Question:

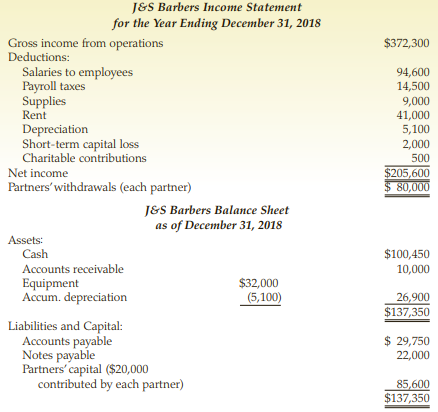

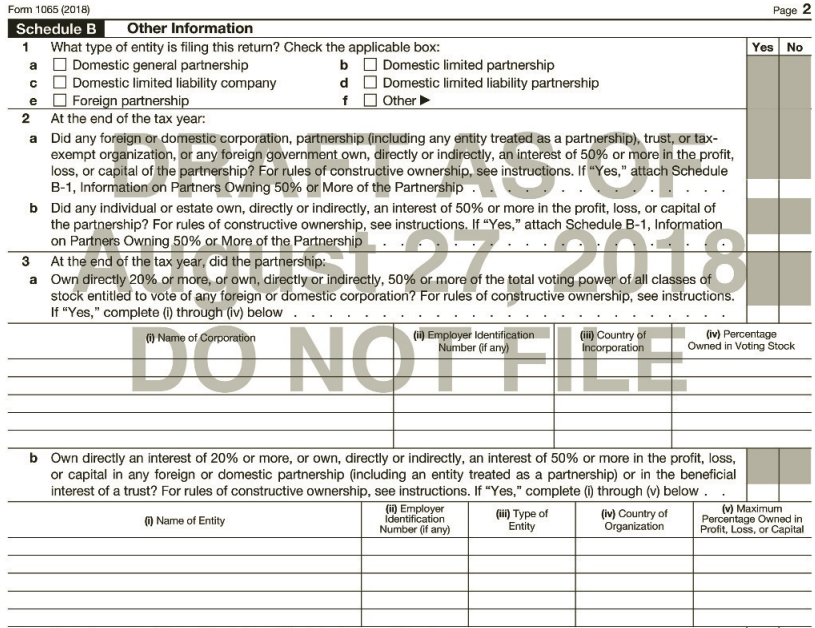

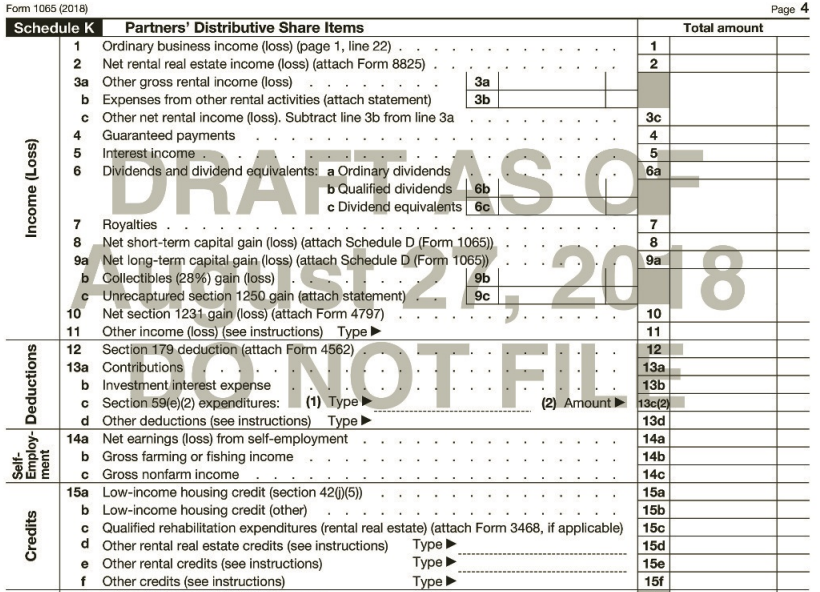

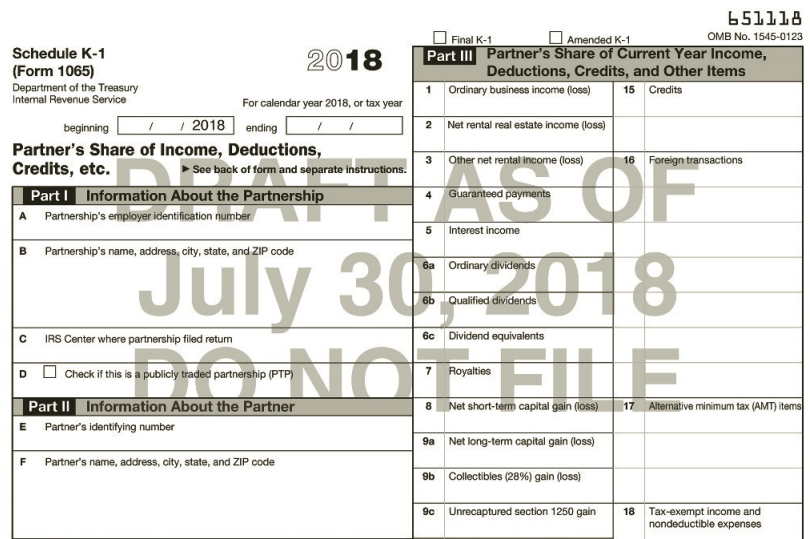

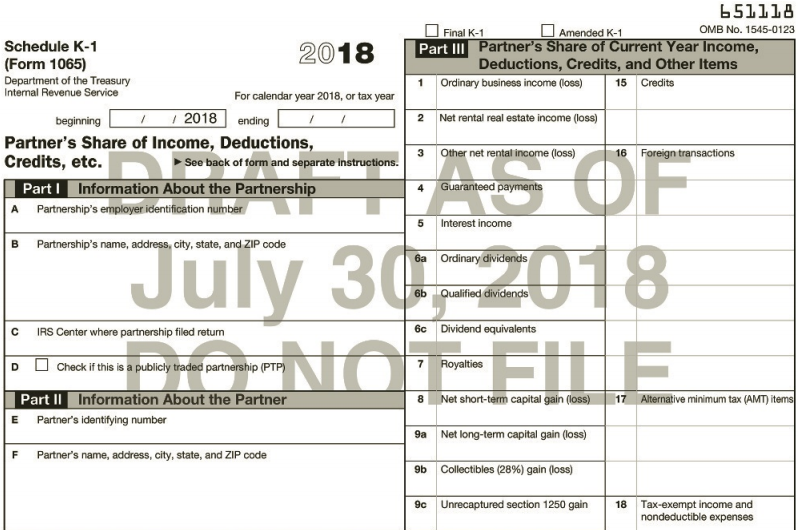

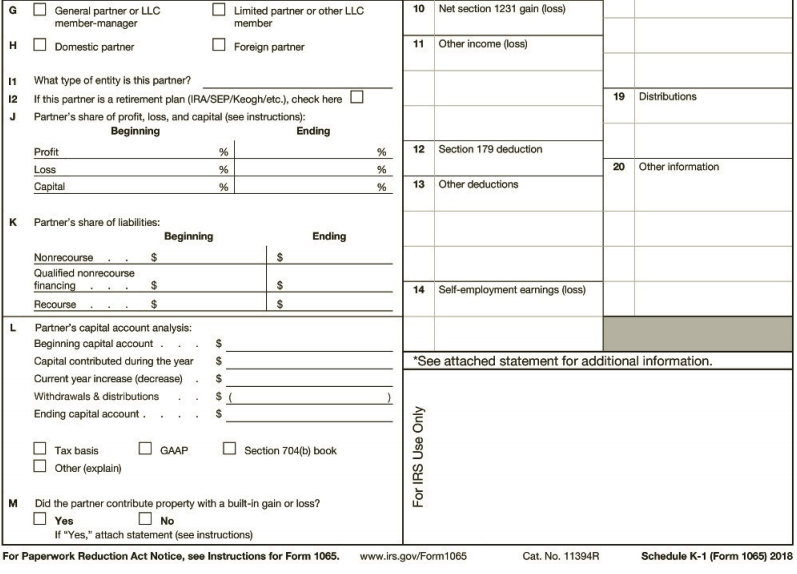

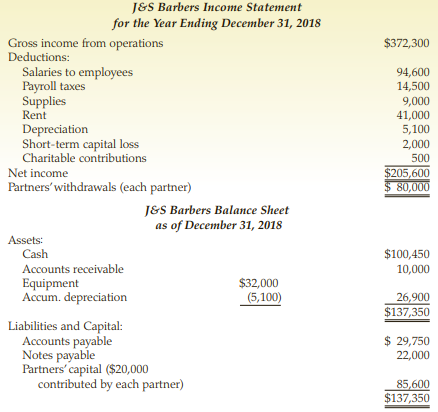

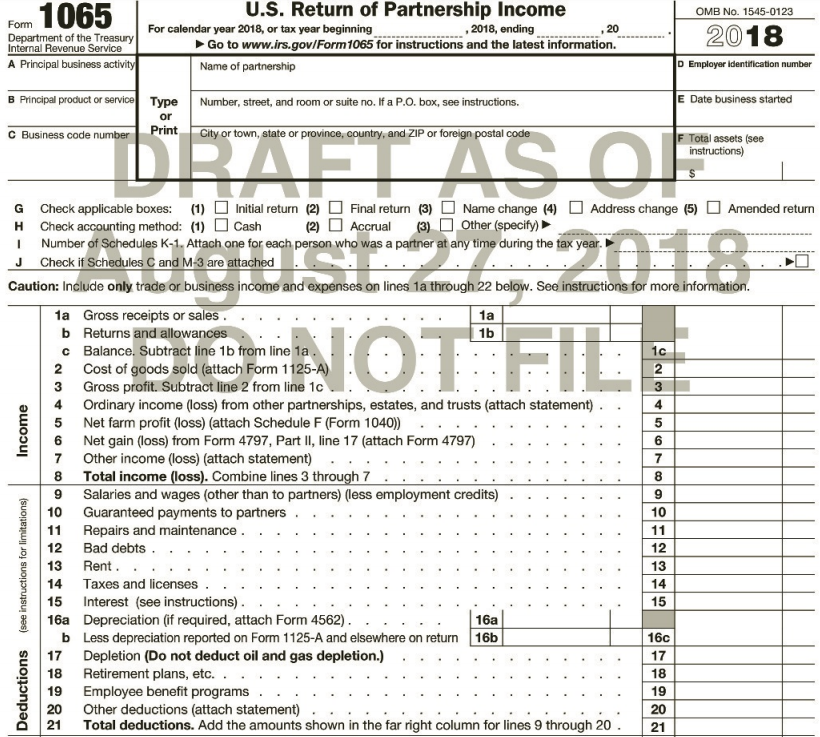

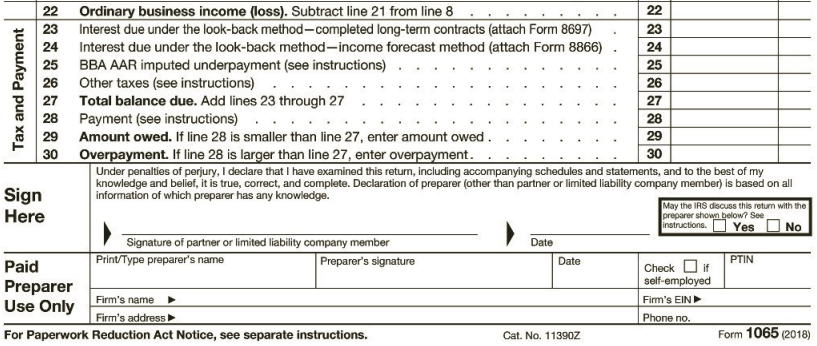

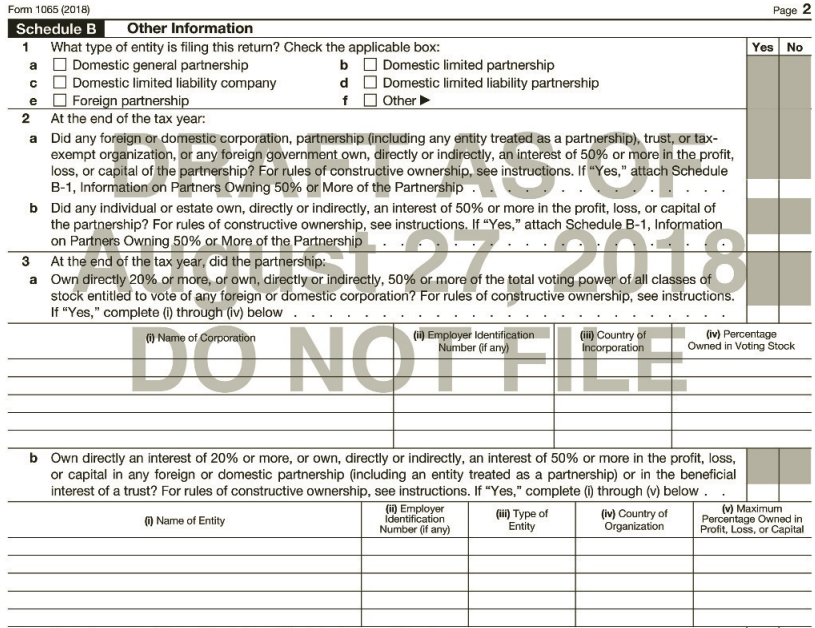

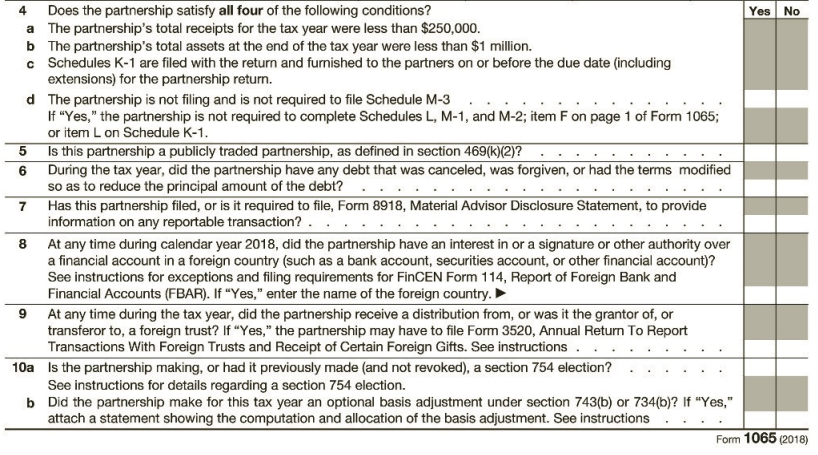

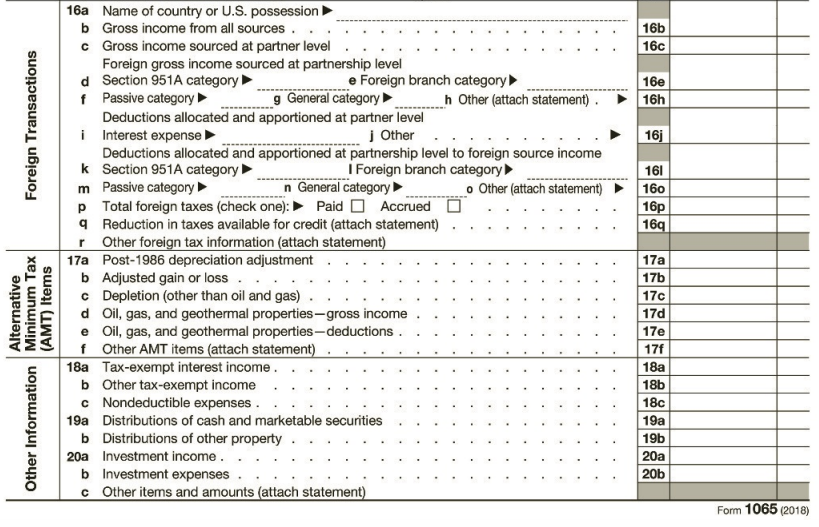

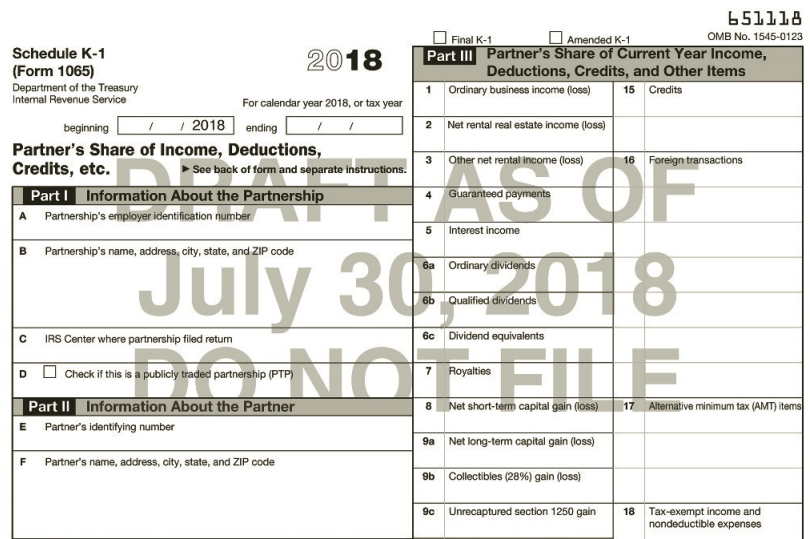

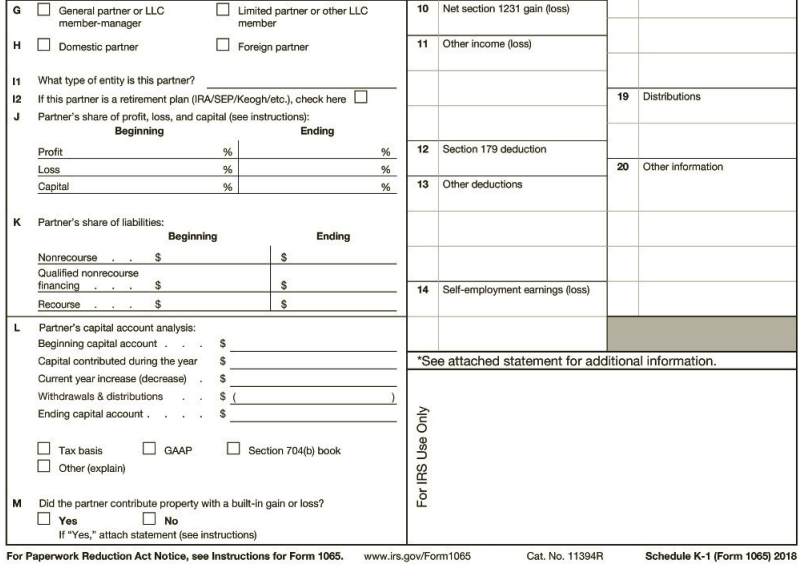

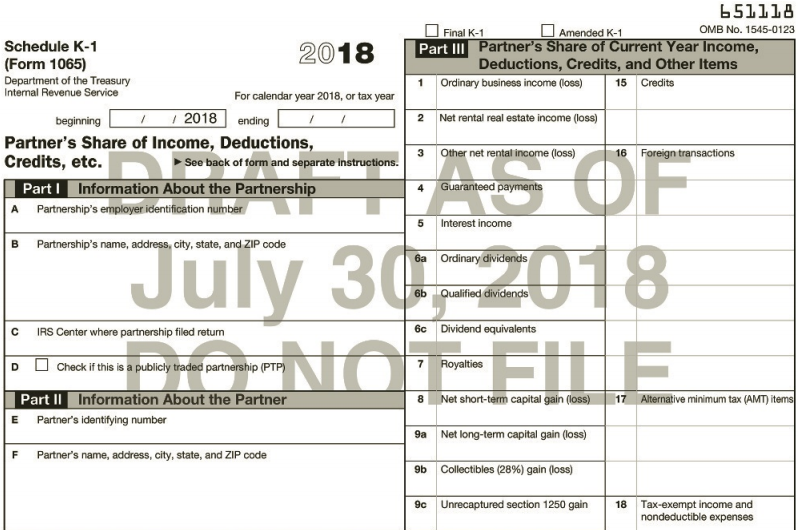

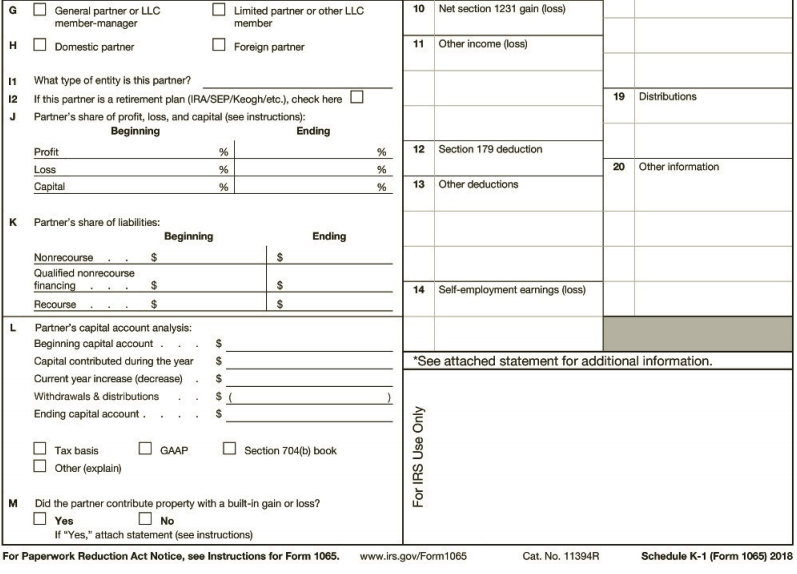

Emily Jackson (Social Security number 765-12-4326) and James Stewart (Social Security number 466-74-9932) are partners in a partnership that owns and operates a barber shop. The partnership’s first year of operation is 2018. Emily and James divide income and expenses equally. The partnership name is J&S Barbers, it is located at 1023 Broadway, New York, NY 10004, and its Federal ID number is 95-6767676. The 2018 financial statements for the partnership are presented below.

Emily lives at 456 E. 70th Street, New York, NY 10006, and James lives at 436 E. 63rd Street, New York, NY 10012.

Required:

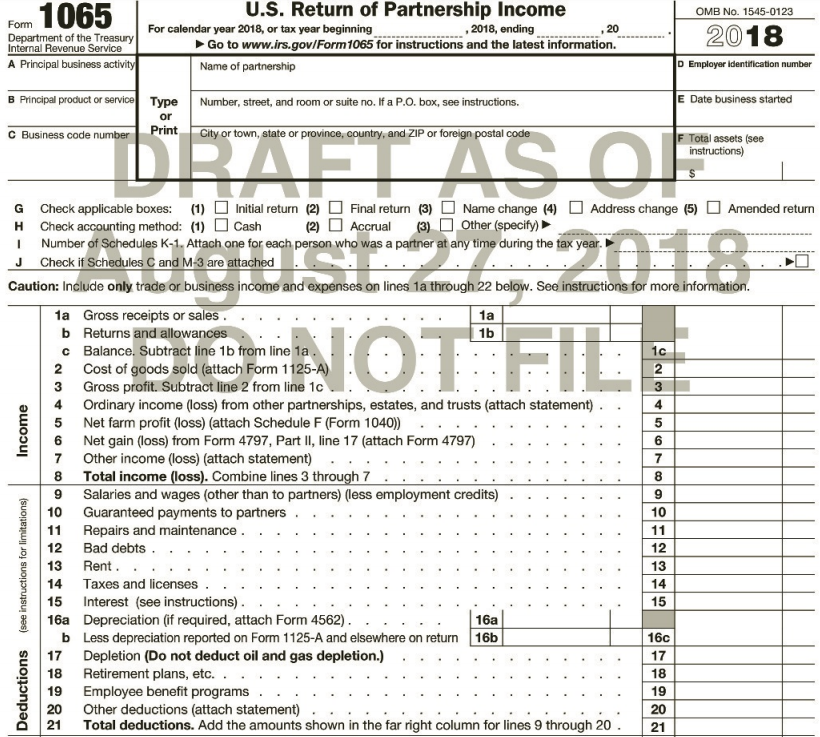

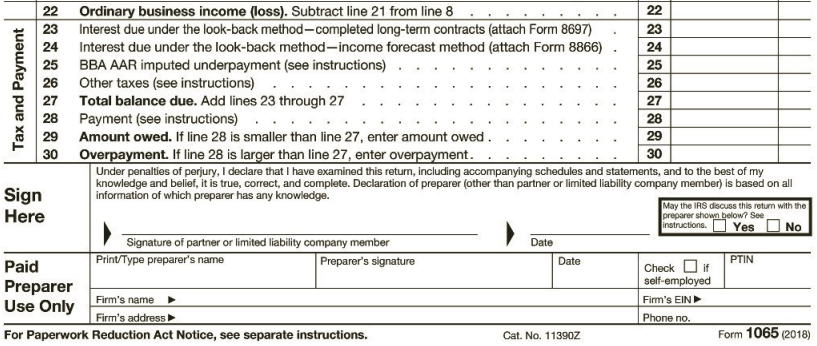

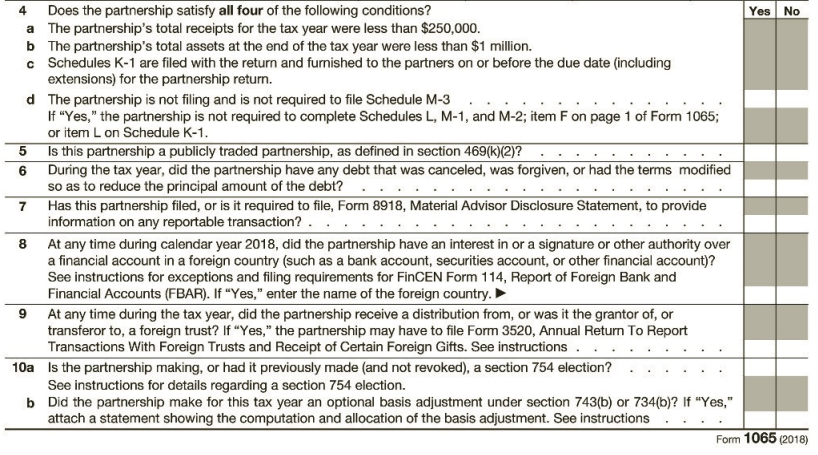

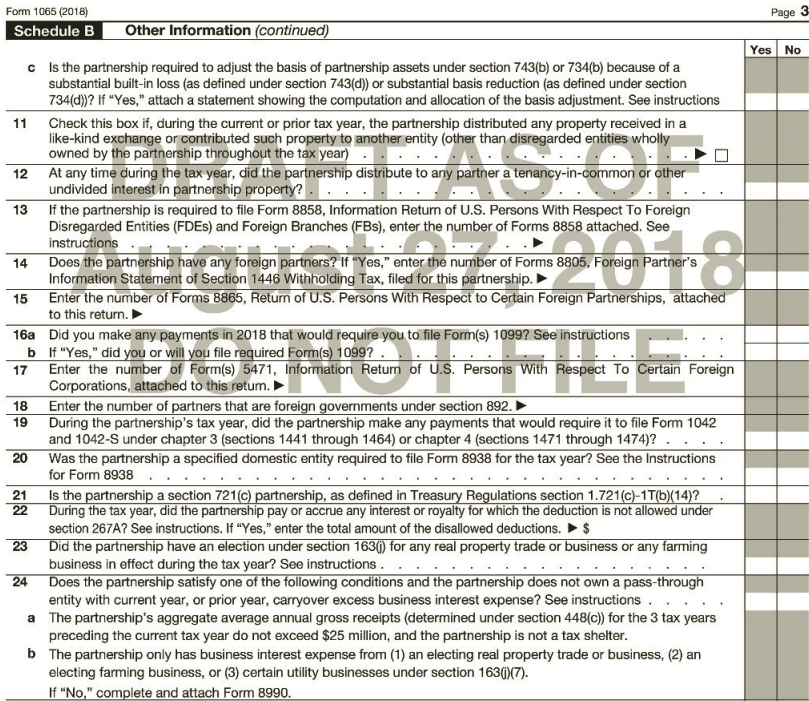

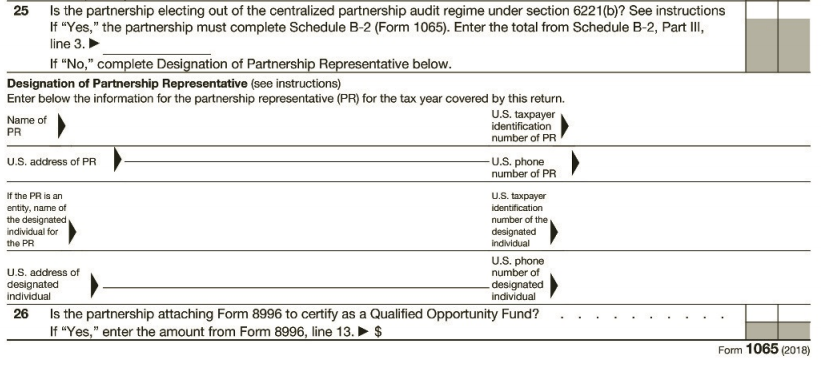

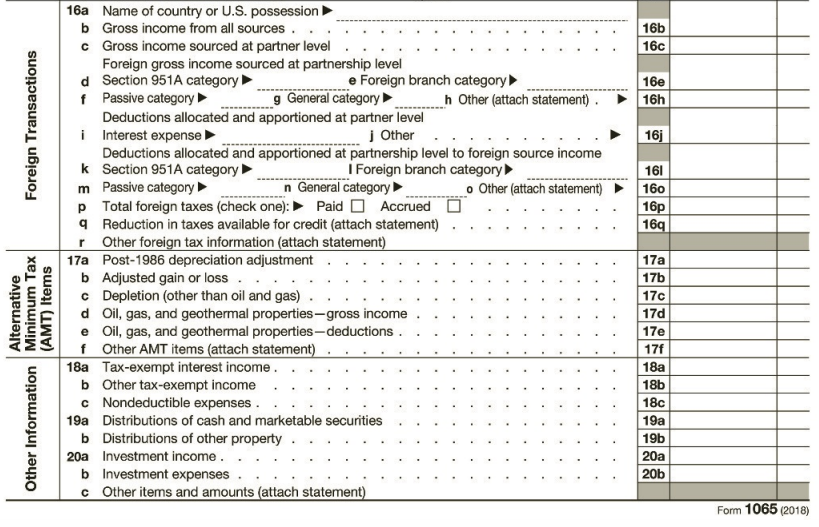

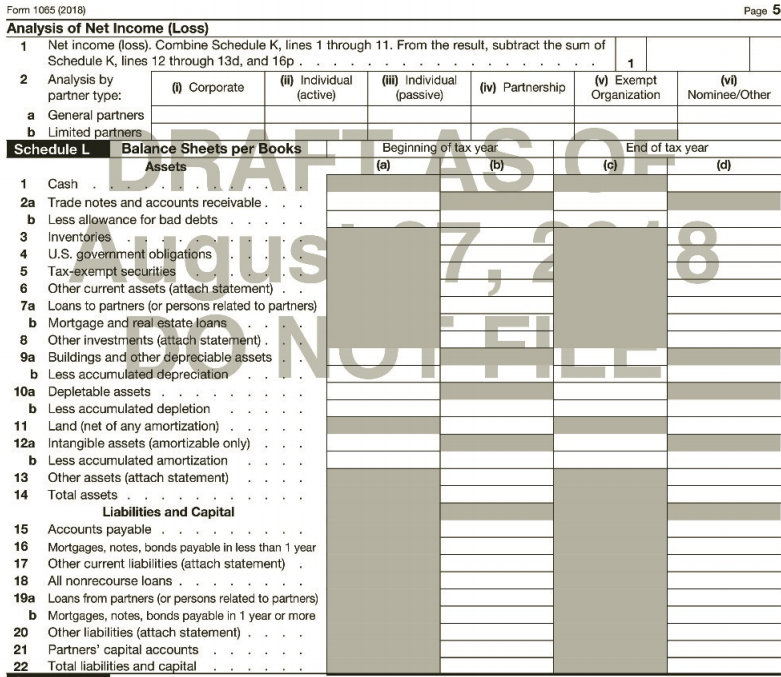

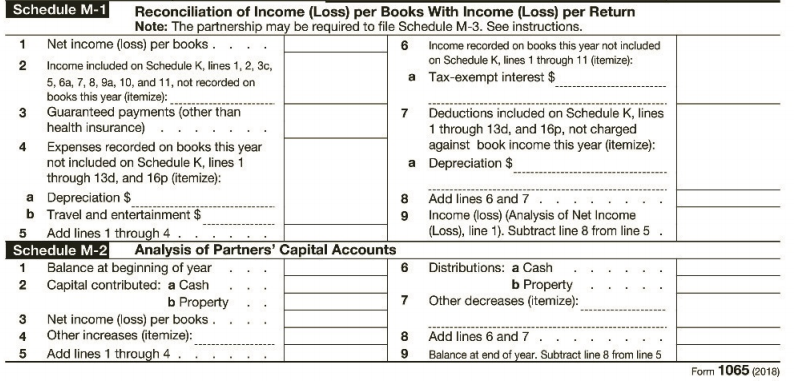

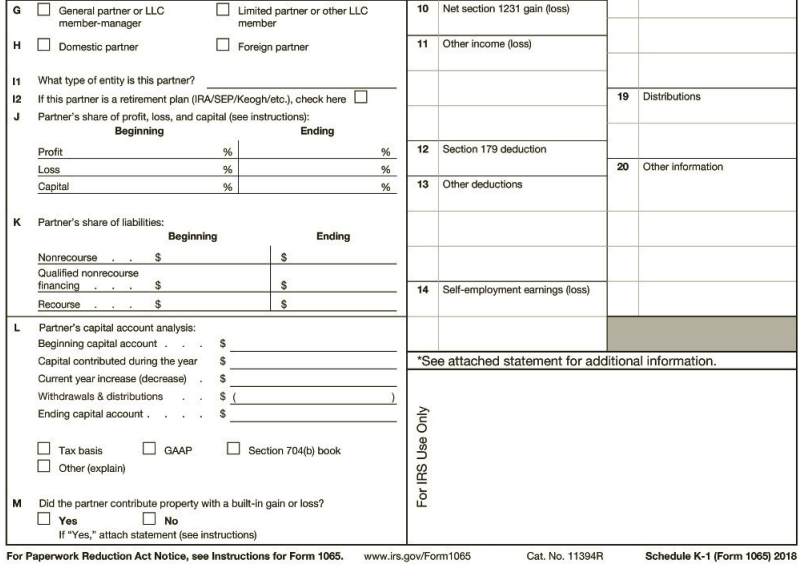

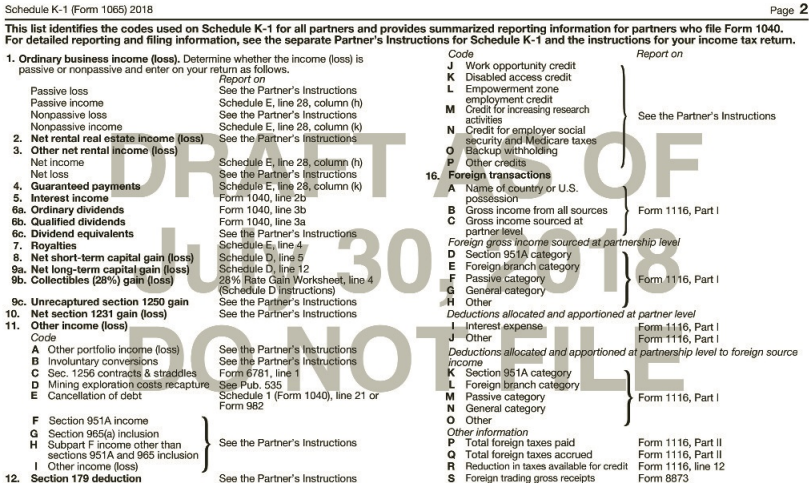

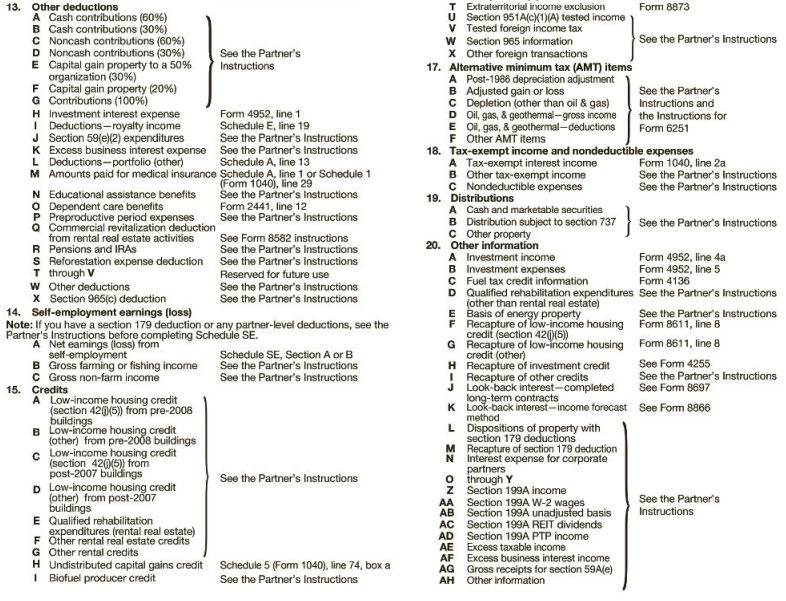

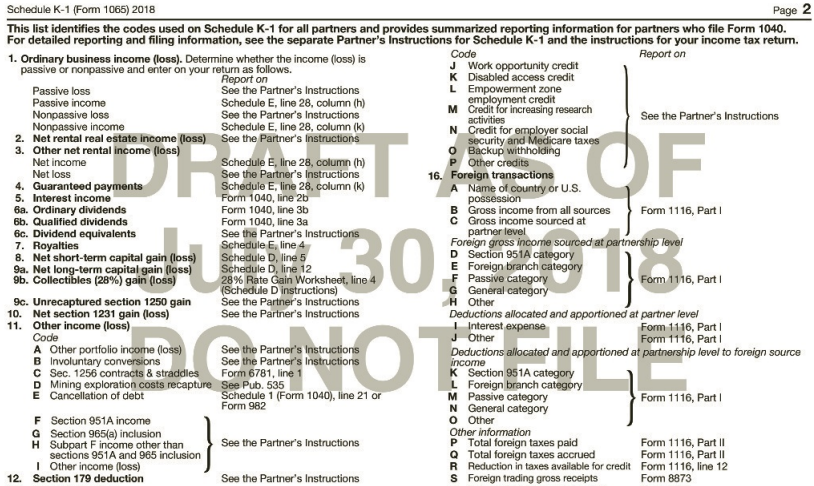

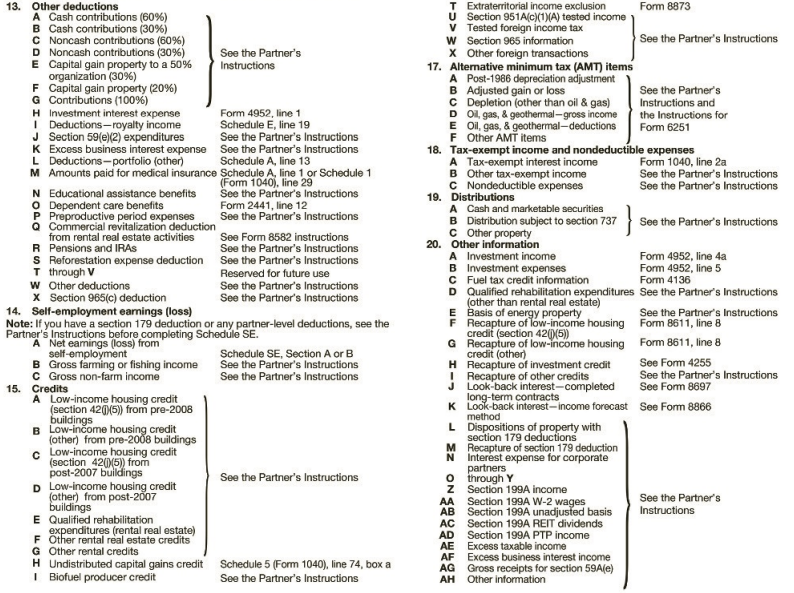

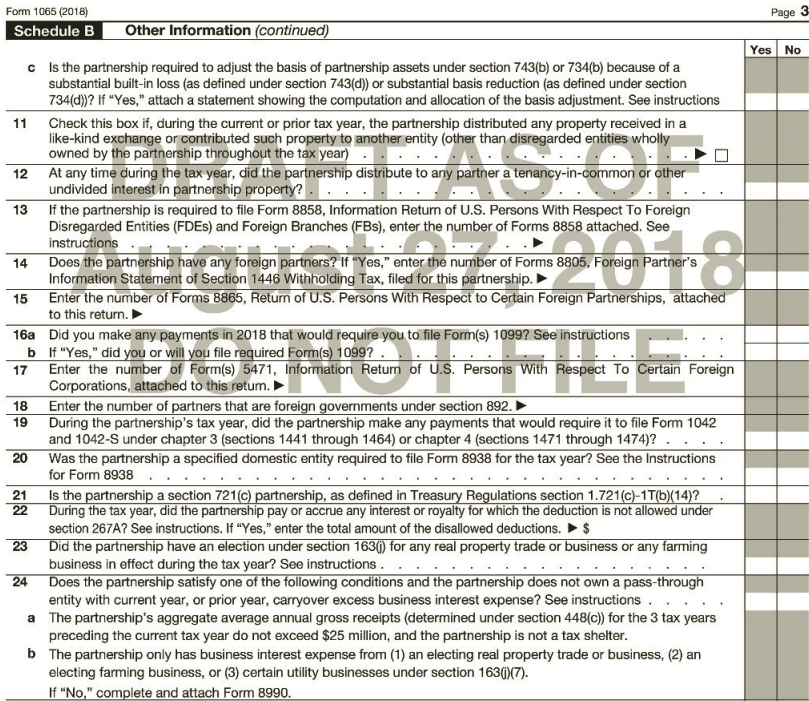

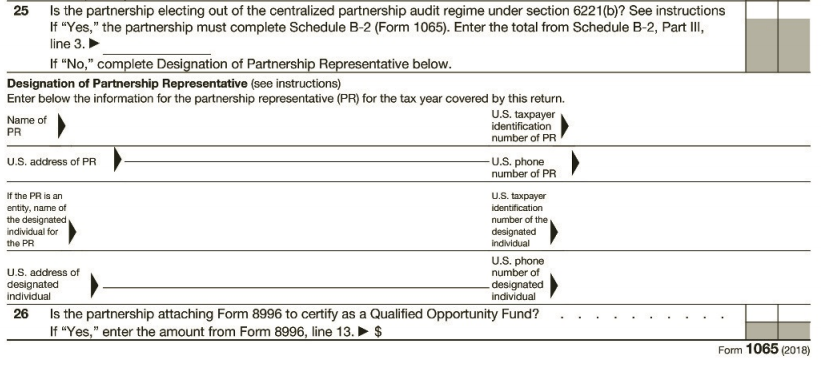

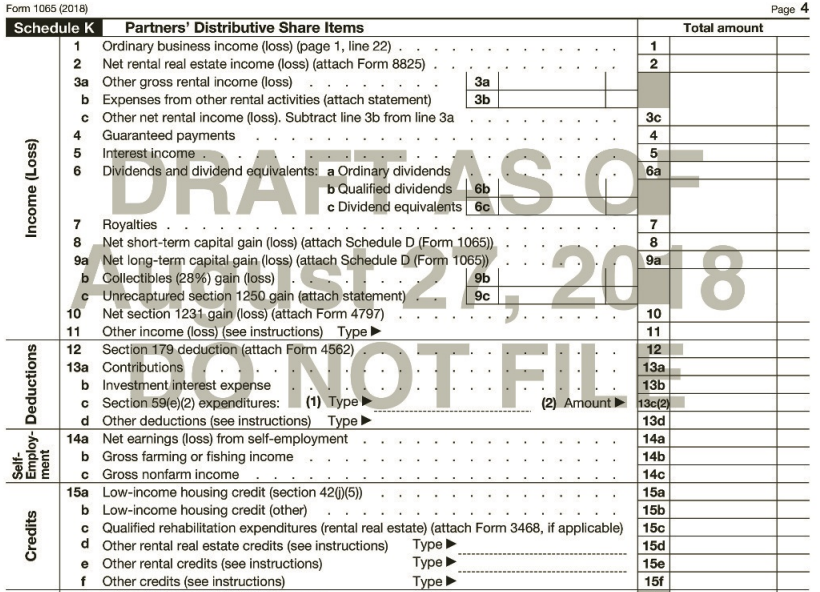

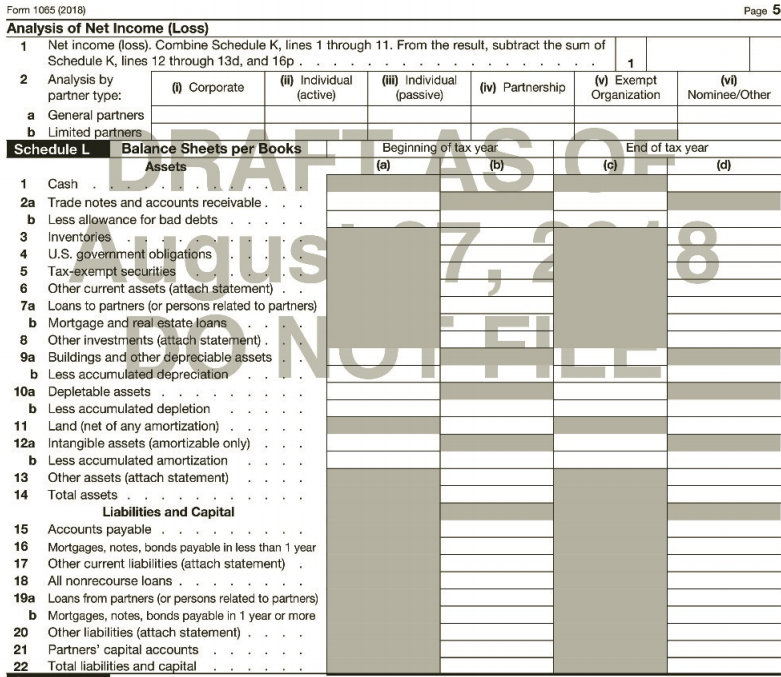

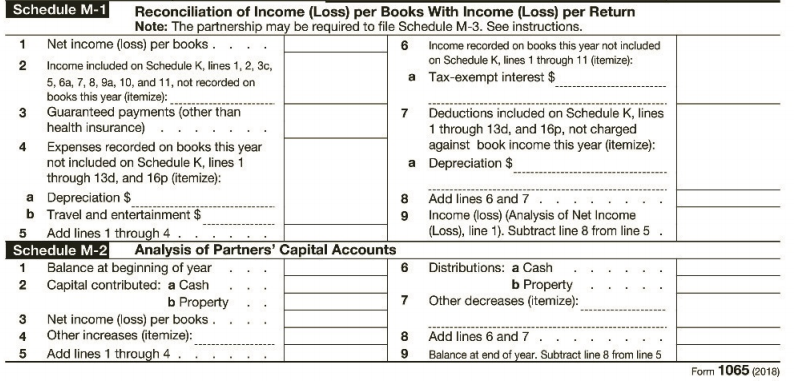

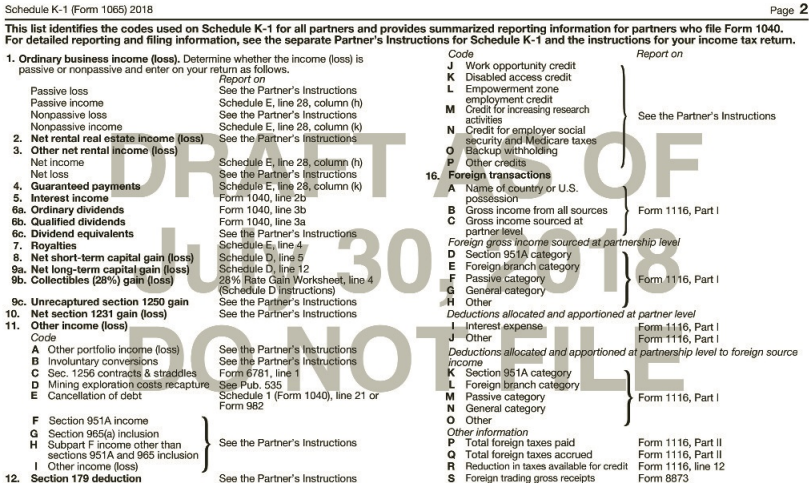

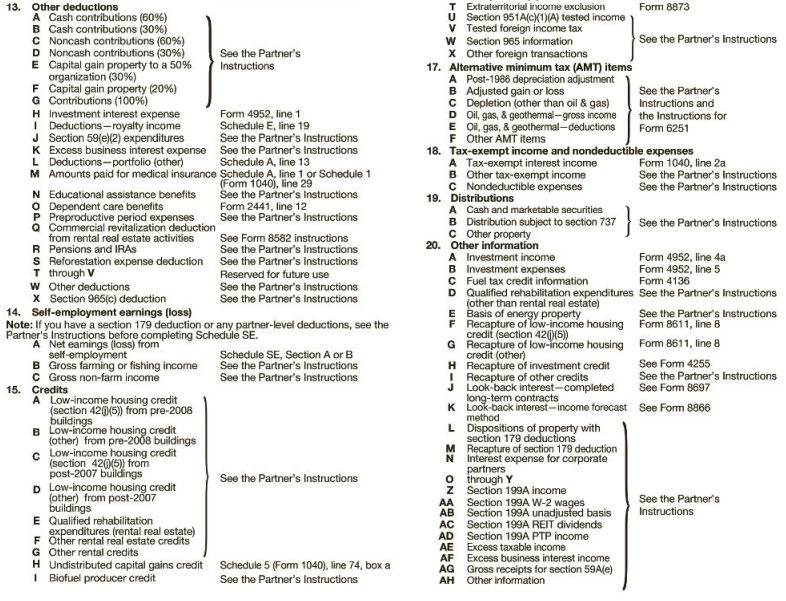

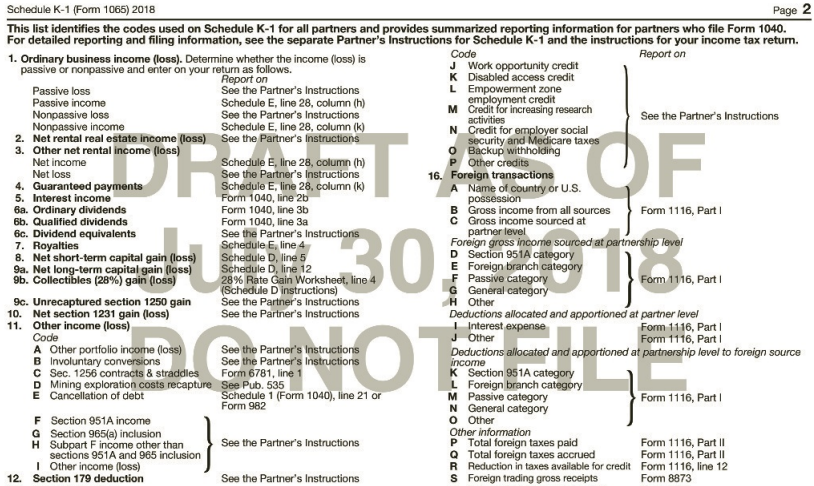

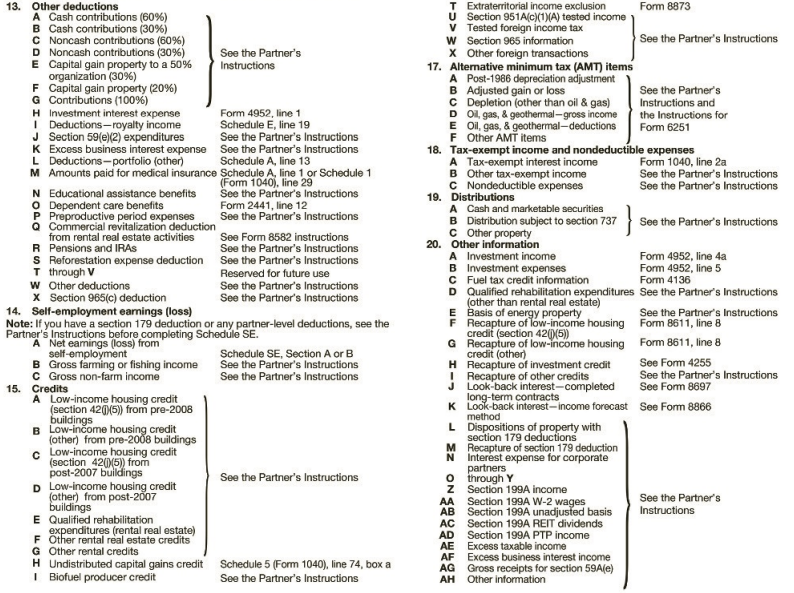

Complete J&S Barbers’ Form 1065 and Emily and James’ Schedule K-1s. Do not fill in Schedule D for the capital loss, Form 4562 for depreciation, or Schedule B-1 related to ownership of the partnership. Make realistic assumptions about any missing data.

Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Transcribed Image Text:

JES Barbers Income Statement for the Year Ending December 31, 2018 Gross income from operations Deductions: $372,300 Salaries to employees Payroll taxes Supplies Rent 94,600 14,500 9,000 41,000 5,100 Depreciation Short-term capital loss Charitable contributions 2,000 500 $205,600 $ 80,000 Net income Partners' withdrawals (each partner) JES Barbers Balance Sheet as of December 31, 2018 Assets: Cash $100,450 Accounts receivable 10,000 Equipment Accum. depreciation $32,000 (5,100) 26,900 $137,350 Liabilities and Capital: Accounts payable Notes payable Partners' capital ($20,000 contributed by each partner) $ 29,750 22,000 85,600 $137,350 U.S. Return of Partnership Income OMB No. 1545-0123 Fom 1065 For calendar year 2018, or tax year beginning Go to www.irs.gov/Form1065 for instructions and the latest information. , 2018, ending 20 Department of the Treasury Internal Revenue Service 2018 A Principal business activity Name of partnership D Employer identification number B Principal product or service Type Number, street, and room or suite no. If a P.O. box, see instructions. E Date business started or BRAFT AS OF Fugust 27, 2018 NOT FILE LON C Business code number Print City or town, state or province, country, and ZIP or foreign postal code Total assets (see instructions) G Check applicable boxes: (1) O Initial return (2) O Final return (3) H Check accounting method: (1) O cash Number of Schedules K-1. Attach one for each person who was a partner at any time during the tax year. Check if Schedules C and M-3 are attached Caution: Include only trade or business income and expenses on lines 1a through 22 below. See instructions for more information. Name change (4) O Address change (5) O Amended return (2) O Accrual (3) O Other (specify) ► 1a Gross receipts or sales. b Returns and allowances c Balance. Subtract line 1b from line la. 2 Cost of goods sold (attach Form 1125-A) 3 Gross profit. Subtract line 2 from line 1c 4 Ordinary income (loss) from other partnerships, estates, and trusts (attach statement) . 5 Net farm profit (loss) (attach Schedule F (Form 1040) 6 Net gain (loss) from Form 4797, Part II, line 17 (attach Form 4797) 7 Other income (loss) (attach statement) 8 Total income (loss). Combine lines 3 through 7 9 Salaries and wages (other than to partners) (less employment credits) 10 Guaranteed payments to partners. Repairs and maintenance. 1a | 1b 1c 2 3 4 8. 10 11 11 12 Bad debts . 12 13 Rent. . 13 14 Taxes and licenses . 14 Interest (see instructions). 16a Depreciation (if required, attach Form 4562). b Less depreciation reported on Form 1125-A and elsewhere on return 17 Depletion (Do not deduct oil and gas depletion.) Retirement plans, etc. . Employee benefit programs Other deductions (attach statement) Total deductions. Add the amounts shown in the far right column for lines 9 through 20 15 15 16a 16b 16c 17 18 18 19 19 20 20 21 21 Income Deductions (see instructions for limitations)