A company is scheduling its temporary differences for the purpose of computing deferred taxes. The company compared

Question:

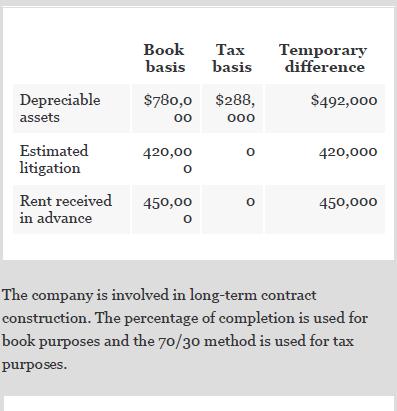

A company is scheduling its temporary differences for the purpose of computing deferred taxes. The company compared tax basis assets and liabilities with book basis assets and liabilities and accumulated the following temporary differences.

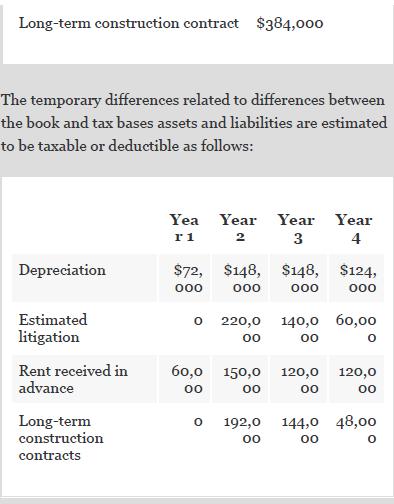

Required 1. Schedule all temporary differences over each of the four future years using the preceding information.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: