A public business entity has adopted FASB ASU No. 2015- 17 and is scheduling temporary differences for

Question:

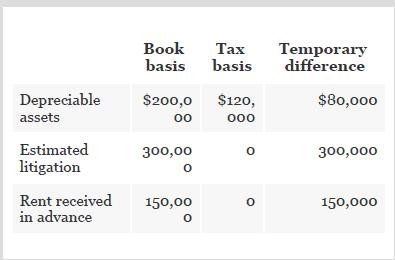

A public business entity has adopted FASB ASU No. 2015-

17 and is scheduling temporary differences for the purpose of computing deferred taxes. The company compared the tax basis assets and liabilities with the book basis assets and liabilities and accumulated the following temporary differences at the end of the current year.

The company is involved in long-term contract construction. The percentage of completion is used for book purposes, and the modified percentage of completion method is used for tax purposes. These are classified as noncurrent on the balance sheet. Temporary differences related to long-term contracts are as follows:

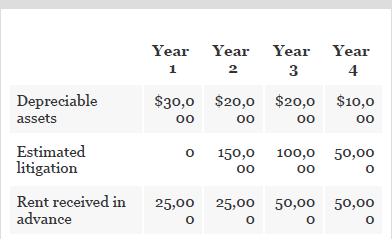

The temporary differences related to differences between book and tax basis assets and liabilities are estimated to be taxable or deductible as follows:

Step by Step Answer: