Diego, age 28, married Dolores, age 27, in 2020. Their salaries for the year amounted to $48,000.

Question:

Diego, age 28, married Dolores, age 27, in 2020. Their salaries for the year amounted to $48,000. They had dividend income of $2,500. Diego and Dolores’ deductions for adjusted gross income amounted to $3,000, their itemized deductions were $16,000, and they have no dependents.

Transcribed Image Text:

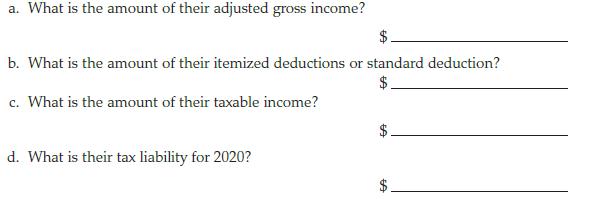

a. What is the amount of their adjusted gross income? b. What is the amount of their itemized deductions or standard deduction? c. What is the amount of their taxable income? d. What is their tax liability for 2020? A

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (7 reviews)

a 47500 48000 2500 3000 b 24...View the full answer

Answered By

Venkata Anoop Suhas Kumar Morisetty

I am a student majoring in Electronics and Electrical Engineering having knowledge ranging from Artificial Intelligence in computer science to Designing circuits, Control systems in Electrical Engineering. I first started tutoring in middle school to fellow juniors in 6th grade, from then I am constantly engaged in teacher fellow batch mates, juniors until now. In the first-year undergrad school, I volunteered under the rotary club to tutor middle and high school students. In the second year of undergrad school, I mentored and tutored successfully 11th and 12th grade students from India to qualify for Joint Entrance Examination-Advanced. On a concluding note, I am a person who is a highly organised and dedicated person who is interested in teaching and spreading knowledge.

0.00

0 Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Diego, age 28, married Dolores, age 27, in 2018 Their salaries for the year amounted to $103,875 and they had interest income of $4,630 Diego and Dolores' deductions for adjusted gross income...

-

Diego, age 28, married Dolores, age 27, in 2019. Their salaries for the year amounted to $47,230 and they had interest income of $3,500. Diego and Dolores deductions for adjusted gross income...

-

Diego, age 28, married Dolores, age 27, in 2018. Their salaries for the year amounted to $47,230 and they had interest income of $3,500. Diego and Dolores deductions for adjusted gross income...

-

Find any horizontal or vertical asymptotes. f(x) = = X 1- X

-

What is the includes relationship used for?

-

Distinguish between target costing and target pricing. transactions. How can opportunity costs, which usually

-

Poverty. The number of Americans living below the official poverty line increased from 24,975,000 to 36,950,000 in the 30 years between 1976 and 2005. What percentage increase was this? You should...

-

A financial analyst is attempting to assess the future dividend policy of Environmental Systems by examining its life cycle. She anticipates no payout of earnings in the form of cash dividends during...

-

1. It takes 2 min to load and unload a machine. Inspection, packaging, and travel between machines total of 1 min. The machining time is 6 min. The operator costs $15 /hr. and the machine costs...

-

Use the JustLee Books database to perform the following activity: There are three major classifications for employees who dont work for the Information Systems Department of JustLee Books: account...

-

Which of the following is a deduction for adjusted gross income in 2020? a. Personal casualty losses b. Medical expenses c. Student loan interest d. Mortgage interest e. None of the above

-

In 2020, Manon earns wages of $54,000. She also has dividend income of $2,800. Manon is single and has no dependents. During the year, Manon sold silver coins held as an investment for a $7,000 loss....

-

LO4,5 Sidney and Gertrude own 40% of Bearcave Bookstore, an S corporation. The remaining 60% is owned by their son Boris. Sidney and Gertrude do not participate in operating or managing the store,...

-

What is the average age (measured by the variable "age") of the sample in the GSS93 subset.sav data set? Is there a significant difference in the age of those who favor the death penalty for murder...

-

Solve the system of linear equations, using the Gauss-Jordan elimination method. (If there is no solution, enter NO SOLUTION. If there are infinitely many solutions, express your answer in terms of...

-

The pay disparity is due to several reasons, one of the main ones being the old stereotypes based on the archetype of the man as the breadwinner of the family. Women are usually hired at a lower...

-

Prepare Balance Sheet: To do this activity you are required to assume the amount and line items that are to be shown on the balance sheet of your business selling homemade articles. Using the...

-

You have a "Consent to Use E-mail Communication" on file for this patient. Draft a short e-mail to her about her lab and chest X-ray results, requesting she contact the office by phone or e-mail to...

-

The following independent items for Last Planet Theatre during the year ended December 31, 2017, may require a transaction journal entry, an adjusting entry, or both. The company records all prepaid...

-

Discuss the concept of the looking-glass self. how do you think others perceive you? do you think most people perceive you correctly?

-

What is the maximum amount a 45-year-old taxpayer and 45-year-old spouse can put into a Traditional or Roth IRA for 2019 (assuming they have sufficient earned income, but do not have an income...

-

Tony is a 45-year-old psychiatrist who has net earned income of $300,000 in 2019. What is the maximum amount he can contribute to his SEP for the year?

-

During 2019, Jill, age 39, participated in a Section 401(k) plan which provides for maximum employee contributions of 12 percent. Jills salary was $80,000 for the year. Jill elects to make the...

-

(15 points) Stressed $2.500,000 of S% 20 year bands. These bonds were issued Jary 1, 2017 and pay interest annually on each January 1. The bonds yield 3% and was issued at $325 8S! Required (2)...

-

Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for...

-

1. A company issued 10%, 10-year bonds with a par value of $1,000,000 on January 1, at a selling price of $885,295 when the annual market interest rate was 12%. The company uses the effective...

Study smarter with the SolutionInn App