Floyd Corporation was formed and began operations on January 1, 2020. The corporation is located at 210

Question:

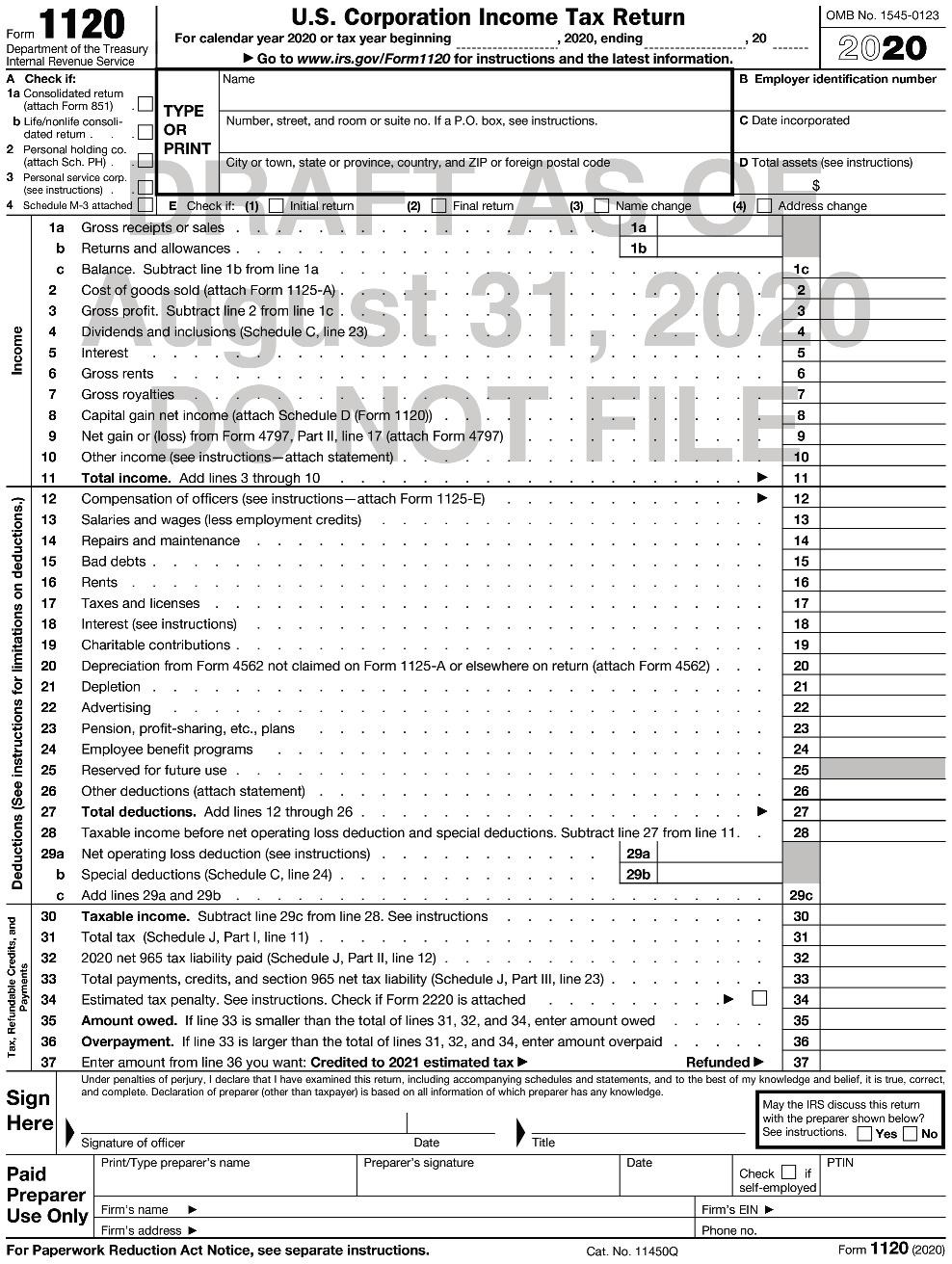

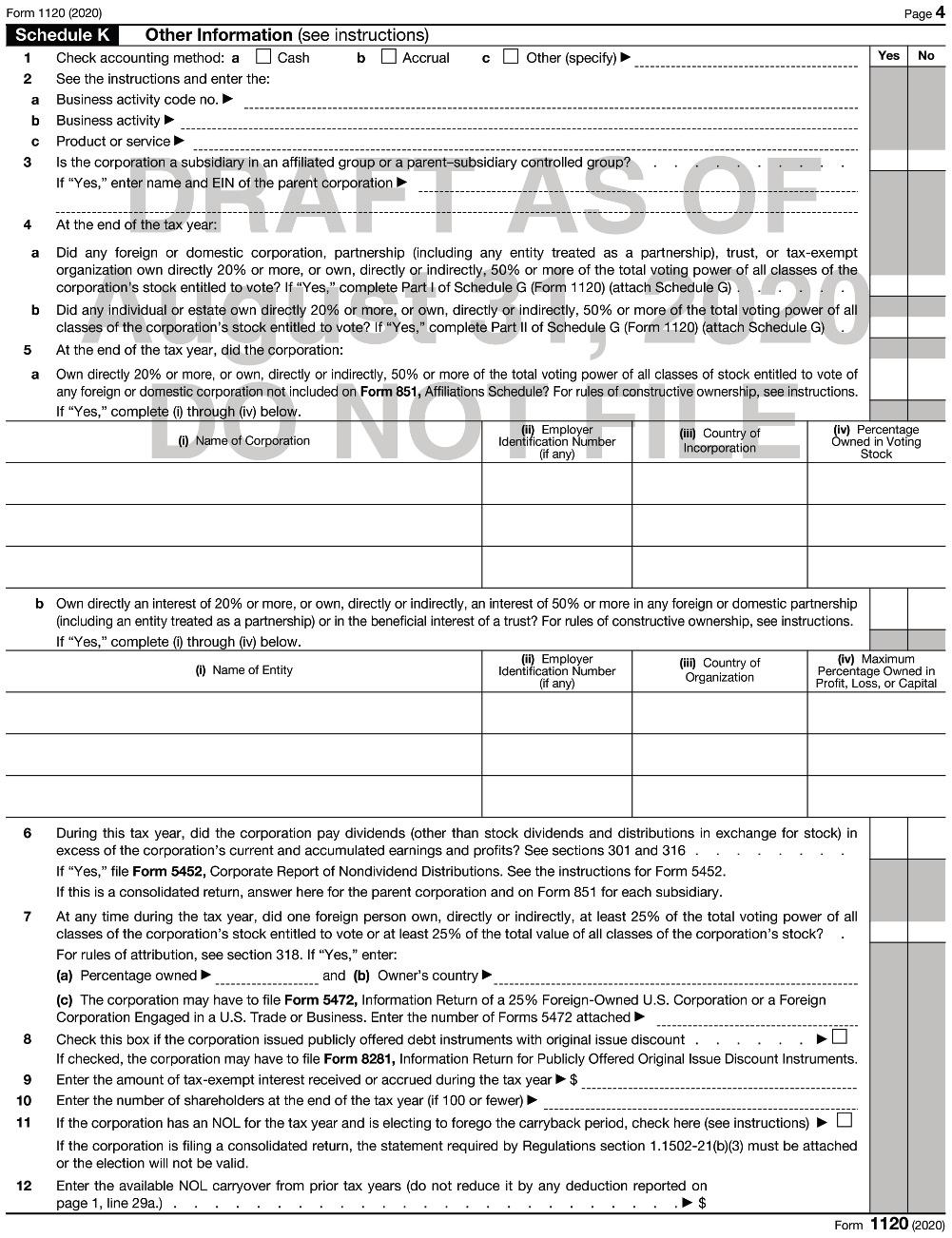

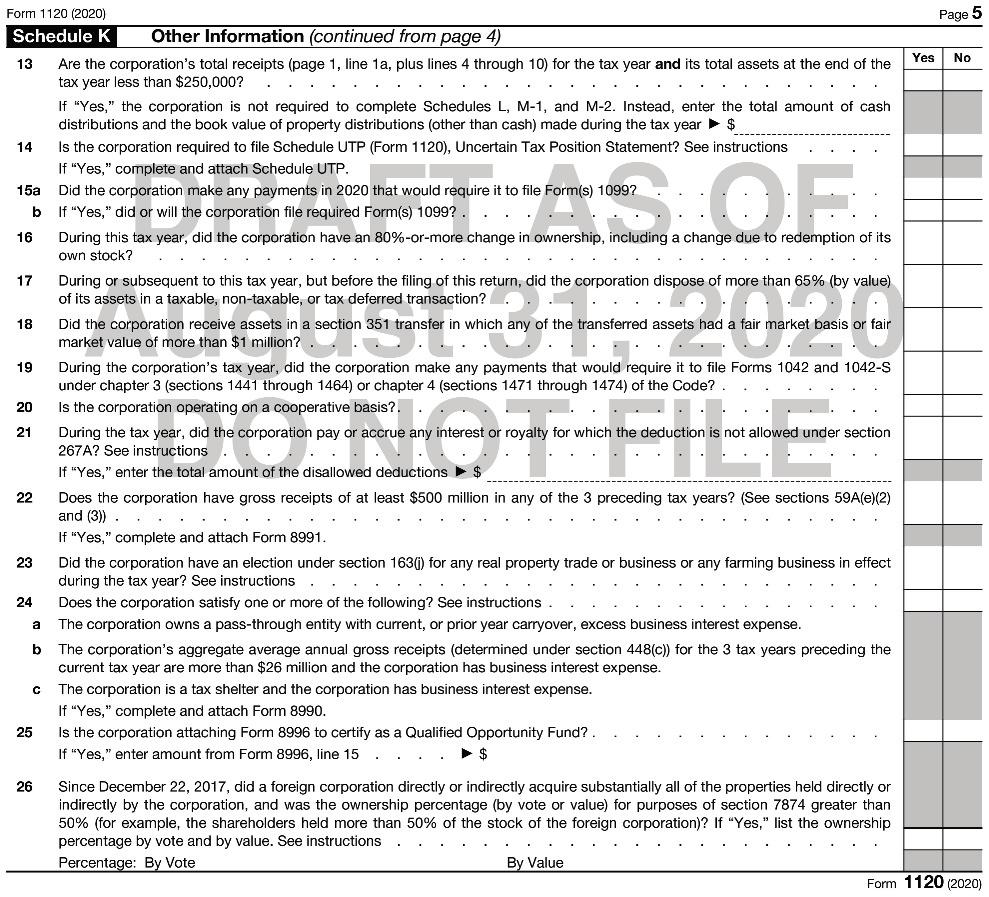

Floyd Corporation was formed and began operations on January 1, 2020. The corporation is located at 210 N. Main St., Pearisburg, VA 24134 and the EIN is 91-1111111.

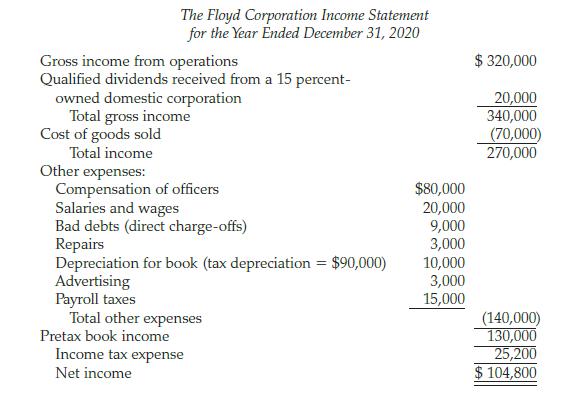

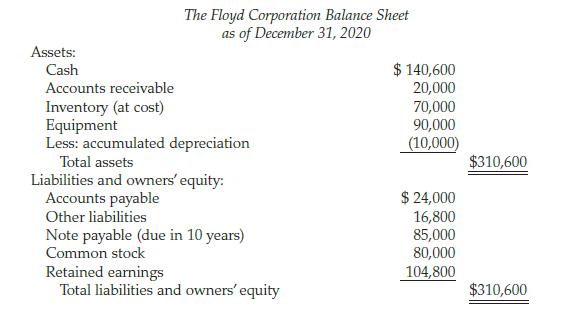

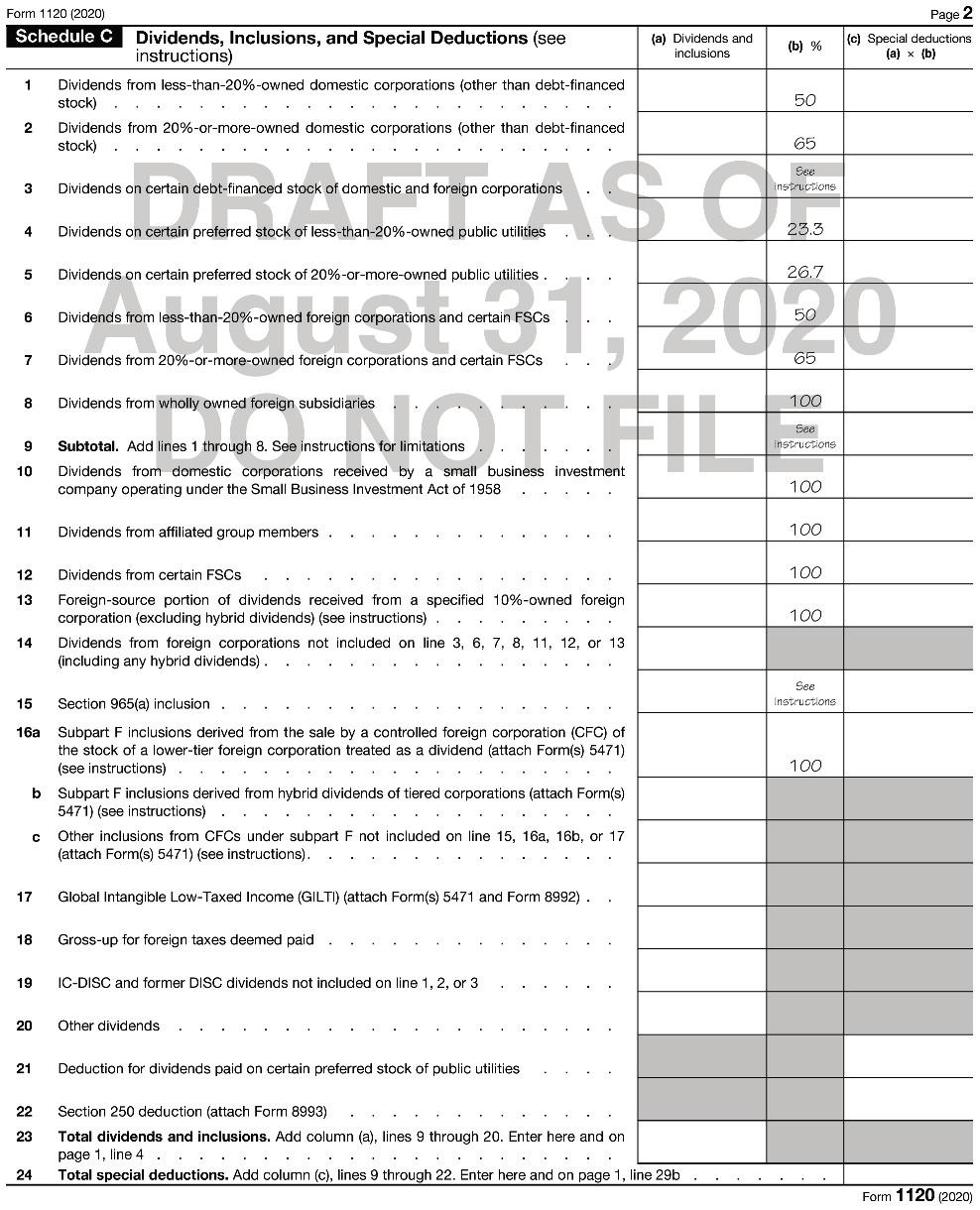

The corporation’s income statement for the year and the balance sheet at year-end are presented below.

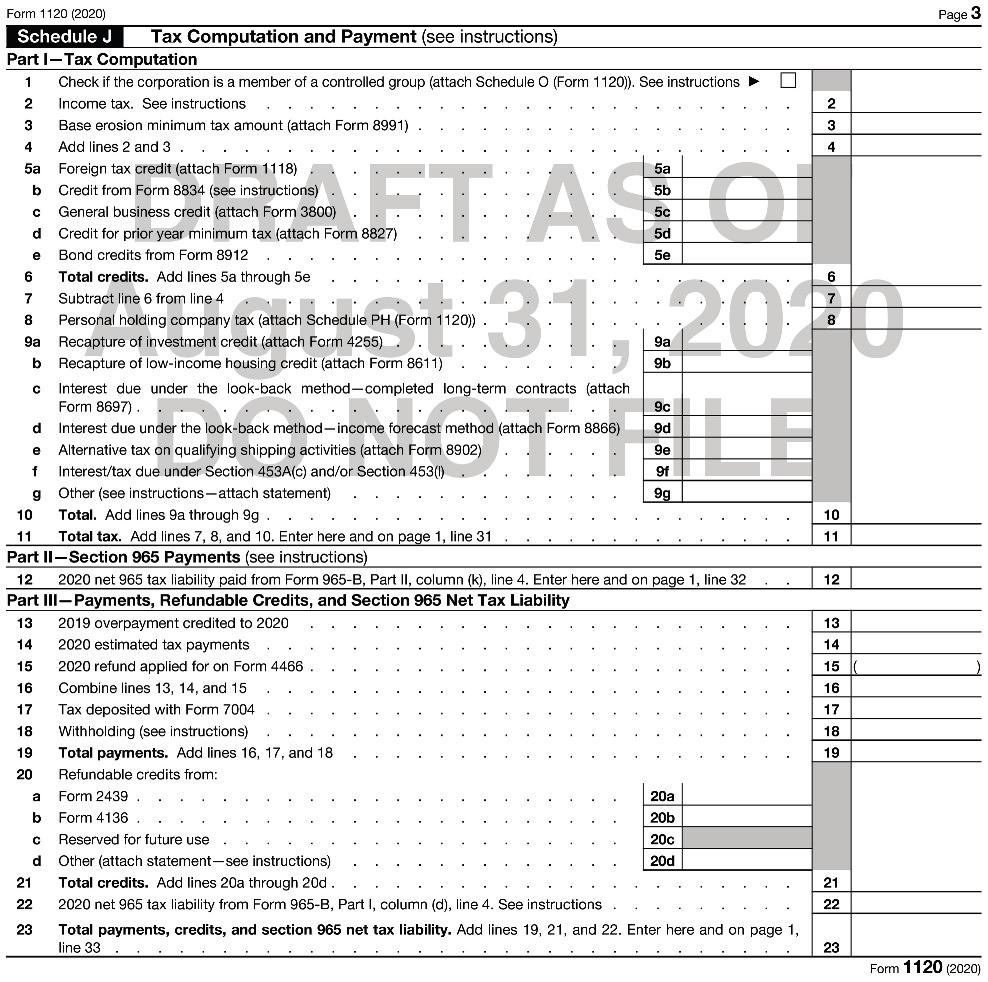

The corporation made estimated tax payments of $9,000. Complete Form 1120 for Floyd Corporation on Pages 11-43 through 11-48.

Transcribed Image Text:

Gross income from operations Qualified dividends received from a 15 percent- owned domestic corporation Total gross income Cost of goods sold Total income The Floyd Corporation Income Statement for the Year Ended December 31, 2020 Other expenses: Compensation of officers Salaries and wages Bad debts (direct charge-offs) Repairs Depreciation for book (tax depreciation = $90,000) Advertising Payroll taxes Total other expenses Pretax book income Income tax expense Net income $80,000 20,000 9,000 3,000 10,000 3,000 15,000 $ 320,000 20,000 340,000 (70,000) 270,000 (140,000) 130,000 25,200 $ 104,800

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 85% (7 reviews)

ANSWER Floyd Corporation Form 1120 US Corporation Income tax return ...View the full answer

Answered By

Danish Sohail

My objective is to become most reliable expert for clients. For last 10 years I have been associated with the field of accounting and finance. My aim is to strive for best results and pay particular attention to client needs. I am always enthusiastic to help clients for issues and concerns related to business studies. I can work on analysis of the financial statements, calculate different ratios and analysis of ratios. I can critically evaluate stock prices based on the financial analysis and valuation for companies using financial statements of the business entity being valued with use of excel tools. I have expertise to provide effective and reliable help for projects in corporate finance, equity investments, financial accounting, cost accounting, financial planning, business plans, marketing plans, performance measurement, budgeting, economic research, risk assessment, risk management, derivatives, fixed income investments, taxation, auditing, and financial performance analysis.

4.80+

78+ Reviews

112+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Olive Corporation was formed and began operations on January 1, 2012. The corporation's income statement for the year and the balance sheet at year-end are presented below. The corporation made...

-

Olive Corporation was formed and began operations on January 1, 2014. The corporations income statement for the year and the balance sheet at year-end are presented below. The corporation made...

-

Olive Corporation was formed and began operations on January 1, 2018. The corporations income statement for the year and the balance sheet at year-end are presented below. The corporation made...

-

A saving bond earns a variable rate of interest that can change six months, with compounding done monthly. The initial rate was 6.8% in early 2015. If that rate continues unchanged for the 3 years of...

-

Did Exxon set the prices in bad faith? Exxon marketed gasoline to retailers in three ways. Franchisees (who owned local gas stations) were required to purchase a minimum number of gallons per month....

-

Understand affi rmative action

-

Heights of young adults. The mean height of men aged 18 to 24 is about 70 inches. Women that age have a mean height of about 65 inches. Do you think that the distribution of heights for all Americans...

-

In Problem Sl-5 assume that Nicole, with the help of a financial newsletter and some library research, has been able to assign probabilities to each of the possible interest rates during the next...

-

On October 31, 2021, Damon Companys general ledger shows a checking account balance of $8,400. The companys cash receipts for the month total $74,340, of which $71,300 has been deposited in the bank....

-

Backline Advertising creates, plans, and handles advertising campaigns in a three-state area. Recently, Backline had to replace an inexperienced office worker in charge of bookkeeping because of some...

-

If a taxpayers 2020 individual income tax return was filed on March 3, 2021, the statute of limitations would normally run out on: a. April 15, 2023 b. March 3, 2022 c. April 15, 2024 d. March 3,...

-

Lamden Company paid its employee Trudy, wages of $61,500 in 2020. Of this amount, $2,400 was allocated to sick pay for two weeks due to Trudys spouse contracting COVID and Trudy being quarantined....

-

What is the SECs role in the formation and improvement of generally accepted accounting principles?

-

1. (5 pts) Given y[n]= 2y[n-1] and y[0]=2, Write MATLAB code to calculate and plot y for 0

-

F ( t ) = t 4 + 1 8 t 2 + 8 1 2 , g ( t ) = ( t + 3 ) / 3 ; find ( f o g ) ( 9 )

-

How did they calculate allocated cost FLIGHT A FLIGHT 350 615 FLIGHT 3 1 Go GALS 20 G EXISTING SCHEME, DETERMINE THE OVE OR FLIGHTS A, B, AND C. 2 ED AT 7.00 PER K1.00 OF PILOT SALAF TOTAL NON-SALARY...

-

High Tech ManufacturingInc., incurred total indirect manufacturing labor costs of $540,000. The company is labor-intensive. Total labor hours during the period were 5,000. Using qualitativeanalysis,...

-

Start with AS/AD and IS/MP in full employment equilibrium. Assume the is a massive positive aggregate demand shock. How would this affect AS/AD and IS/MP and prices and output relative to the full...

-

What is the likely result of relentless imitation or benchmarking?

-

If you want to solve a minimization problem by applying the geometric method to the dual problem, how many variables and problem constraints must be in the original problem?

-

Mike bought a solar electric pump to heat his pool at a cost of $2,500 in 2019. What is Mikes credit?

-

In 2019, Jeff spends $6,000 on solar panels to heat water for his main home. What is Jeffs credit for his 2019 purchases? SCHEDULE EIC (Form 1040 or 1040-SR) Earned Income Credit OMB No. 1545-0074...

-

George and Amal file a joint return in 2019 and have AGI of $39,800. They each make a $1,600 contribution to their respective IRAs. Assuming that they are not eligible for any other credits, what is...

-

assume that we have only two following risk assets (stock 1&2) in the market. stock 1 - E(r) = 20%, std 20% stock 2- E(r) = 10%, std 20% the correlation coefficient between stock 1 and 2 is 0. and...

-

Flexible manufacturing places new demands on the management accounting information system and how performance is evaluated. In response, a company should a. institute practices that reduce switching...

-

Revenue and expense items and components of other comprehensive income can be reported in the statement of shareholders' equity using: U.S. GAAP. IFRS. Both U.S. GAAP and IFRS. Neither U.S. GAAP nor...

Study smarter with the SolutionInn App