A company is scheduling temporary differences for the purpose of computing deferred taxes. The company compared tax

Question:

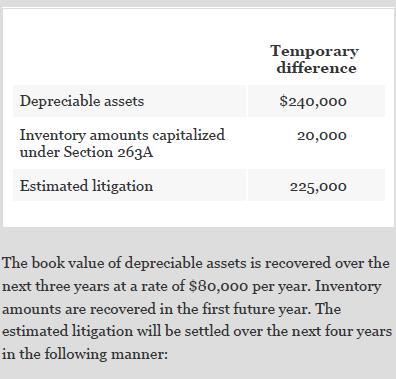

A company is scheduling temporary differences for the purpose of computing deferred taxes. The company compared tax basis assets and liabilities with book basis assets and liabilities and accumulated the following temporary differences.

Transcribed Image Text:

Temporary difference Depreciable assets $240,000 Inventory amounts capitalized 20,000 under Section 263A Estimated litigation 225,000 The book value of depreciable assets is recovered over the next three years at a rate of $80,000 per year. Inventory amounts are recovered in the first future year. The estimated litigation will be settled over the next four years in the following manner:

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

A public business entity has adopted FASB ASU No. 2015- 17 and is scheduling temporary differences for the purpose of computing deferred taxes. The company compared the tax basis assets and...

-

A company is scheduling temporary differences for the purpose of computing deferred taxes. The company compared the tax basis assets and liabilities with the book basis assets and liabilities and...

-

A company is scheduling its temporary differences for the purpose of computing deferred taxes. The company compared tax basis assets and liabilities with book basis assets and liabilities and...

-

Suppose that a surgical ward has gathered the following information for four nursing activities and two types of patients for the current period: Required: 1. Determine the total nursing costs...

-

Which two of the functions f(x) = 1, g(x) = x, h(a) = sin x are closest to each other on the interval [0, 1 ] under (a) The L1 norm? (b) The L2 norm? (c) The Lx norm?

-

Classify each cost by placing an X in the appropriate columns. The first cost is completed as an example. Use the following information for Short Exercises S21- 2 and S21- 3. Maynard Company reports...

-

The test statistic F is never greater than 1. In Exercises 7 and 8, determine whether the statement is true or false. If the statement is false, rewrite it as a true statement.

-

In his book Capitalism and Freedom, economist Milton Friedman wrote on page 133: There is one and only one social responsibility of businessto use its resources and engage in activities designed to...

-

Will the virtual teams be able to offer global environmental solutions for organizations and society?Explain

-

Can the number of instructions executed serve as a timer mechanism in a real-time operating system? How?

-

A company is in the process of scheduling temporary differences for year 3. The company has found that some temporary differences accumulate over several years and then eliminate over several years....

-

Gary and Christina Worden own the Mainstreet Inn, a bed and breakfast, in Parkville, Missouri. A stone wall ran the length of the property behind the inn. A driveway and walkway along the wall were...

-

Your beginning salary is $68,000. You deposit 8% each year in a savings account that earns 3% interest. Your salary increases by 5% per year and inflation is 2.5% per year. What value does your...

-

Any global marketing strategy, that is in the words of Peter Drucker (2003)" any commitment of present resources to future expectations", has to start with taking stock of the changes in the global...

-

A bank is considering purchasing partial ownership in a firm. The bank has $100 in cash, $250 in debt (due in one year), and an additional underlying asset that will be worth either $0 ("low") or...

-

How might interdisciplinary collaborations between psychology, sociology, neuroscience, and public health contribute to a more comprehensive understanding of resilience and its applications in...

-

Guatemala can produce two goods - coffee and bananas. If it allocates all of its resources to coffee production, it can produce 80 units of coffee and if it allocates all of its resources to bananas,...

-

Specific heat is defined as the amount of energy needed to increase the temperature of a unit mass of a substance by one degree. The specific heat of water at room temperature is 4.18 kJ/kg C in SI...

-

Element compound homogeneous mixture (heterogeneous mixture) 4) A piece of gold has a mass of 49.75 g. What should the volume be if it is pure gold? Gold has a density of 19.3 g/cm (3 points) D=m/v...

-

28. In the C++ code given in (a) and (b), find any syntax or logical errors. (8, 11) a. int *myPtr = new int; int *yourPtr; *myPtr = 5; yourPtr myPtr; //Line 1 //Line 2 //Line 3 //Line 4 cout < <...

-

Write the following Java programs; then build and run them. When they build and run correctly, copy the code into a separate text file for each program, with the same name as that program. Submit the...

-

I) (30 pts) - This assignment will acquaint you with the use of parameter passing, return values, if/else blocks, and user inputs. You will create a program that prompts the user for a set of...

Study smarter with the SolutionInn App