Determine from the tax table in Appendix A the amount of the income tax for each of

Question:

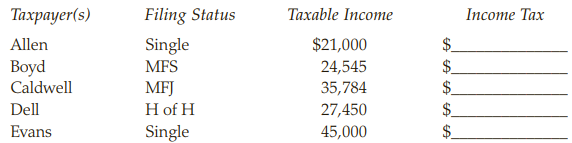

Determine from the tax table in Appendix A the amount of the income tax for each of the following taxpayers for 2018:

Transcribed Image Text:

Тахрауerls) Allen Boyd Caldwell Тахаble Income Income Tax Filing Status $21,000 24,545 35,784 27,450 Single $. $. MFS MFJ H of H Dell Evans Single 45,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (16 reviews)

Allen 2333 Boy...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Use the present value table in Appendix A and Appendix B to compute the NPV of each of the following cash outflows: a. $22,000 paid at the end of 4 years. The discount rate is 5 percent. b. $2,000...

-

Use the standard normal table in Appendix A to find the area a. Above (that is, to the right of) a point thats 2.0 standard deviations below the mean. b. In an interval starting 1.57 standard...

-

Use the standard normal table in Appendix A to find the area a. At or below a point 1.64 standard deviations to the right of the mean. b. At or below a point 2.33 standard deviations to the left of...

-

Carbon has the electron configuration 1s 2s2p. The two unpaired electrons in the n = 2 level suggests that carbon will form two bonds. We know, however, that carbon forms four bonds in most compounds...

-

Merchandise costing $2,000 is sold for $3,000 on terms 2/10, n/30. If the buyer pays within the discount period, what amount will be reported on the income statement as net sales and as gross profit?

-

Why is the annual operating budget one of the most important financial reports a hospitality manager should know, understand and use?

-

Even if all the points on an i-chart Pall between the control limits, the process may be out of control. - Exnlain. - 1 5 10 15 20 25

-

A plant asset with a cost of $40,000 and accumulated depreciation of $36,000 is sold for $6,000. Required a. What is the book value of the asset at the time of sale? b. What is the amount of gain or...

-

Sally earns gross wages of $1200 per week. She has standard deductions for social security and medicare. She is single with 1 allowance. She also has 6% of her gross wages put into a retirement...

-

Pendray Systems Corporation began operations on January 1, 20Y5 as an online retailer of computer software and hardware. The following financial statement data were taken from Pendray's records at...

-

Arthur is 65 years old and single. He supports his father, who is 90 years old, blind, and has no income. What is Arthurs standard deduction? a. $12,000 b. $13,600 c. $15,200 d. $18,000 e. $21,200

-

For each of the following cases, indicate the filing status for the taxpayer(s) for 2018 using the following legend: A. Single B. Married filing a joint return C. Married filing separate returns D....

-

A 60-kg girl weighs herself by standing on a scale in an elevator. What does the scale read when? (a) The elevator is descending at a constant rate of 10 m/s; (b) The elevator is descending at 10 m/s...

-

In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is...

-

Briefly describe the case you have chosen. Categorize the social worker's experience as vicarious trauma, compassion fatigue, or burnout. Provide justification. Identify the social worker's score on...

-

Given f(x) below, find f'(x). f(x) = = m 5z In (2) et dt

-

Olsen & Alain, CPAs (O&A) performed the audit of Rocky Point Brewery (RPB), a public company in 20X1 and 20X2. In 20X2, O&A also performed tax services for the company. Which statement best describes...

-

Exercise 9-4 (Algo) Prepare a Flexible Budget Performance Report [LO9-4] Vulcan Flyovers offers scenic overflights of Mount Saint Helens, the volcano in Washington State that explosively erupted in...

-

In a Patterson synthesis, the spots correspond to the lengths and directions of the vectors joining the atoms in a unit cell. Sketch the pattern that would be obtained for a planar, triangular...

-

Prove the result that the R 2 associated with a restricted least squares estimator is never larger than that associated with the unrestricted least squares estimator. Conclude that imposing...

-

List the 7 rules that all taxpayers must meet in order to claim the EIC?

-

List the rules that apply to taxpayers without a qualifying child in order to claim the EIC?

-

List the rules that apply to taxpayers without a qualifying child in order to claim the EIC?

-

How does budgeting household expenses differ from budgeting business expenses? What are the similarities?

-

This is a partial adjusted trial batance of Cullumber Compary manualys

-

Which of the following journal entries will record the payment of a $1,500 salaries payable originally incurred for Salaries Expense? Select one: A. Debit Salaries Expense; credit Salaries Payable B....

Study smarter with the SolutionInn App