Question:

LO 4.2 3. Go to the IRS Web site (www.irs.gov) and find the most recent IRS Publication 1542, Per Diem Rates. What is the maximum per diem rate for lodging and M&IE for each of the following towns:

a. Flagstaff, AZ

b. Palm Springs, CA

c. Denver, CO

Transcribed Image Text:

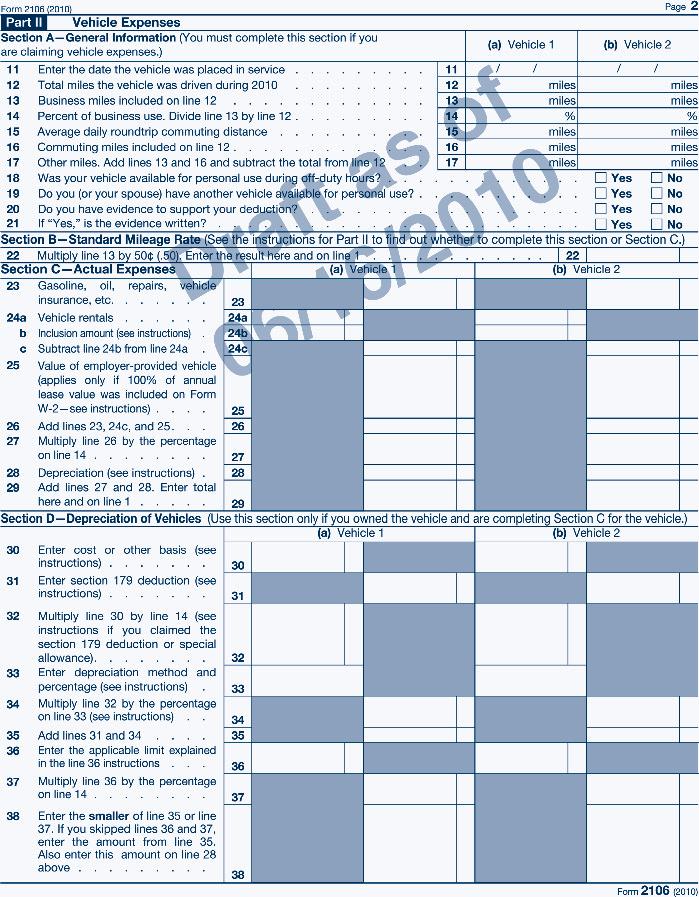

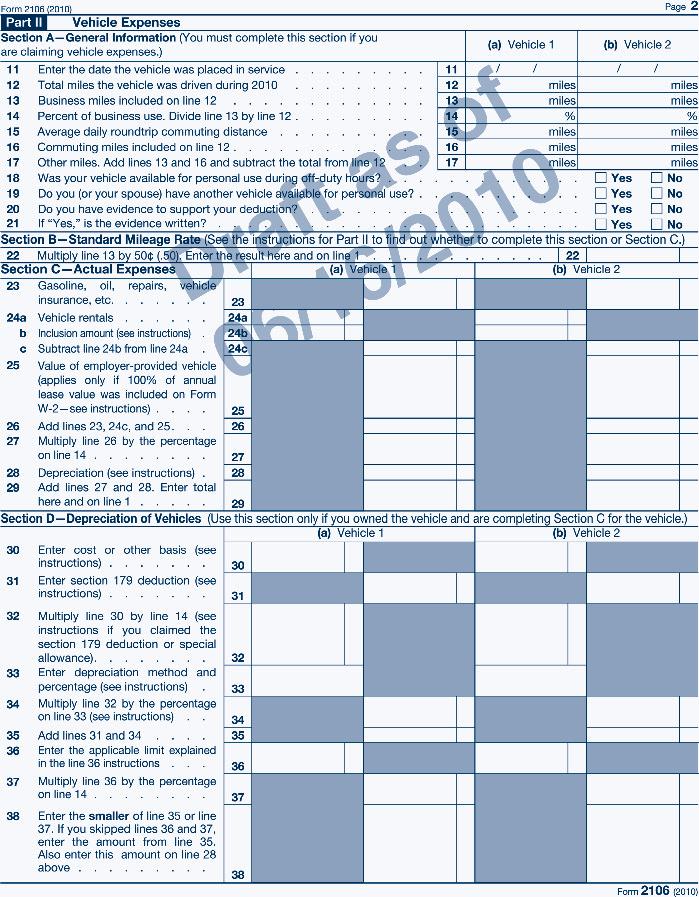

12 Total miles the vehicle was driven during 2010 13 Form 2106 (2010) Part II Vehicle Expenses Section A-General Information (You must complete this section if you are claiming vehicle expenses.) 11 Enter the date the vehicle was placed in service Business miles included on line 12 Page 2 (a) Vehicle 1 (b) Vehicle 2 11 12 miles miles 13 miles miles 14 Percent of business use. Divide line 13 by line 12. 14 % % 15 Average daily roundtrip commuting distance 16 Commuting miles included on line 12. 17 Other miles. Add lines 13 and 16 and subtract the total from line 12 18 Was your vehicle available for personal use during off-duty hours? S 15 16 17 19 Do you (or your spouse) have another vehicle available for personal use?. 20 Do you have evidence to support your deduction 21 If "Yes," is the evidence written? Section C-Actual Expenses 23 Gasoline, oil, repairs, vehicle insurance, etc. 24a Vehicle rentals . b Inclusion amount (see instructions) c Subtract line 24b from line 24a 25 Value of employer-provided vehicle (applies only if 100% of annual lease value was included on Form W-2-see instructions).... 26 Add lines 23, 24c, and 25. 225 27 22 Multiply line 26 by the percentage on line 14 Depreciation (see instructions). 25 26 27 28 28 29 Add lines 27 and 28. Enter total here and on line 1 .. 29 Section B-Standard Mileage Rate (See the instructions for Part II to find out whether to complete this section or Section C.) 22 Multiply line 13 by 50 (.50). Enter the result here and on line 22 (a) Vehicle 23 24a 24b 24c 5/2010 miles miles miles miles miles miles Yes No Yes No Yes No Yes No (b) Vehicle 2 Section D-Depreciation of Vehicles (Use this section only if you owned the vehicle and are completing Section C for the vehicle.) 30 Enter cost or other basis (see (a) Vehicle 1 (b) Vehicle 2 instructions). 31 Enter section 179 deduction (see instructions). 85 30 31 32 33 Multiply line 30 by line 14 (see instructions if you claimed the section 179 deduction or special allowance). Enter depreciation method and percentage (see instructions). 32 33 34 Multiply line 32 by the percentage on line 33 (see instructions) 34 35 Add lines 31 and 34. 35 36 Enter the applicable limit explained in the line 36 instructions 36 37 Multiply line 36 by the percentage on line 14. 37 38 Enter the smaller of line 35 or line 37. If you skipped lines 36 and 37, enter the amount from line 35. Also enter this amount on line 28 above 38 Form 2106 (2010)