Indicate the date that the statute of limitations would run out on each of the following 2020

Question:

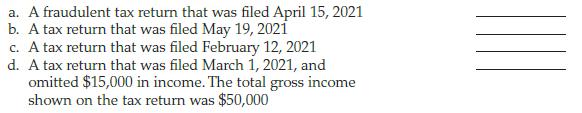

Indicate the date that the statute of limitations would run out on each of the following 2020 individual tax returns:

Transcribed Image Text:

a. A fraudulent tax return that was filed April 15, 2021 b. A tax return that was filed May 19, 2021 c. A tax return that was filed February 12, 2021 d. A tax return that was filed March 1, 2021, and omitted $15,000 in income. The total gross income shown on the tax return was $50,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

a Never b May 19 2024 assuming a valid e...View the full answer

Answered By

Hassan Ali

I am an electrical engineer with Master in Management (Engineering). I have been teaching for more than 10years and still helping a a lot of students online and in person. In addition to that, I not only have theoretical experience but also have practical experience by working on different managerial positions in different companies. Now I am running my own company successfully which I launched in 2019. I can provide complete guidance in the following fields. System engineering management, research and lab reports, power transmission, utilisation and distribution, generators and motors, organizational behaviour, essay writing, general management, digital system design, control system, business and leadership.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Indicate the date that the statute of limitations would run out on each of the following individual tax returns: a. A fraudulent 2014 tax return that was filed April 15, 2015. b. A 2014 tax return...

-

Indicate the date that the statute of limitations would run out on each of the following individual tax returns: a. A fraudulent 2016 tax return that was filed April 15, 2017. ................

-

Indicate the date that the statute of limitations would run out on each of the following 2018 individual tax returns: a. A fraudulent tax return that was filed April 15, 2019 b. A tax return that was...

-

Assume the premises: S. S-P. P~N, ~R-N. Give a detailed informal proof of: R. Number each step and give an explanation for each. Write all the steps in the proof at once in the Math Editor. (it works...

-

The Brugger Corp. owned a farm, operated by Jason Weimer, who acted as the companys business agent. Tri-Circle, Inc. was a farm equipment company. On behalf of Brugger, Weimer offered to buy from...

-

Learn how to recruit employees and be able to use this information when applying for jobs

-

Mens heights. The distribution of heights of young men is approximately Normal with mean 70 inches and standard deviation 2.5 inches. Sketch a Normal curve on which this mean and standard deviation...

-

Consider a point course of light. How would the intensity of light vary with distance from the source according to? (a) Wave theory (b) Particle (photon) theory? Would this help to distinguish the...

-

What am I doing wrong? Required information Use the following information for Exercises 9-12 below. (Algo) [The following information applies to the questions displayed below.] Following are the...

-

Calculate the molar volume of saturated liquid and the molar volume of saturated vapor by the Redlich/Kwong equation for one of the following and compare results with values found by suitable...

-

Melodies taxable income is $39,000 and she pays income tax of $4,486. If Melodies taxable income increases to $43,000, she would pay income taxes of $5,256. What is Melodies marginal tax rate? a....

-

In the 2020 tax year, Michelle paid the following amounts relating to her 2018 tax return: Which of the above items may be deducted on Michelles 2020 individual income tax return? Explain Tax...

-

Watson Dunn is planning to value BCC Corporation, a provider of a variety of industrial metals and minerals. Dunn uses a single - stage FCFF approach. The financial information Dunn has assembled for...

-

(AVR) PR=IAVR=1R = (power dissipated by a resistor) (28.12) R

-

As a manager and an entrepreneur, you will face a new challenge - business venture structured on the theory of the firm. You are opening a restaurant in your selected town in the State of NY (please...

-

Install on ubuntu , please provide a screenshot for each step 1)How to install base64 on ubuntu 2)What kind of analysis is performed by Cuckoo? How to install Cuckoo on ubuntu?

-

rt a letter to Rose McBride. Writing Plan - Refusal to a Request Rubric Buffer: Start with a neutral statement on which both reader and writer can agree, such as a compliment, appreciation, a quick...

-

FACTS: The Budvar Company sells parts to a foreign customer on December 1, Year 1, with payment of 20,000 crowns to be received on March 1, Year 2. Budvar enters into a forward contract (with a...

-

Look at PengAtlas Maps 2.1 (Top Merchandise Importers and Exporters) and 2.2 (Top Service Importers and Exporters). Compare the global position of the United States in merchandise versus service...

-

Suppose that the laptop of Prob. 2.16 is placed in an insulating briefcase with a fully charged battery, but it does not go into sleep mode, and the battery discharges as if the laptop were in use....

-

Lucas, a single U.S. citizen, works in Denmark for MNC Corp during all of 2019. His MNC salary is $87,000. Lucas may exclude from his gross income wages of: a. $0 b. $40,000 c. $87,000 d. $105,900

-

John and Joan pay $16,500 of qualified adoption expenses in 2019 to finalize the adoption of a qualified child. Their AGI is $197,000 for 2019. What is their adoption credit for 2019? a. $0 b....

-

In connection with the adoption of an eligible child who is a U.S. citizen and who is not a child with special needs, Sean pays $4,000 of qualified adoption expenses in 2018 and $3,000 of qualified...

-

When credit terms for a sale are 2/15, n/40, the customer saves by paying early. What percent (rounded) would this savings amount to on an annual basis

-

An industrial robot that is depreciated by the MACRS method has B = $60,000 and a 5-year depreciable life. If the depreciation charge in year 3 is $8,640, the salvage value that was used in the...

-

What determines a firm's beta? Should firm management make changes to its beta? Be sure to consider the implications for the firm's investors using CAPM.

Study smarter with the SolutionInn App