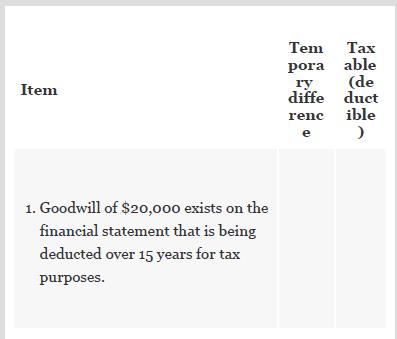

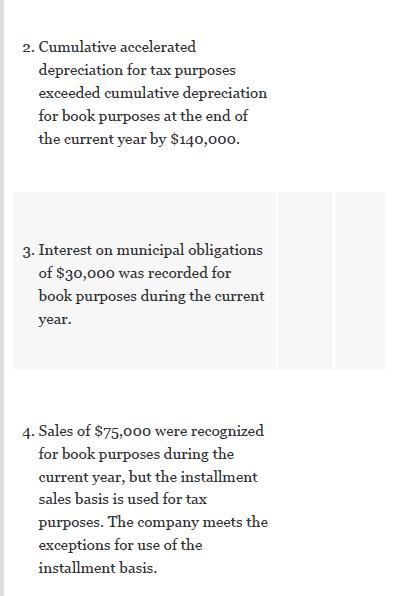

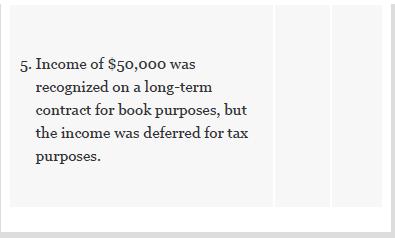

The following table lists several items that represent differences between book and tax income or between book

Question:

The following table lists several items that represent differences between book and tax income or between book and tax basis of assets and liabilities. For each item, indicate if it is a temporary difference, and, if so, whether the item will be taxable or deductible in future years for purposes of computing deferred taxes.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: