A. Russell (birthdate February 2, 1967) and Linda (birthdate August 30, 1972) Long have brought you the

Question:

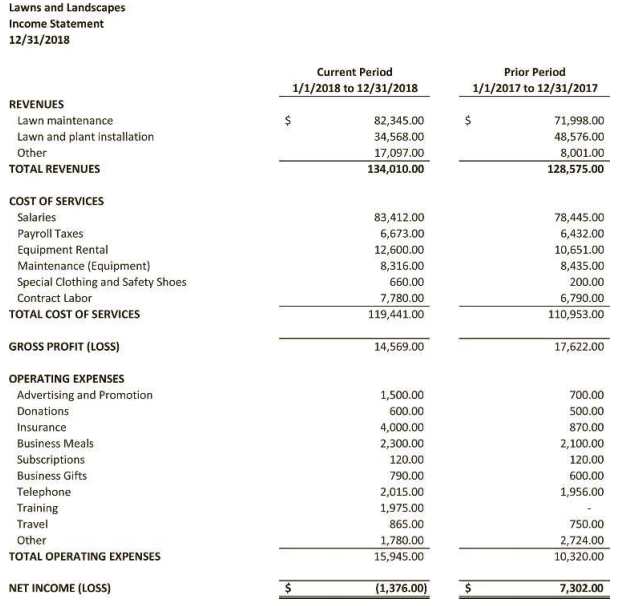

A. Russell (birthdate February 2, 1967) and Linda (birthdate August 30, 1972) Long have brought you the following information regarding their income and expenses for the current year. Russell owns and operates a landscaping business called Lawns and Landscapes Unlimited. The business is operated out of their home, located at 1234 Cherry Lane, Nampa, ID 83687. The principal business code is 561730. Russell’s bookkeeper provided the following income statement from the landscaping business:

The bookkeeper provided the following additional information:

● Donations expense is a $600 donation to the Campaign to Re-Elect Senator Ami Dahla.

● Training includes $575 for an educational seminar on bug control. It also includes the cost for Russell to attend an online certificate program in landscaping in order to improve his skills and advertise his designation as a certified landscaper. The tuition, fees, and books cost $1,400. He also drove his personal car 57 miles round trip to Boise to take exams three times for a total of 171 miles.

● No business gift exceeded $22 in value. The business uses the cash method of accounting and has no accounts receivable or inventory held for resale. In addition to the above expenses, the Longs have set aside one room of their house as a home office. The room is 200 square feet and their house has a total of 1,600 square feet. They pay $12,600 per year rental on their house, and the utilities amount to $3,000 for the year.

The Longs also have the following interest income for the year: Interest from Idaho Bank and Trust bond portfolio $42,810 The Longs have two dependent children, Bill (Social Security number 123-23-7654) and Martha (Social Security number 345-67-8654). Both Bill and Martha are full-time high school students, ages 17 and 18, respectively. Russell’s Social Security number is 664-98-5678 and Linda’s is 554-98-3946. They made an estimated tax payment to the IRS of $2,500 on December 31, 2018.

Required: Complete the Longs’ federal tax return for 2018 on Form 1040, Schedule 1, Schedule 5, Schedule B, Schedule C, and Form 8829. Do not complete Form 4562 (depreciation)

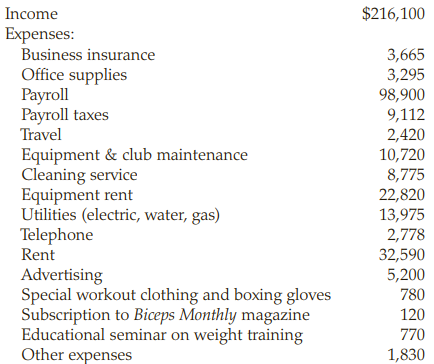

B. Christopher Crosphit (age 42) owns and operates a health club called “Catawba Fitness.” The business is located at 4321 New Cut Road, Spartanburg, SC 29303. The principal business code is 812190. Chris had the following income and expenses from the health club:

The business uses the cash method of accounting and has no accounts receivable or inventory held for resale. Chris has the following interest income for the year: Upper Piedmont Savings Bank savings account $12,831 Morgan Bank bond portfolio interest 12,025 Chris has been a widower for 10 years with a dependent son, Arnold (Social Security number 276-23-3954), and he files his tax return as head of household. Arnold is an 18-year-old high school student; he does not qualify for the child tax credit. They live next door to the health club at 4323 New Cut Road. Chris does all the administrative work for the health club out of an office in his home. The room is 171 square feet and the house has a total of 1,800 square feet. Chris pays $20,000 per year in rent and $4,000 in utilities. Chris’ Social Security number is 565-12-6789. He made an estimated tax payment to the IRS of $1,000 on April 15, 2018.

Required: Complete Chris’ federal tax return for 2018 on Form 1040, Schedule 1, Schedule 5, Schedule B, Schedule C, and Form 8829. Do not complete Form 4562 (depreciation).

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill