A company purchased property in year 1 with a cost basis of $120,000 and a useful life

Question:

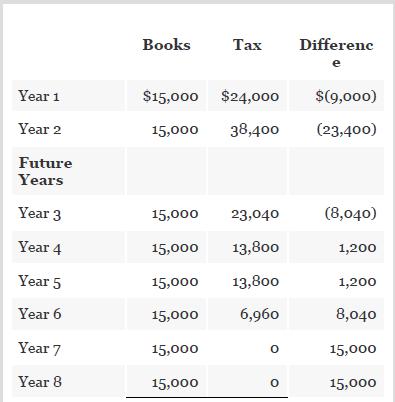

A company purchased property in year 1 with a cost basis of $120,000 and a useful life of eight years. The company is using straight-line depreciation for book purposes and accelerated depreciation over a five-year period for tax purposes. The depreciation for tax and books follows.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: