John Williams (birthdate August 2, 1974) is a single taxpayer, and he lives at 1324 Forest Dr.,

Question:

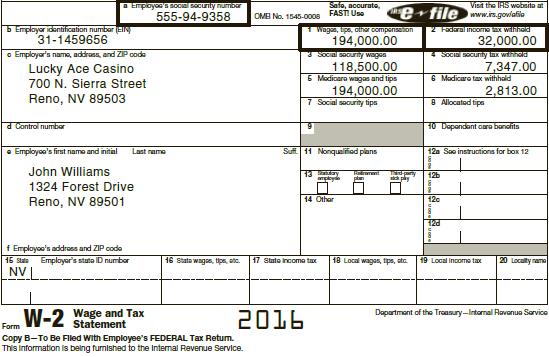

John Williams (birthdate August 2, 1974) is a single taxpayer, and he lives at 1324 Forest Dr., Reno, NV 89501. His Social Security number is 555-94-9358. John’s earnings and withholdings as the manager of a local casino for 2016 are reported on his Form W-2:

John’s other income includes interest on a savings account at Nevada National Bank of $13,575.

John pays his ex-wife, Sarah McLoughlin, $4,000 per month. When their 12-year-old child (in the wife’s custody) reaches 18, the payments are reduced to $2,750 per month. His ex-wife’s Social Security number is 554-44-5555.

In 2016, John purchased a new car and so he kept track of his sales tax receipts during the year. His actual sales tax paid is $3,560, which exceeds the estimated amount per the IRS tables.

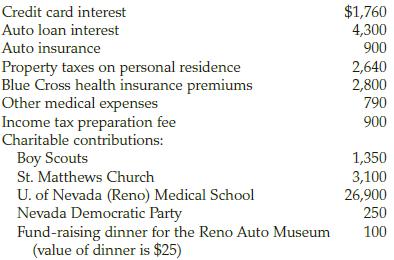

During the year, John paid the following amounts (all of which can be substantiated):

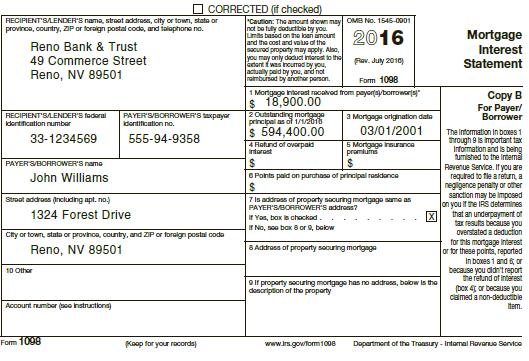

John also received the following Form 1098:

Required: Complete John’s federal tax return for 2016. Use Form 1040, Schedule A, and Schedule B, from Pages 5-53 through 5-56 to complete this tax return. Make realistic assumptions about any missing data.

Step by Step Answer:

Income Tax Fundamentals 2017

ISBN: 9781305872738

35th Edition

Authors: Gerald E. Whittenburg, Steven Gill, Martha Altus Buller