Olive Corporation was formed and began operations on January 1, 2018. The corporations income statement for the

Question:

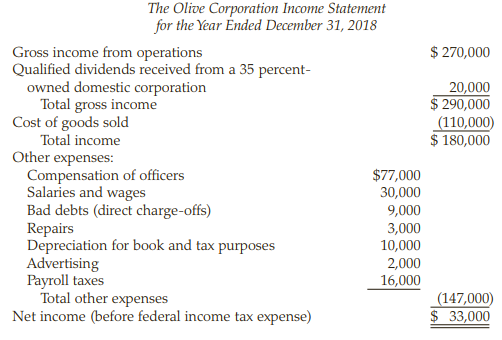

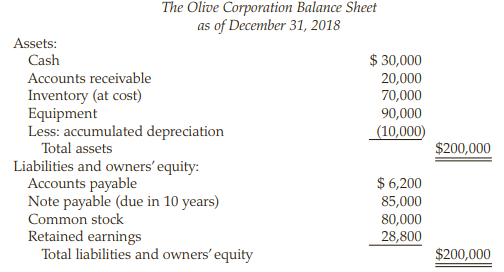

Olive Corporation was formed and began operations on January 1, 2018. The corporation’s income statement for the year and the balance sheet at year-end are presented below.

The corporation made estimated tax payments of $5,000 and the corporation’s book federal income tax expense is equal to the federal tax liability. Complete Form 1120 for Olive Corporation on Pages 11-39 through 11-44.

Transcribed Image Text:

The Olive Corporation Income Statement for the Year Ended December 31, 2018 $ 270,000 Gross income from operations Qualified dividends received from a 35 percent- owned domestic corporation Total gross income Cost of goods sold Total income Other expenses: Compensation of officers Salaries and wages Bad debts (direct charge-offs) Repairs Depreciation for book and tax purposes Advertising Payroll taxes Total other expenses Net income (before federal income tax expense) 20,000 $ 290,000 (110,000) $ 180,000 $77,000 30,000 9,000 3,000 10,000 2,000 16,000 (147,000) $ 33,000 The Olive Corporation Balance Sheet as of December 31, 2018 Assets: Cash $ 30,000 Accounts receivable 20,000 70,000 Inventory (at cost) Equipment Less: accumulated depreciation 90,000 (10,000) Total assets $200,000 Liabilities and owners' equity: Accounts payable Note payable (due in 10 years) Common stock Retained earnings Total liabilities and owners' equity $ 6,200 85,000 80,000 28,800 $200,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 68% (16 reviews)

Form 1120 Department of the Treasury Internal Revenue Service A Check if 1a Consolidated return attach Form 851 b Lifenonlife consoli dated return 2 Personal holding co attach Sch PH Income 2 3 US Cor...View the full answer

Answered By

Muhammad Khurram

I have strong General Management skills to apply in your projects. Over last 3 years, I have acquired great knowledge of Accounting, Auditing, Microsoft Excel, Microsoft PowerPoint, Finance, Microsoft Project, Taxation, Strategic Management, Human Resource, Financial Planning, Business Planning, Microsoft Word, International Business, Entrepreneurship, General Management, Business Mathematics, Advertising, Marketing, Supply Chain, and E-commerce. I can guarantee professional services with accuracy.

4.80+

249+ Reviews

407+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Olive Corporation was formed and began operations on January 1, 2014. The corporations income statement for the year and the balance sheet at year-end are presented below. The corporation made...

-

Olive Corporation was formed and began operations on January 1, 2012. The corporation's income statement for the year and the balance sheet at year-end are presented below. The corporation made...

-

Complete Blue Catering Service Inc.'s (BCS) 2014 Form 1120, Schedule D, and Schedule G (if applicable) using the information provided below. Form 4562 for depreciation is not required. Include the...

-

Steve Jobs wrote some Python code to determine if Apple met its quota for the Apple Newton. What does his code below output? quota = 10000000 newton 5000000 print("Welcome to Mac") if newton quota:...

-

Fes Company is making adjusting journal entries for the year ended December 31, 2013. In developing information for the adjusting journal entries, you learned the following: a. A two-year insurance...

-

Let R be the region bounded by y = 1/x p and the x-axis on the interval [1, a], where p > 0 and a > 1 (see figure). Let V x and V y be the volumes of the solids generated when R is revolved about the...

-

Determine the latest start and finish times for activities

-

Use the data in MEAP00_01.RAW to answer this question. (i) Estimate the model mathA = (0 + (1 lunch + (2 log(enroll) + (3log(exppp) + u by OLS and obtain the usual standard errors and the fully...

-

Compute each of the following. 8!= P(13,8)=C(13,8)=

-

Which of the graphs in Fig. Q25.12 best illustrates the current I in a real resistor as a function of the potential difference V across it? Explain. Figure Q25.12 (a) (b) (c) (d)

-

Quince Corporation has taxable income of $485,000 for its calendar tax year. Calculate the corporations income tax liability for 2018 before tax credits.

-

Tayla Corporation generated $340,000 of taxable income in the 2018. What is Taylas corporate tax liability? a. $71,400 b. $119,000 c. $115,600 d. $0 e. None of the above

-

How does the RFP relate to the organization of the proposal?

-

As the human resource manager, how would you evaluate the training needs of your staff? How can you ensure that the training you would provide is effective? What data might be used to make your...

-

MARYLAND CORPORATION manufactures three liquid products - Alpha, Beta and Gamma using a joint process with direct materials, direct labor and overhead totaling $560,000 per batch. In addition, the...

-

Three common organizational structures. Mention one organization for each organizational structure which is following a specific organizational structure. Also, provide support to your answer by...

-

You are a retail manager at Kitchen Nightmare, a relatively new store at the mall that sells mostly items for kitchens, like forks, oven mitts, etc.. You have been open since the fall of 2021 and...

-

Examine the extent to which the Department of Veteran Affairs has established any processes or procedures to ensure knowledge retention of departing employees. Why is it important to manage the...

-

Milton Manufacturing Company produces a variety of textiles for distribution to wholesale manufacturers of clothing products. The companys primary operations are located in Long Island City, New...

-

The outer loop controls the number of students. Note that the inner loop of this program is always executed exactly three times, once for each day of the long weekend. Modify the code so that the...

-

Sherry rents her vacation home for 6 months and lives in it for 6 months during the year. Her gross rental income during the year is $6,000. Total real estate taxes for the home are $950, and...

-

Chrissy receives 200 shares of Chevron stock as a gift from her father. The stock cost her father $9,000 10 years ago and is worth $10,500 at the date of the gift. a. If Chrissy sells the stock for...

-

Which of the following forms is used to report government payments such as a state income tax refund? a. Form W-2G b. Form 1099-Casino c. Form 1099-G d. Form 1099-Lottery e. Form 1099-C

-

Which of the following statements regarding traditional cost accounting systems is false? a. Products are often over or under cost in traditional cost accounting systems. b. Most traditional cost...

-

Bart is a college student. Since his plan is to get a job immediately after graduation, he determines that he will need about $250,000 in life insurance to provide for his future wife and children...

-

Reporting Financial Statement Effects of Bond Transactions (please show me how you got the answers) Lundholm, Inc., which reports financial statements each December 31, is authorized to issue...

Study smarter with the SolutionInn App