Abbe, age 56, started a new job in 2020. At Abbes previous employer she had filed a

Question:

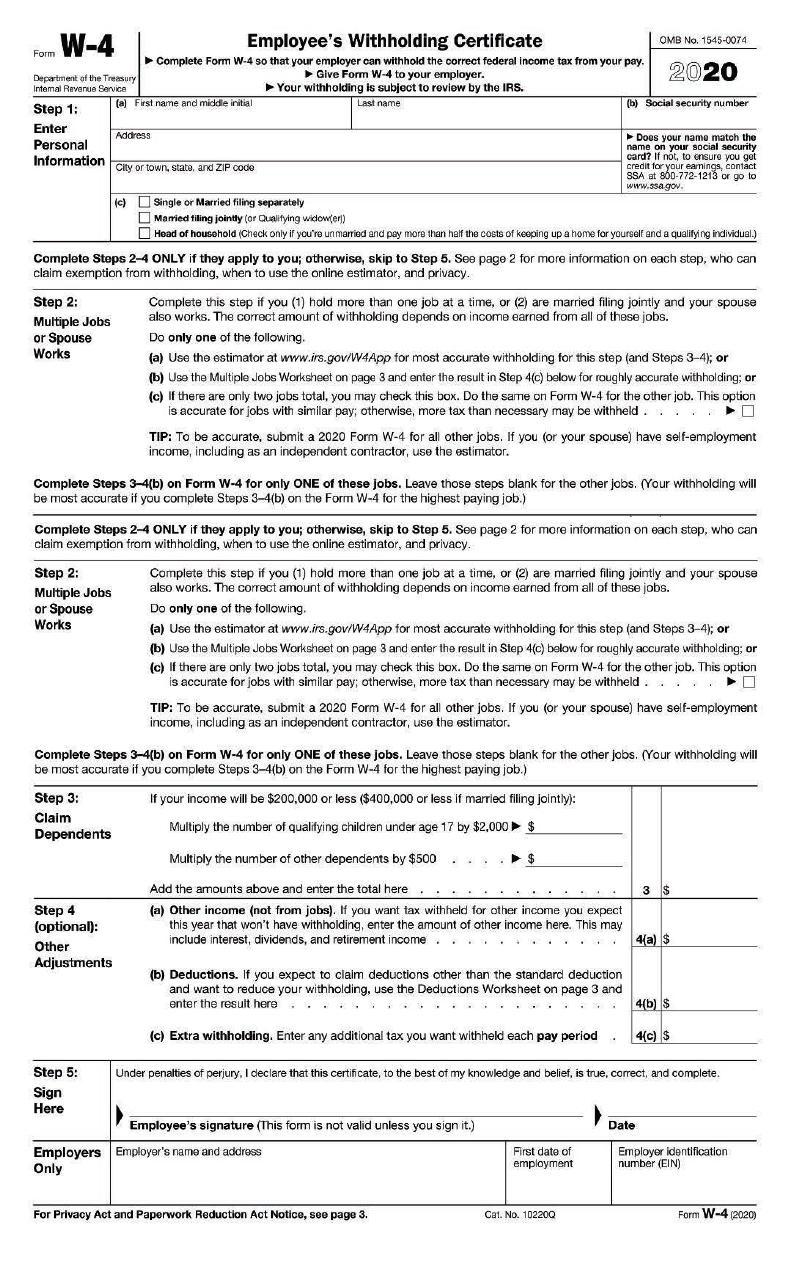

Abbe, age 56, started a new job in 2020. At Abbe’s previous employer she had filed a Form W-4 with 5 allowances. Abbe’s new employer will:

a. Use a copy of Abbe’s previous Form W-4 to calculate income tax withholding.

b. Permit Abbe to file a new W-4 using either the old allowances method or the new method.

c. Require Abbe to complete a new 2020 version of Form W-4.

d. Require Abbe to withhold as a single taxpayers with no dependents.

e. Require Abbe to use the IRS on-line withholding estimator.

Transcribed Image Text:

Form W-4 Department of the Treasury Internal Revenue Service Step 1: Enter Personal Information Step 2: Multiple Jobs or Spouse Works Step 2: Multiple Jobs or Spouse Works Employee's Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Your withholding is subject to review by the IRS. Last name (a) First name and middle initial Step 3: Claim Dependents Address Step 4 (optional): Other Adjustments City or town, state, and ZIP code Step 5: Sign Here (c) Single or Married filing separately Complete Steps 2-4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the online estimator, and privacy. Married filling jointly (or Qualifying widow(er)) Head of household (Check only if you're unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) Complete Steps 3-4(b) on Form W-4 for only ONE of these jobs. Leave those steps blank for the other jobs. (Your withholding will be most accurate if you complete Steps 3-4(b) on the Form W-4 for the highest paying job.) Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. The correct amount of withholding depends on income earned from all of these jobs. Do only one of the following. Complete Steps 2-4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the online estimator, and privacy. OMB No. 1545-0074 2020 (b) Social security number (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3-4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or (c) If there are only two jobs total, you may check this box. Do the same on Form W-4 for the other job. This option is accurate for jobs with similar pay; otherwise, more tax than necessary may be withheld... 0 Does your name match the name on your social security card? If not, to ensure you get credit for your earnings, contact SSA at 800-772-1213 or go to www.ssa.gov. TIP: To be accurate, submit a 2020 Form W-4 for all other jobs. If you (or your spouse) have self-employment income, including as an independent contractor, use the estimator. Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. The correct amount of withholding depends on income earned from all of these jobs. Complete Steps 3-4(b) on Form W-4 for only ONE of these jobs. Leave those steps blank for the other jobs. (Your withholding will be most accurate if you complete Steps 3-4(b) on the Form W-4 for the highest paying job.) If your income will be $200,000 or less ($400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000 $ $ Do only one of the following. (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3-4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or (c) If there are only two jobs total, you may check this box. Do the same on Form W-4 for the other job. This option is accurate for jobs with similar pay; otherwise, more tax than necessary may be withheld.... 0 TIP: To be accurate, submit a 2020 Form W-4 for all other jobs. If you (or your spouse) have self-employment income, including as an independent contractor, use the estimator. (b) Deductions. If you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the Deductions Worksheet on page 3 and enter the result here (c) Extra withholding. Enter any additional tax you want withheld each pay period Multiply the number of other dependents by $500 Add the amounts above and enter the total here (a) Other income (not from jobs). If you want tax withheld for other income you expect this year that won't have withholding, enter the amount of other income here. This may include interest, dividends, and retirement income.. 4(a) $ Employee's signature (This form is not valid unless you sign it.) Employers Employer's name and address Only For Privacy Act and Paperwork Reduction Act Notice, see page 3. First date of employment Cat. No. 10220Q Under penalties of perjury, I declare that this certificate, to the best of my knowledge and belief, is true, correct, and complete. 3 $ 4(b) $ 4(c) $ Date Employer identification number (EIN) Form W-4 (2020)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (8 reviews)

Answered By

Shaira grace

I have experience of more than ten years in handing academic tasks and assisting students to handle academic challenges. My level of education and expertise allows me communicate eloquently with clients and therefore understanding their nature and solving it successfully.

5.00+

4+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The process for employee withholding involves: a. Using only a 2020 Form W-4 for all employees to calculate income tax withholding. b. Using a 2020 Form W-4 for new employees (all existing employees...

-

Carol Harris, Ph.D, CPA, is a single taxpayer and she lives at 674 Yankee Street, Durham, NC 27409. Her Social Security number is 793-52-4335. Carol is an Associate Professor of Accounting at a local...

-

Brandon Stroud was driving a golf car made by Textron, Inc., to transport guests at Christmas party. The golf car did not have lights, but Textron did not warn against using it on public roads at...

-

States compete for lucrative filing fees by passing corporate statutes that favor management. One proposed solution to this problem would be a federal system of corporate registration. Is this a good...

-

Do you think that EI is a measurable ability? If so, what is the best way to measure it?

-

Understand how to choose a capital structure. LO.1

-

Outdoor Life manufactures snowboards. Its cost of making 1,890 bindings is as follows: Direct materials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ....

-

please please please , i am ask that question for several sevaeral time . please i need a solution and full explain of this solution please i am lose my money please Question 4 Rensing. Inc. has...

-

Alcorn Service Company was formed on January 1, Year 1. Events Affecting the Year 1 Accounting Period 1. Acquired $20,000 cash from the issue of common stock. 2. Purchased $800 of supplies on...

-

Using the information from Problem 11, complete Form 941 and Worksheet 1 located on Pages 9-55 to 9-58 for Drew for the second quarter of 2020. Assume the following additional information: Drew was...

-

Pat sells land for $25,000 cash and a $75,000 5-year note. If her basis in the property is $30,000 and she receives only the $25,000 down payment in the year of sale, how much is Pats taxable gain in...

-

Four samples each contain a single radioactive isotope. Sample A has 1 mol of matter and an activity of 100 Bq. Sample B has 10 mol and 100 Bq, sample C has 100 mol and 100 Bq, and sample D has 100...

-

Share your thoughts on the descriptions of coaching versus mentoring. Discuss which technique you personally find more helpful, incorporating your peers' example scenarios if possible. Provide...

-

Hanung Corp has two service departments, Maintenance and Personnel. Maintenance Department costs of $380,000 are allocated on the basis of budgeted maintenance-hours. Personnel Department costs of...

-

Discuss difference between nominal interest rate and real interest rate. Explain why real interest rate is more important than the nominal interest rate using your answer to Question 1 of the...

-

Refer to Figure 14-1. How would an increase in the money supply move the economy in the short and long run?

-

1) Special Relativity. Statement: Imagine this situation: Alice stands in New York City while Bob, aboard a plane departing from Boston, directly crosses over Alice at t=0. Disregard the vertical...

-

Indicate what a heuristic is and give four examples of it?

-

Why did management adopt the new plan even though it provides a smaller expected number of exposures than the original plan recommended by the original linear programming model?

-

For married taxpayers filing a joint return in 2016, at what AGI level does the phase-out limit for contributions to Qualified Tuition Programs start? a. $110,000 b. $190,000 c. $220,000 d. There is...

-

Which of the following is not true with respect to education incentives? a. The contributions to qualified tuition programs (Section 529 plans) are not deductible. b. The contributions to educational...

-

During 2016, Carl (a single taxpayer) has a salary of $91,500 and interest income of $15,500. Calculate the maximum contribution Carl is allowed for an educational savings account. a. $0 b. $400 c....

-

Physical Units Method, Relative Sales Value Method Farleigh Petroleum, Inc., is a small company that acquires high - grade crude oil from low - volume production wells owned by individuals and small...

-

A proposed $2.5 M investment in new equipment at a 100 MG/y M&Ms factory will save the plant $800,000/y in energy costs. Assuming an annual interest rate of 5%/y (compounded annually), and an...

-

Brief Exercise 10-7 Coronado Company obtained land by issuing 2,250 shares of its $14 par value common stock. The land was recently appraised at $103,240. The common stock is actively traded at $44...

Study smarter with the SolutionInn App