Kana is a single wage earner with no dependents and taxable income of $168,700 in 2020. Her

Question:

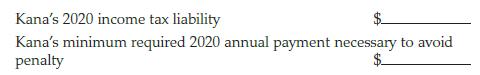

Kana is a single wage earner with no dependents and taxable income of $168,700 in 2020. Her 2019 taxable income was $155,000 and tax liability was $31,375. Calculate the following (note: this question requires the use of the tax tables in Appendix A):

Transcribed Image Text:

Kana's 2020 income tax liability Kana's minimum required 2020 annual payment necessary to avoid penalty

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

3499950 Kanas tax liability is 168700 163300 x 3...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Kana is a single wage earner with no dependents and taxable income of $205,000 in 2018. Her 2017 taxable income was $155,000 and tax liability was $36,382. Calculate the following Kanas 2018 income...

-

Kana is a single wage earner with no dependents and taxable income of $155,000 in 2017. Her 2017 withholding was $32,000. Her 2016 taxable income was $151,000 and tax liability was $35,317. Calculate...

-

Michele is single with no dependents and earns $32,000 this year. Michele claims exempt on her Form W-4. Which of the following is correct concerning her Form W-4? a. Michele may not under any...

-

Consider the example in Exhibit 5.5. Can you think of anything else you might do with that example that would be helpful to the ultimate decisionmaker? exhibit 5.5 Decision Tree Analysis Using Net...

-

The marbled murrelet is a seabird on the list of endangered species. Pacific Lumber Co. received permission to harvest trees from land on which the murrelet nested, on the condition that it would...

-

Understand the concept of pay equity

-

800 on the SAT. It is possible to score higher than 800 on the SAT, but scores above 800 are reported as 800. (That is, a student can get a reported score of 800 without a perfect paper.) In 2007,...

-

On October 1, Natalie King organized Real Solutions, a new consulting firm. On October 31, the companys records show the following items and amounts. Use this information to prepare an October income...

-

Comparative financial statements for Weller Corporation, a merchandising company, for the year ending December 31 appear below. The company did not issue any new common stock during the year. A total...

-

PROBLEM 2.60 Two cables tied together at C are loaded as shown. Determine the range of values of P for which both cables remain taut. 300 W 120 lb

-

Amy is a single taxpayer. Her income tax liability in the prior year was $3,803. Amy earns $50,000 of income ratably during the current year and her tax liability is $4,315. In order to avoid...

-

Sherina Smith (Social Security number 785-23-9873) lives at 536 West Lapham Street, Milwaukee, WI 53204, and is self-employed for 2020. She estimates her required annual estimated income tax payment...

-

The 60-MHz proton NMR spectrum of 2, 2, 3, 3-tetra-chlorobutane consists of a sharp singlet at 25oC, but at -45oC consists of two singlets of different intensities separated by about 10 Hz. Explain...

-

inverse function of f ( x ) = 9 - 8 e ^ x

-

Let = <3,2,-1) = < 1,3 -> W=

-

1. This is a group assignment, and the lecturer will create and finalize assignment groups in week 3/4. (4-5 members in each group). 2. Identify a problem (only one problem relating to OB) in an...

-

Fromthefollowinginformation, preparejournalentriestodistributetransportationexpenses(ontheaverage rate permilepermonthmethod)andstoresexpenses. Truckmileageduringthemonth:...

-

2 Staffing at the Optimal Utilization A large theme park is attempting to staff its check-in desks. Currently, the arrival rate is A = 364.5 customers per hour, and each server can check-in p=81...

-

Most developed economies have some illegal immigrants. The United States has the largest number of illegal immigrants in the country: approximately 10 to 11 million. Without legal US identification...

-

Which of the following gives the range of y = 4 - 2 -x ? (A) (- , ) (B) (- , 4) (C) [- 4, ) (D) (- , 4] (E) All reals

-

Tom has a successful business with $100,000 of taxable income before the election to expense in 2019. He purchases one new asset in 2019, a new machine which is 7-year MACRS property and costs...

-

Derek purchases a small business from Art on June 30, 2019. He paid the following amounts for the business: Fixed assets...........................$180,000...

-

William sold Section 1245 property for $25,000 in 2019. The property cost $38,500 when it was purchased 5 years ago. The depreciation claimed on the property was $19,200. a. Calculate the adjusted...

-

In the context of portfolio theory, what is diversification primarily intended to do ? A ) Increase returns. B ) Reduce risk. C ) Maximize tax efficiency. D ) Simplify investment management.

-

4. The risk-free rate of return is 3.78% and the market risk premium is 6.42%. What is the expected rate of return on a stock with a beta of 1.09?

-

Maddox Resources has credit sales of $ 1 8 0 , 0 0 0 yearly with credit terms of net 3 0 days, which is also the average collection period. Maddox does not offer a discount for early payment, so its...

Study smarter with the SolutionInn App