For each of the following situations (none of the taxpayers claim dependents), indicate whether the taxpayer(s) is

Question:

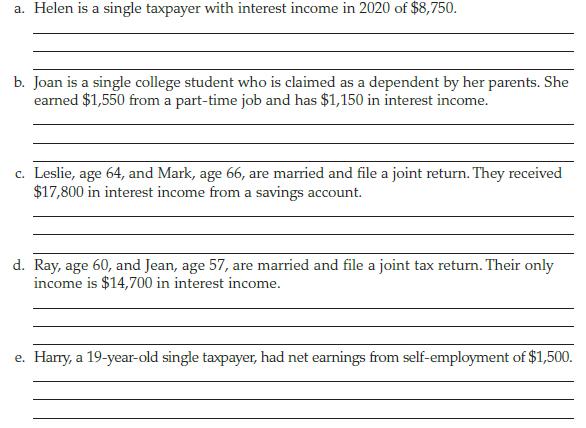

For each of the following situations (none of the taxpayers claim dependents), indicate whether the taxpayer(s) is (are) required to file a tax return for 2020. Explain your answer.

Transcribed Image Text:

a. Helen is a single taxpayer with interest income in 2020 of $8,750. b. Joan is a single college student who is claimed as a dependent by her parents. She earned $1,550 from a part-time job and has $1,150 in interest income. c. Leslie, age 64, and Mark, age 66, are married and file a joint return. They received $17,800 in interest income from a savings account. d. Ray, age 60, and Jean, age 57, are married and file a joint tax return. Their only income is $14,700 in interest income. e. Harry, a 19-year-old single taxpayer, had net earnings from self-employment of $1,500.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 25% (4 reviews)

a No Income is less than the 12400 standard deduction b Yes Unearned income was ...View the full answer

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

For each of the following situations (none of the taxpayers claim dependents), indicate whether the taxpayer(s) is (are) required to file a tax return for 2015. Explain your answer. a. Helen is a...

-

For each of the following situations (none of the taxpayers claim dependents), indicate whether the taxpayer(s) is (are) required to file a tax return for 2018. Explain your answer. a. Helen is a...

-

For each of the following situations (none of the taxpayers claim dependents), indicate whether the taxpayer(s) is (are) required to file a tax return for 2016. Explain your answer. a. Helen is a...

-

In Problems 1158, perform the indicated operation, and write each expression in the standard form a + bi. -3i(7 + 6i)

-

To review your skills in developing a class diagram, develop a domain model class diagram, including associations and multiplicities, based on the following narrative. A clinic with three dentists...

-

In the long run, we need to achieve superior quantitative financial performance. But in the short run we need to achieve superior qualitative, nonfinancial performance. Is this correct? Explain.

-

Drunk driving. A newspaper article on drunk driving cited data on traffic deaths in Rhode Island: Forty-two percent of all fatalities occurred on Friday, Saturday, and Sunday, apparently because of...

-

Use the same transaction data for Magnificent Modems, Inc., as was used in Chapter 1 (see page 52). Required a. Based on these data, identify each cost incurred by the company as (1) fixed versus...

-

0 Required Information (The following information applies to the questions displayed below.) Altira Corporation provides the following information related to its merchandise Inventory during the...

-

The next diagram depicts a system of aqueducts that originate at three rivers (nodes R1, R2, and R3) and terminate at a major city (node T), where the other nodes are junction points in the system....

-

Nicoula is a server at a La Jolla restaurant. Nicoula received $1,200 in unreported tips during 2020 and owes Social Security and Medicare taxes on these tips. Her total income for the year,...

-

Wanda is a single 50-year-old taxpayer with no dependents. Her only income is $41,000 of wages. Calculate her taxable income and her tax liability. Please show your work.

-

Is there a generation gap in the type of music that people listen to? The following table represents the type of favorite music for a sample of 1,000 respondents classified according to their age...

-

14. (3 points) Using our model of the egg and vinegar (part one), what is the causal account in this model? Refer to your model and work through the components and relationships that cause this...

-

D. Rewrite the following statements from an "I Approach" to a "You Approach". (5 marks) 1. We have not received your signed invoice so we cannot process payment. 2. I need to know what type of model...

-

AP Precalculus Unit 1 Study Guide: Polynomials Name: Date: 19. The graph of an ODD function is given for the interval -6x0. Use the properties of odd functions to sketch the graph of the function on...

-

Step 1 of 5: Determine the lower class boundary for the second class. Scores on a Test Class Frequency 30-47 11 48-65 14 66-83 11 84-101 9 102-119 12

-

Write a 1,500-2,000-word evaluation paper using the following instructions to complete this assignment. Go to the FBI Uniform Crime Reporting Program website (See link in the Class Resources). Search...

-

Kinder Company has the following balances in selected accounts on June 30, 2017, its fiscal year end. Accounts Receivable.............................................$0 Accumulated...

-

Identify the Critical Infrastructure Physical Protection System Plan.

-

In 2019, what is the top tax rate for individual long-term capital gains and the top tax rate for long-term capital gains of collectible items assuming that the Medicare tax does not apply. a. 10; 20...

-

In 2019, Tim, a single taxpayer, has ordinary income of $29,000. In addition, he has $2,000 in short-term capital gains, long-term capital losses of $10,000, and long-term capital gains of $4,000....

-

Oscar, a single taxpayer, sells his residence of the last 10 years in January of 2019 for $190,000. Oscars basis in the residence is $45,000, and his selling expenses are $11,000. If Oscar does not...

-

assume that we have only two following risk assets (stock 1&2) in the market. stock 1 - E(r) = 20%, std 20% stock 2- E(r) = 10%, std 20% the correlation coefficient between stock 1 and 2 is 0. and...

-

Flexible manufacturing places new demands on the management accounting information system and how performance is evaluated. In response, a company should a. institute practices that reduce switching...

-

Revenue and expense items and components of other comprehensive income can be reported in the statement of shareholders' equity using: U.S. GAAP. IFRS. Both U.S. GAAP and IFRS. Neither U.S. GAAP nor...

Study smarter with the SolutionInn App