retirement plan assets through the choice of various mutual funds. ABC Company has recently established a phantom stock plan in which Archie is a participant. Archie's interest is 1% of ABC as of year-end 2016. Case 7 | Archie and Elaine Peyton 101 The investment options for the retirement plan are as follows. XYZ Small Company Growth Fund Fund objectives The Fund seeks long-term growth of capital Portfolio concept The Fund invests primarily in common stock of small and medium- size companies that are early in their life cycle and have the potential to become major enterprises. Fund objective: Portfolio concept XYZ Growth Fund The Fund seeks growth of capital and, secondarily, income The Fund seeks to invest in equity securities (stocks) placing primary emphasis on those securities that Fund Management believes to be undervalued. The Fund may invest up to 20% in foreign securities XYZ Index Fund The Fund seeks to approximate the total return of the S&P 500 Index The Fund invests primarily in a portfolio of equity securities (stocks) that are included in the S&P 500 Index. Fund objective: Portfolio concept Fund objective: XYZ Foreign Fund The Fund seeks long-term capital growth through investments in stocks and debt obligations of companies and governments outside the United States The Fund generally invests in common stocks; however, it may also invest in preferred stocks and certain debt securities, rated or unrated, such as convertible bonds and bonds selling at a discount. Portfolio concept: Fund objective: Portfolio concept XYZ Balanced Fund The Fund seeks the highest total investment return consistent with prudent risk. The Fund has a fully managed investment policy utilizing equity. debt, and convertible securities XYZ Income Fund The Fund seeks a high level of income, consistent with the prudent Investment of capital, through a flexible investment program emphasizing high-grade bonds. The Fund invests primarily in a broad range of high-grade, income- producing securities, such as corporate bonds and government securities. Fund objective: Portfolio concept: Fund objective: Portfolio concept: XYZ Money Market Fund The Fund seeks preservation of capital, current income, and liquidity. The Fund is a money market mutual fund that seeks capital preservation, current income, and liquidity through investment in a portfolio of high-quality, short-term money market instruments, including securities is issued by the US government, its agencies, or instrumentalities 102 Personal Financial Planning Cases & Applications Textbook 10th Edition 2017-2018 The company has made the following profit-sharing contributions to the retire. ment plan for Archie and Elaine for each of the related years. Archie Elaine 2017 None None 2016 $15,000 $3,600 2015 $ 0 $ 0 2014 $13,605 $3,265 2013 $10,366 52,488 2012 $ 8,954 $2,369 Balance 1/1/12 $25,000 $ 0 All contributions are made December 31 of the indicated year. ANNUALIZED RETURNS OF RETIREMENT FUNDS 2007 2008 2009 2010 2011 2012 2006 2013 2014 2015 2016 XYZ Small Co. - - - 4.83% 41.14% 15.01% Growth Fund - XYZ Growth Fund - - - 32.96% 0.03% 25.20% 9.97% 32.37% 1.77% 14.50% 36.82% 9.56% 1.02% 37.23% 13.25% XYZ Index Trust 28.77% XYZ Foreign Fund 24.75% 21.99% 30.53% -3,01% 18.25% 0.10% 36.82% 0.35% 11.15% 7.08% 19.89% 4.60% XYZ Balanced Fund 17.04% 22.98% 1.06% 24.69% 5.03% 13.71% 0.91% 32,87% 11.60% XYZ Income Fund 14.75% 0.74% 8.91% 12.75% 8.32% 17.32% 6.74% 12.58% 9.21% 1.43% 18.54% 4.21% XYZ Money Market Fund 3.87% 4,01% 5,02% 5.40% 4.75% 5.00% 5.25% 6.01% 6.71% 5.20 Gifts, Estates, Trusts, and Will Information They do not have any estate planning documents at this time. 103 Case 7 | Archle and Elaine Peyton Income Statement STATEMENT OF CASH FLOWS Archie and Elaine Peyton For January 1, 2016 to December 31, 2016 (Projected to be similar for 2017) CASH INFLOWS Salaries Archie $100,000 Elaine 24 000 Total salaries $124.000 Investment income ML Brokerage Account $ 3.050 Elaine's investment portfolio Savings account 618 Elaine's education fund Investment income $ 9,501 Total cash inflows $133.501 CASH OUTFLOWS Living expenses Food $ 4,300 Clothing Entertainment 6.500 Utilities, cable, and phone 5,000 Auto maintenance 1.200 Church 2.000 Home mortgage 14,934 Auto loans 18.818 Credit card 4,300 Total living expenses 5 61,052 Insurance Health 5 2.400 Auto 1,660 Life 520 Homeowners with endorsements Disability Total insurance $ 7,207 command 1,677 Taxes Property Cresidence) Federal income (withholdings) State income Payroll (FICA) (Schedule 1) $ 4,452 36,840 4,000 9.46 $ 54,778 Total taxes Total cash outflows Net cash flow (surplus) $123,037 $10,464 104 Personal Financial Planning Cases & Applications Textbook 10th Edition 2017-2018 Schedule 1: Payroll Taxes Old-Age, Survivors, and Disability Insurance Archie $100,000 x 62% = 56,200 Elaine $ 24,000 x 6.2% = $1,488 $7,688 Medicare Archie Elaine $100,000 x 1.45% $ 24.000 x 1.45% = - $1.450 $348 $1,798 $9,486 Total 2016 Payroll Tax Limits Income $118,500 Unlimited OASDI Medicare Tax Rate 6.2% 1.45% " 51 Case 7 l Archie and Elaine Peyton 105 Balance Sheet STATEMENT OF FINANCIAL POSITION Archie and Elaine Peyton As of January 1, 2017 Assets Liabilities and Net Worth Liquid assets Short-term liabilities Checking $ 7,500 52 Credit cards $ 4,300 Savings 15.450 Total liquid assets $ 22,950 Long-term liabilities Invested assets Horne mortgage $144.981 First Mutual Growth Funds $ 7,950 51/52 Auto loans 40,069 ML Brokerage Account 100,000 Margin loan 7.500 Elaine's investment portfolio 210,000 Total long-term $192,550 Elaine's education fund 22,747 Archie's vested retirement plan 80,000 Total liabilities $196,850 account Elaine's vested retirement plan 12,000 account Archie's individual retirement 9,000 account (IRA) Total invested assets $441,697 Use assets Home $185,000 Net worth $552,797 Truck 32,000 Car 21,000 Boat 10,000 Furs and jewelry 10,000 Furniture and household 27,000 Total use assets $285,000 Total liabilities Total assets $749,647 and net worth $749,647 option CONTO Notes to financial statements Al assets are stated at for market value Liabilities are stated at principal only The checking account is a noninterest-bearing account "The savings account earns 4% per year. See detal of fund "ML Brokerage Account is stated at gross value, which does not include margin loan of $7,500 "Margin loan is for ML Brokerage Acount. Interest rate is currently %. "Archie's IRA is currently invested in CDs at a local bank. Title designations 51 Archie's property 52 Flaine's property JT Joint tenancy with right of survivorship 106 Personal Financial Planning Cases & Applications Textbook 10th Edition 2017-2018 Information Regarding Assets and Liabilities Investment Income ML Brokerage Account Money market Bonds Margin interest $300 3,350 (600) $3,050 Elaine's Investment portfolio Bonds Stocks $1,300 3,471 $4,771 $ 618 $1,062 $9.501 Savings account Elaine's education fund TOTAL House Principal residence Fair market value (current) Original loan Term Interest rate Monthly payment Remaining mortgage Remaining term January 1, 2014 (purchase) $185,000 $148,000 30 years 9.5% $1,244.46 $144,981 27 years Boat The boat is a 90-horsepower fishing boat that was originally bought for $10,000 and is owned outright. Automobiles Purchase price Down payment Term Interest rate Monthly payment Payments remaining Outstanding balance Archie's 2015 Truck $40,000 $0 48 months 7% $957.85 Elaine's 2014 Car $35.000 $10,000 48 months 8% 5610.32 20 $11,392.23 $28,677.07 Case 7 Ardhi and in Peyton 107 20 ML Brokerage Account Account Name: Archie Peyton Account Number: AB100402 Balances Money Market Price/share Shares Current Yell e Market Value Money market $ 1.00 6.667.00 45% $6.567.00 Bonds Coupon Cost Basis fele Market Value $10,000 U.S. Treasury note 75% $10,351.18 $10,000.00 $15.000 US Treasury bond 6.0% 13,138.54 10,579.83 550.000 US Treasury bond 0.0% 4,093.40 3.982.02 $20,000 Davidson debenture 8.5% 17.455.93 16,288.44 545.039.15 $40,850.29 Stocks Price/share Shares Cost Basis Fair Market Value Stock 1 5 5.20 2,000 $10,000 $10,400 Stock 2 5 4.85 1,500 6,750 7,275 Stock 3 $26.00 500 11,250 13,000 $28,000 $30,675 These stocks do not currently pay dividends. Mutual Funds Price/share Shares Cost Basis Fair Market Value Emerging growth fund $21.00 $12,250 $10,500 Balanced fund $18.00 425 8,925 7.650 Municipal bond fund $12.00 250 3,500 3,000 $24,675 $21,150 Note: All distributions from these funds are reinvested. Number of Options Option Option Fair Market Options Contracts Premium Exercise Price Expiration Stock 2 call options 5 $3.00 $ 5.50 July 2017 $486.37 Stock 3 put options $5.00 $24.00 March 2017 5171.34 5657.71 TOTAL ACCOUNT VALUE $100,000 MARGIN LOAN BALANCE 57.500 NET ACCOUNT VALUE $92,500 500 Value 5 Personal Financial Planning Cases & Applications Textbook 10th Edition 2017-2018 First Mutual Growth Fund Account Name: Archie Peyton Account Number: AB100357 Price Share Total Shares Shares Transaction D ate Amount Buy 04/01/15 $ 2,500 Buy 08/01/15 $ 4,000 Reinvest dividend 12/01/15 $ 500 Buy 02/01/16 $3,000 Buy 04/01/16 $2,000 Buy 06/01/16 $ 1,500 Sell 12/01/16 $11,880 Reinvest dividend 12/01/16 1,080 BALANCE 12/31/16 - Note: All distributions from this fund are reinvested. $25.00 $20.00 $12.50 $15.00 $15.00 $20.00 $25.00 $27.00 $27.00 $26.50 100 200 40 200 100 60 (440) 40 100 300 340 540 640 700 260 300 300 $ 2,500 56,000 $4,250 5 8,100 $12,800 $17.500 $ 7,020 $ 8,100 $ 7,950 - Elaine's Investment Portfolio Bonds Cument Fair Market Value Bonds Term $10,000 U.S. Treasury bonds $5,000 U.S. Treasury bonds 10 20 Duration 7 .12 years 9 .95 years Total value of bonds $10.000 $5,000 $15,000 Shares 1,000 575 200 500 1,000 1,250 Stock Stock A Stock B Stock C Stock D Stock E Stock F X 6 % 11% 7% 3% 25% 22% Beta 0.65 0.75 0.65 0.70 0.95 1.10 11% 9 % 10% 8% 15% 18% Stocks P/ E R Ratio 75% 13.0 65% 14.0 30% 15.1 45% 25.2 70% 14.4 20% 11.1 D ividend Yield Basis 3.0% $30,000 3.7% $45,000 3.7% $20,000 0.0% $11,000 0.0% $20,000 0.0% $23,000 Total value of stocks Fair Market Value $ 38,000 $46,000 $17,000 $ 8,500 $18,000 $25,000 $152,500 Case 7 | Archie and Elaine Peyton 109 Mutual Funds Front-End Fal Market Value $ 205 $5,100 Shares 210 300 443 1,000 320 410 Mutual Rund Fund A Fund B Fund C Fund D Fund Fund F Style M G L G M V M G LG LG x 14% 11.5% 6% -6% 4% 7% Alpha 3% 5% (4%) (10%) 3%) 2.5%) Beta 1.1 0.94 0.65 0.70 1.1 0. 9 o 12% 8% 8% 20% 5% 3 % Expense Ratio 21% 1.0% 2.25% 52% 81% 42% 4% 60% $ 2.500 $5,000 $10,000 4.5% $11.075 185% 58.000 $ 7.500 1.75% 59.500 1.5% $10,000 Total value of mutual funds 8.000 $8.200 542,500 Note: All distributions from the mutual funds are reinvested. TOTAL PORTFOLIO VALUE $210.000 5-year average return Standard deviation Coefficient of determination Large Medium Growth Value 2. Archie and Elaine expect to need 80% of their current pretax income during retirement. Elaine would like to retire at age 65 and Archie at age 62. They both expect their retirement period to be 30 years. 3. Archie wants to review both his and Elaine's life insurance needs and have estate planning documents drafted for both of them. 4. They would like to minimize any death tax liability. 5. Archie and Elaine plan to travel extensively during retirement. 6. They want to be debt free by the time they retire. 7. They want to pay off their credit card debt in the upcoming year. Economic Information Inflation has averaged 4% over the last 20 years. Inflation is expected to be 3.5% for the foreseeable future. control (Assumed) Treasury Yield Curve 315 + 3 months 6 months 9 months 1 year 3 years 5 years 10 years 20 years 25 years Current Yields for Treasury Securities Months -.0% 6 Months 9 Months 45% 4.7% 1 Year 5.0% 3 Years 6.0% 5 Years 7.5% 10 Years 8.5% 20 Years 9.0% 25 Years 9,0% 30 Years 8.8% Person Financial Planning Cams & Applications Tet to dion 01.2018 Today is January 1, 2017 Archie and Elaine Peyton have come to you, a financial planner, for help in developing a plan to accomplish their financial goals. From your initial meeting together, you have gathered the following information. Personal Background and Information Archie Peyton (Age 47) Archie Peyton is an executive in ABC Company, a closely held corporation. His current salary is $100,000, and he expects increases of 5% per year. Elaine Peyton (Age 50) Elaine Peyton is Archie's administrative assistant. Her present salary is $24,000. She expects raises of 5% per year. This is a second marriage for Elaine. Her first husband, Jerry, died five years ago Elaine was the beneficiary of Jerry's $250.000 life insurance policy with which she cre- ated her investment portfolio Hoy99 The Peytons Archie and Elaine have been married for three years. They do not reside in a com munity property state. The Children Elaine has two children from her first marriage, Jerry Jr., age 16, and Christopher, ape 12. Archie and Elaine have one daughter, Kelsey, who is now 2 years old. All of the children live with them. The children are cared for during the day by their paternal grandmother who lives next door When they were first married, Archie wanted to adopt Jerry Jr. and Christopher, but the children refused. Since then, Archie and the two boys have been in continual conflict. As a result, Elaine expects to use her investment portfolio to pay for the boys' education, without any assistance from Archie. Personal and Financial Objectives 1. The Peytons want to plan for their children's college education. They plan for each child to attend a private institution for five years beginning at age 18 with a cost of $25,000 a year per child (today's cost). The expected educational inflation rate is 6%. Case 7 Ardhi and bone Peyton 95 2. Archie and Elaine expect to need 80% of their current pretax income during retirement. Elaine would like to retire at age 65 and Archie at age 62. They both expect their retirement period to be 30 years. 3. Archie wants to review both his and Elaine's life insurance needs and have estate planning documents drafted for both of them 4. They would like to minimize any death tax liability 5. Archie and Elaine plan to travel extensively during retirement 6. They want to be debt free by the time they retire. 7. They want to pay off their credit card debt in the upcoming year. Economic Information Inflation has averaged 4% over the last 20 years. Inflation is expected to be 3.5% for the foreseeable future. (Assumed) Treasury Yield Curve 10.00 9.00 8.00 7.00 6.00 5.00 3.00 1.00 0.00 + 3 months 6 months 9 months 1 year 3 years 5 years 10 years 20 years 25 years 30 years Current Yields for Treasury Securities 3 Months 4.0% 6 Months 9 Months 4,5% 4,7% 1 Year 5.0% 3 Years 6.0% 5 Years 75% 10 Years 8.5% 20 Years 9.0% 25 Years 0.0% 30 Years 8.8% Perso n l ig ass Applications Textbook to Edition 2017-2018 Current Mortgage Rates 8.75% for 30 year loans 8.25% for 15-year loans Closing costs of 3% will not be included in the refinancing of the existing more Expected Standard Deviation 15% Economic Outlook-Investments Expected Returns (Parta) Arressive stocks 15% Growth stocks S&P 500 Index 10% Corporate bonds 7% Money markets 5% 90-day T-bills 12% 10% Insurance Information Life Insurance Policy A Policy B Policy C Policy D Insured Archie Elaine Elaine Archie Archie Owner Archie Elaine Elaine Beneficiary Archie's mother Estate of Archie Jerry J. & Jerry Ir & Christopher (equally) $48,000 Christopher (equally) $50.000 $200,000 Original amount Policy type Group term $100,000 30-year decreasing term Group term Modified premium whole life 50 $0 50 5420 $100 $60 Cash value Annual premium Premium payor Date purchased Current coverage $0 $250 Employer Annually $200,000 Archie 2008 $75,000 Employer Annually 548,000 Elaine 2013 $50,000 Case 7 Archie and Elaine Peyton 97 Health Insurance The entire family is covered under the ABC Company health insurance plan. The Peytons currently pay $200 per month for the employer-provided major medical plan. The deductible is $500 per person up to a maximum of three persons. The policy con- tains a stop-loss limit of $5,000 per year and an 80/20 coinsurance provision Disability Insurance Archie has a personally owned disability insurance policy that covers accident and sickness and has an own occupation definition with a 180-day elimination period. The policy pays monthly benefits of 60% of current gross income until Archie reaches age 65. Homeowners Insurance HO-2 Policy Dwelling $150,000 Other structure $15,000 Personal property* $ 75,000 Loss of use (20% of dwelling) $ 30,000 "No rider for replacement value on personal property. There is an endorsement for furs and jewelry (premium $30 annually). Personal Financial Planning Cases & Applications Textbook 10th Edition 2017-2018 Scheduled Personal Property Endorsement This Endorsement Changes the Policy. Please Read Carefully. For an additional premium, we cover the classes of personal property indicated by an amount of insurance. This coverage is subject to the DEFINITION, SECTION 1 CONDITIONS, SECTIONS I AND E CONDITIONS and all provisions of this endorsement. The Section 1 deductible as shown on the Declarations does not apply to this coverage. Class of Personal Property Amount of Insurance Premium 1. Jewelry, as scheduled. $10,000 $30 2. Furs and garments trimmed with Same as 1 fur or consisting principally of fur, as scheduled 3. Cameras, projection machines, films, $5,000 and related artides of equipment, as listed. 4. Musical instruments and related articles of equipment, as listed. You agree not to perform with these instruments for pay unless specifically provided under this policy. Silverware, silver-plated ware, goldware, gold-plated ware, and pewterware, but excluding pens, pencils, flasks, smoking implements, or jewelry. Golfer's equipment meaning golf clubs, golf clothing, and golf equipment. 7. Fine arts, as scheduled. This premium is based on your statement that the property insured is located at the following address. 8. Postage stamps 9. Rare and current coins Case 7 Archie and Elaine Peylon SCHEDULE Amount of Article Description Insurance Diamond Bracelet 12 pure 1/3k diamonds, 14k white gold setting 53,000 Diamond Necklace 18" 14k gold chain, pure 2k diamond pendant 57,000 T-Max 90 35 mm body $ 500 300Z leres 53,000 Hasenbladt Gamera body +2 lens $1,500 THE AMOUNTS SHOWN FOR EACH ITEM IN THE SCHEDULE ARE LIMITED BY CONDITION 2. LOSS SETTLEMENT ON PAGE 3 OF THIS ENDORSEMENT Entries may be left blank shown elsewhere in this policy for this coverage HO 04 61 04 91 Automobile Insurance PERSONAL AUTO POLICY DECLARATIONS PAGE COVERAGES Auto 1 $100,000/$300,000 $10,000 $100,000/$300,000 Auto 2 $100,000/$300,000 $10,000 $100,000/$300,000 Semiannual Premium $400 $100 $150 Part A-Liability Part Medical payments Part C-Uninsured motorists Part D-Damage to your auto Collision Other than collision Towing and labor Total semiannual premium $500 deductible $250 deductible $100 maximum $500 deductible $250 deductible 100 maximum $100 $70 $ 10 $830 Investment Information During Elaine's marriage to Jerry, an education fund was established for both Jerry Jr. and Christopher. Since Jerry died, Elaine has no longer contributed to this fund. At the present time, the fund balance is $22,747. The money has been invested at 6%, and the Peytons have the option of renewing the short-term certificate of deposit (CD) in April at an interest rate of 4%. When Elaine received the life insurance proceeds of $250,000 from Jerry's death, she asked a broker to help her manage the money. Her broker, John, placed her funds 100 Personal Financial Planning Cases & Applications Textbook 10th Edition 2017-2018 in an investment account over which he has full discretion. John's record regarding Elaine's investment portfolio over the last five years is as follows. 2013 2014 2015 2016 2012 (10,0) Load-adjusted total return ? (8.5) 12.0 3.0 Elaine did not have the information for 2013 and has been unable to obtain it from John. Elaine considers herself to be a conservative to moderate investor and has little experience or education in investments. Archie believes that he is a more moderate investor, and he has more experience with investments than Elaine. Income Tax Information The Peytons are in the 25% marginal tax bracket for federal income tax and 6% for state income tax. Retirement Information Both Elaine and Archie plan to retire when Elaine turns 65. They expect their retirement portfolio to earn a 10% pretax average annual rate of return. They also expect their retirement period to last 30 years. Social Security retirement benefits for Archie are expected to be $26,000 annually at age 67, while Elaine's Social Security benefit will be $9,600 annually at age 67. Archie has not contributed to the traditional IRA in several years. ABC Company sponsors a profit-sharing plan with a Section 401(k) feature. The Section 401(k) component of the plan allows participants to defer up to 20% of salary. The plan also matches $0.50 for every dollar contributed, up to 6% of salary. Neither Archie nor Elaine has ever made deferrals to the plan, but both have vested balances in the plan, as follows. Vested Balance as of January 1, 2017 Archie SB0,000 Elaine $12,000 The plan allows participants to self-direct their retirement plan assets through the choice of various mutual funds. ABC Company has recently established a phantom stock plan in which Archie is a participant. Archie's interest is 1% of ABC as of year-end 2016. Case 7 | Archie and Elaine Peyton 101 The investment options for the retirement plan are as follows. XYZ Small Company Growth Fund Fund objectives The Fund seeks long-term growth of capital Portfolio concept The Fund invests primarily in common stock of small and medium- size companies that are early in their life cycle and have the potential to become major enterprises. Fund objective: Portfolio concept XYZ Growth Fund The Fund seeks growth of capital and, secondarily, income The Fund seeks to invest in equity securities (stocks) placing primary emphasis on those securities that Fund Management believes to be undervalued. The Fund may invest up to 20% in foreign securities XYZ Index Fund The Fund seeks to approximate the total return of the S&P 500 Index The Fund invests primarily in a portfolio of equity securities (stocks) that are included in the S&P 500 Index. Fund objective: Portfolio concept Fund objective: XYZ Foreign Fund The Fund seeks long-term capital growth through investments in stocks and debt obligations of companies and governments outside the United States The Fund generally invests in common stocks; however, it may also invest in preferred stocks and certain debt securities, rated or unrated, such as convertible bonds and bonds selling at a discount. Portfolio concept: Fund objective: Portfolio concept XYZ Balanced Fund The Fund seeks the highest total investment return consistent with prudent risk. The Fund has a fully managed investment policy utilizing equity. debt, and convertible securities XYZ Income Fund The Fund seeks a high level of income, consistent with the prudent Investment of capital, through a flexible investment program emphasizing high-grade bonds. The Fund invests primarily in a broad range of high-grade, income- producing securities, such as corporate bonds and government securities. Fund objective: Portfolio concept: Fund objective: Portfolio concept: XYZ Money Market Fund The Fund seeks preservation of capital, current income, and liquidity. The Fund is a money market mutual fund that seeks capital preservation, current income, and liquidity through investment in a portfolio of high-quality, short-term money market instruments, including securities is issued by the US government, its agencies, or instrumentalities 102 Personal Financial Planning Cases & Applications Textbook 10th Edition 2017-2018 The company has made the following profit-sharing contributions to the retire. ment plan for Archie and Elaine for each of the related years. Archie Elaine 2017 None None 2016 $15,000 $3,600 2015 $ 0 $ 0 2014 $13,605 $3,265 2013 $10,366 52,488 2012 $ 8,954 $2,369 Balance 1/1/12 $25,000 $ 0 All contributions are made December 31 of the indicated year. ANNUALIZED RETURNS OF RETIREMENT FUNDS 2007 2008 2009 2010 2011 2012 2006 2013 2014 2015 2016 XYZ Small Co. - - - 4.83% 41.14% 15.01% Growth Fund - XYZ Growth Fund - - - 32.96% 0.03% 25.20% 9.97% 32.37% 1.77% 14.50% 36.82% 9.56% 1.02% 37.23% 13.25% XYZ Index Trust 28.77% XYZ Foreign Fund 24.75% 21.99% 30.53% -3,01% 18.25% 0.10% 36.82% 0.35% 11.15% 7.08% 19.89% 4.60% XYZ Balanced Fund 17.04% 22.98% 1.06% 24.69% 5.03% 13.71% 0.91% 32,87% 11.60% XYZ Income Fund 14.75% 0.74% 8.91% 12.75% 8.32% 17.32% 6.74% 12.58% 9.21% 1.43% 18.54% 4.21% XYZ Money Market Fund 3.87% 4,01% 5,02% 5.40% 4.75% 5.00% 5.25% 6.01% 6.71% 5.20 Gifts, Estates, Trusts, and Will Information They do not have any estate planning documents at this time. 103 Case 7 | Archle and Elaine Peyton Income Statement STATEMENT OF CASH FLOWS Archie and Elaine Peyton For January 1, 2016 to December 31, 2016 (Projected to be similar for 2017) CASH INFLOWS Salaries Archie $100,000 Elaine 24 000 Total salaries $124.000 Investment income ML Brokerage Account $ 3.050 Elaine's investment portfolio Savings account 618 Elaine's education fund Investment income $ 9,501 Total cash inflows $133.501 CASH OUTFLOWS Living expenses Food $ 4,300 Clothing Entertainment 6.500 Utilities, cable, and phone 5,000 Auto maintenance 1.200 Church 2.000 Home mortgage 14,934 Auto loans 18.818 Credit card 4,300 Total living expenses 5 61,052 Insurance Health 5 2.400 Auto 1,660 Life 520 Homeowners with endorsements Disability Total insurance $ 7,207 command 1,677 Taxes Property Cresidence) Federal income (withholdings) State income Payroll (FICA) (Schedule 1) $ 4,452 36,840 4,000 9.46 $ 54,778 Total taxes Total cash outflows Net cash flow (surplus) $123,037 $10,464 104 Personal Financial Planning Cases & Applications Textbook 10th Edition 2017-2018 Schedule 1: Payroll Taxes Old-Age, Survivors, and Disability Insurance Archie $100,000 x 62% = 56,200 Elaine $ 24,000 x 6.2% = $1,488 $7,688 Medicare Archie Elaine $100,000 x 1.45% $ 24.000 x 1.45% = - $1.450 $348 $1,798 $9,486 Total 2016 Payroll Tax Limits Income $118,500 Unlimited OASDI Medicare Tax Rate 6.2% 1.45% " 51 Case 7 l Archie and Elaine Peyton 105 Balance Sheet STATEMENT OF FINANCIAL POSITION Archie and Elaine Peyton As of January 1, 2017 Assets Liabilities and Net Worth Liquid assets Short-term liabilities Checking $ 7,500 52 Credit cards $ 4,300 Savings 15.450 Total liquid assets $ 22,950 Long-term liabilities Invested assets Horne mortgage $144.981 First Mutual Growth Funds $ 7,950 51/52 Auto loans 40,069 ML Brokerage Account 100,000 Margin loan 7.500 Elaine's investment portfolio 210,000 Total long-term $192,550 Elaine's education fund 22,747 Archie's vested retirement plan 80,000 Total liabilities $196,850 account Elaine's vested retirement plan 12,000 account Archie's individual retirement 9,000 account (IRA) Total invested assets $441,697 Use assets Home $185,000 Net worth $552,797 Truck 32,000 Car 21,000 Boat 10,000 Furs and jewelry 10,000 Furniture and household 27,000 Total use assets $285,000 Total liabilities Total assets $749,647 and net worth $749,647 option CONTO Notes to financial statements Al assets are stated at for market value Liabilities are stated at principal only The checking account is a noninterest-bearing account "The savings account earns 4% per year. See detal of fund "ML Brokerage Account is stated at gross value, which does not include margin loan of $7,500 "Margin loan is for ML Brokerage Acount. Interest rate is currently %. "Archie's IRA is currently invested in CDs at a local bank. Title designations 51 Archie's property 52 Flaine's property JT Joint tenancy with right of survivorship 106 Personal Financial Planning Cases & Applications Textbook 10th Edition 2017-2018 Information Regarding Assets and Liabilities Investment Income ML Brokerage Account Money market Bonds Margin interest $300 3,350 (600) $3,050 Elaine's Investment portfolio Bonds Stocks $1,300 3,471 $4,771 $ 618 $1,062 $9.501 Savings account Elaine's education fund TOTAL House Principal residence Fair market value (current) Original loan Term Interest rate Monthly payment Remaining mortgage Remaining term January 1, 2014 (purchase) $185,000 $148,000 30 years 9.5% $1,244.46 $144,981 27 years Boat The boat is a 90-horsepower fishing boat that was originally bought for $10,000 and is owned outright. Automobiles Purchase price Down payment Term Interest rate Monthly payment Payments remaining Outstanding balance Archie's 2015 Truck $40,000 $0 48 months 7% $957.85 Elaine's 2014 Car $35.000 $10,000 48 months 8% 5610.32 20 $11,392.23 $28,677.07 Case 7 Ardhi and in Peyton 107 20 ML Brokerage Account Account Name: Archie Peyton Account Number: AB100402 Balances Money Market Price/share Shares Current Yell e Market Value Money market $ 1.00 6.667.00 45% $6.567.00 Bonds Coupon Cost Basis fele Market Value $10,000 U.S. Treasury note 75% $10,351.18 $10,000.00 $15.000 US Treasury bond 6.0% 13,138.54 10,579.83 550.000 US Treasury bond 0.0% 4,093.40 3.982.02 $20,000 Davidson debenture 8.5% 17.455.93 16,288.44 545.039.15 $40,850.29 Stocks Price/share Shares Cost Basis Fair Market Value Stock 1 5 5.20 2,000 $10,000 $10,400 Stock 2 5 4.85 1,500 6,750 7,275 Stock 3 $26.00 500 11,250 13,000 $28,000 $30,675 These stocks do not currently pay dividends. Mutual Funds Price/share Shares Cost Basis Fair Market Value Emerging growth fund $21.00 $12,250 $10,500 Balanced fund $18.00 425 8,925 7.650 Municipal bond fund $12.00 250 3,500 3,000 $24,675 $21,150 Note: All distributions from these funds are reinvested. Number of Options Option Option Fair Market Options Contracts Premium Exercise Price Expiration Stock 2 call options 5 $3.00 $ 5.50 July 2017 $486.37 Stock 3 put options $5.00 $24.00 March 2017 5171.34 5657.71 TOTAL ACCOUNT VALUE $100,000 MARGIN LOAN BALANCE 57.500 NET ACCOUNT VALUE $92,500 500 Value 5 Personal Financial Planning Cases & Applications Textbook 10th Edition 2017-2018 First Mutual Growth Fund Account Name: Archie Peyton Account Number: AB100357 Price Share Total Shares Shares Transaction D ate Amount Buy 04/01/15 $ 2,500 Buy 08/01/15 $ 4,000 Reinvest dividend 12/01/15 $ 500 Buy 02/01/16 $3,000 Buy 04/01/16 $2,000 Buy 06/01/16 $ 1,500 Sell 12/01/16 $11,880 Reinvest dividend 12/01/16 1,080 BALANCE 12/31/16 - Note: All distributions from this fund are reinvested. $25.00 $20.00 $12.50 $15.00 $15.00 $20.00 $25.00 $27.00 $27.00 $26.50 100 200 40 200 100 60 (440) 40 100 300 340 540 640 700 260 300 300 $ 2,500 56,000 $4,250 5 8,100 $12,800 $17.500 $ 7,020 $ 8,100 $ 7,950 - Elaine's Investment Portfolio Bonds Cument Fair Market Value Bonds Term $10,000 U.S. Treasury bonds $5,000 U.S. Treasury bonds 10 20 Duration 7 .12 years 9 .95 years Total value of bonds $10.000 $5,000 $15,000 Shares 1,000 575 200 500 1,000 1,250 Stock Stock A Stock B Stock C Stock D Stock E Stock F X 6 % 11% 7% 3% 25% 22% Beta 0.65 0.75 0.65 0.70 0.95 1.10 11% 9 % 10% 8% 15% 18% Stocks P/ E R Ratio 75% 13.0 65% 14.0 30% 15.1 45% 25.2 70% 14.4 20% 11.1 D ividend Yield Basis 3.0% $30,000 3.7% $45,000 3.7% $20,000 0.0% $11,000 0.0% $20,000 0.0% $23,000 Total value of stocks Fair Market Value $ 38,000 $46,000 $17,000 $ 8,500 $18,000 $25,000 $152,500 Case 7 | Archie and Elaine Peyton 109 Mutual Funds Front-End Fal Market Value $ 205 $5,100 Shares 210 300 443 1,000 320 410 Mutual Rund Fund A Fund B Fund C Fund D Fund Fund F Style M G L G M V M G LG LG x 14% 11.5% 6% -6% 4% 7% Alpha 3% 5% (4%) (10%) 3%) 2.5%) Beta 1.1 0.94 0.65 0.70 1.1 0. 9 o 12% 8% 8% 20% 5% 3 % Expense Ratio 21% 1.0% 2.25% 52% 81% 42% 4% 60% $ 2.500 $5,000 $10,000 4.5% $11.075 185% 58.000 $ 7.500 1.75% 59.500 1.5% $10,000 Total value of mutual funds 8.000 $8.200 542,500 Note: All distributions from the mutual funds are reinvested. TOTAL PORTFOLIO VALUE $210.000 5-year average return Standard deviation Coefficient of determination Large Medium Growth Value 2. Archie and Elaine expect to need 80% of their current pretax income during retirement. Elaine would like to retire at age 65 and Archie at age 62. They both expect their retirement period to be 30 years. 3. Archie wants to review both his and Elaine's life insurance needs and have estate planning documents drafted for both of them. 4. They would like to minimize any death tax liability. 5. Archie and Elaine plan to travel extensively during retirement. 6. They want to be debt free by the time they retire. 7. They want to pay off their credit card debt in the upcoming year. Economic Information Inflation has averaged 4% over the last 20 years. Inflation is expected to be 3.5% for the foreseeable future. control (Assumed) Treasury Yield Curve 315 + 3 months 6 months 9 months 1 year 3 years 5 years 10 years 20 years 25 years Current Yields for Treasury Securities Months -.0% 6 Months 9 Months 45% 4.7% 1 Year 5.0% 3 Years 6.0% 5 Years 7.5% 10 Years 8.5% 20 Years 9.0% 25 Years 9,0% 30 Years 8.8%