Sherina Smith (Social Security number 785-23-9873) lives at 536 West Lapham Street, Milwaukee, WI 53204, and is

Question:

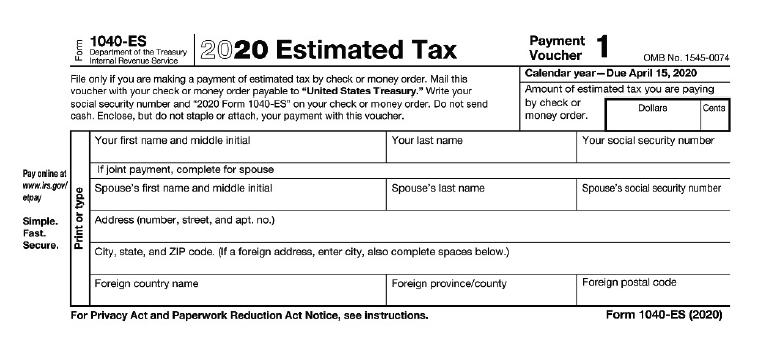

Sherina Smith (Social Security number 785-23-9873) lives at 536 West Lapham Street, Milwaukee, WI 53204, and is self-employed for 2020. She estimates her required annual estimated income tax payment for 2020 to be $8,468. She was required to pay $254 when she timely filed her prior year tax return. Complete the first quarter voucher below for Sherina for 2020.

Transcribed Image Text:

Pay online at www.lrs.gov/ etpay Simple. Fast. Secure. 1040-ES Department of the Treasury Internal Revenue Service 2020 Estimated Tax File only if you are making a payment of estimated tax by check or money order. Mail this voucher with your check or money order payable to "United States Treasury." Write your social security number and "2020 Form 1040-ES" on your check or money order. Do not send cash. Enclose, but do not staple or attach, your payment with this voucher. Your first name and middle initial Your last name Print or type If joint payment, complete for spouse Spouse's first name and middle initial Spouse's last name Address (number, street, and apt. no.) City, state, and ZIP code. (If a foreign address, enter city, also complete spaces below.) Foreign country name Foreign province/county For Privacy Act and Paperwork Reduction Act Notice, see instructions. Payment Voucher OMB No. 1545-0074 Calendar year-Due April 15, 2020 Amount of estimated tax you are paying by check or money order. Dollars Centa Your social security number Spouse's social security number Foreign postal code Form 1040-ES (2020)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

For 2020 Estimated Tax File only if you are making a payment of estimated tax by check or money orde...View the full answer

Answered By

Nidhul Vn

Hi, i'm Nidhul vn.i love teaching,especially doing problem in physics and i take tutions for physics students for 1 year.Everything nature contain physics.It's one the another subject which can reveal the screats in universe which is still unknown.I am glad to help you in solivng problems in physics.Thank you.

0.00

0 Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Sherina Smith (Social Security number 785-23-9873) lives at 536 West Lapham Street, Milwaukee, WI 53204, and is self-employed for 2019. She estimates her required annual estimated tax payment for...

-

Sherina Smith (Social Security number 785-23-9873) lives at 536 West Lapham Street, Milwaukee, WI 53204, and is self-employed for 2018. She estimates her required annual estimated tax payment for...

-

Alice West (Social Security number 785-23-9873) lives at 13234 Madison Street, Milwaukee, WI 53214, and is self-employed for 2016. She estimates her required annual estimated tax payment for 2016 to...

-

United Research Associates (URA) had received a contract to produce two units of a new cruise missile guidance control. The first unit took 4,000 hours to complete and cost $ 30,000 in materials and...

-

Tariq Ahmad decided to dispose of some of his laboratorys hazardous chemicals by shipping them to his home in Pakistan. He sent the chemicals to Castelazo (a company in the United States) to prepare...

-

Understand the concept of job evaluation

-

Womens SAT scores. The average performance of women on the SAT, especially the math part, is lower than that of men. The reasons for this gender gap are controversial. In 2007, college-bound senior...

-

A machine with a book value of $250,000 has an estimated six-year life. A proposal is offered to sell the old machine for $243,000 and replace it with a new machine at a cost of $320,000. The new...

-

The following balance sheet information is provided for Greene Company for Year 2: What is the company's quick (acid-test) ratio? (Round your answer to 2 decimal places.) Multiple Choice 3.19 166 138...

-

Jamie Lee Jackson, age 26, is in her last semester of college and is anxiously waiting for graduation day that is just around the corner! She still works part-time as a bakery clerk, has been...

-

Kana is a single wage earner with no dependents and taxable income of $168,700 in 2020. Her 2019 taxable income was $155,000 and tax liability was $31,375. Calculate the following (note: this...

-

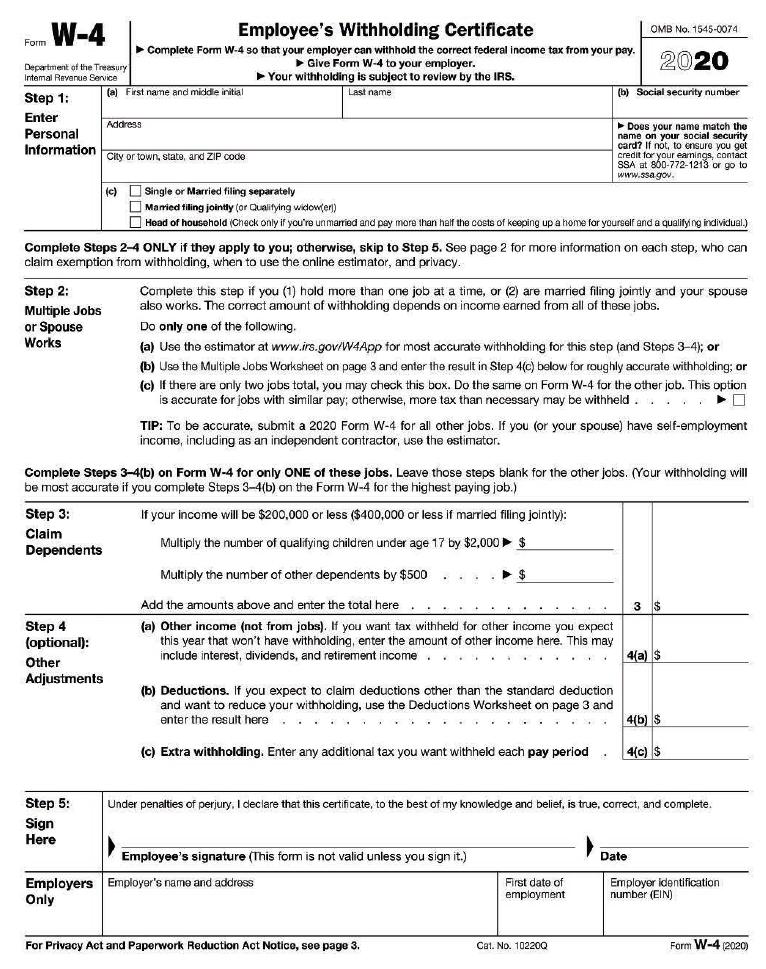

Sophie is a single taxpayer. For the first payroll period in July 2020, she is paid wages of $2,200 monthly. Sophie claims one allowance on her pre-2020 Form W-4. . a. Use the percentage method to...

-

The following accounts were taken from the financial statements of Orville Company. ______ Interest revenue ______ Common stock ______ Utilities payable ______ Accumulated depreciationequipment...

-

If f ( x ) = ( 1 3 - In ( x ) ) ^ 8 , determine f ' ( 1 ) .

-

1. ThestocksAandBhavethefollowingdistributionsofreturns. A B Probability State1 3 4 0.2 State2 5 2 0.3 State3 4 8 0.2 State4 6 5 0.1 State5 6 1 0.2 2....

-

Define nested designs. Explain why the nested designs are important.

-

3 x y 3 + x y = l n ( x ) solve for d y d x

-

Let ln ( xy ) + y ^ 8 = x ^ 7 + 2 . Find dy / dx .

-

Suppose you work for a New Zealand company exporting a container of kiwis to Haiti or Iraq. The customs official informs you that there is a delay in clearing your container through customs, and the...

-

For the following exercises, write the polynomial function that models the given situation. Consider the same rectangle of the preceding problem. Squares of 2x by 2x units are cut out of each corner....

-

Carey exchanges land for other land in a qualifying like-kind exchange. Careys basis in the land given up is $115,000, and the property has a fair market value of $150,000. In exchange for her...

-

Your supervisor has asked you to research the following situation concerning Owen and Lisa Cordoncillo. Owen and Lisa are brother and sister. In May 2019, Owen and Lisa exchange land they both held...

-

Amy is a single taxpayer. Her income tax liability in the prior year was $5,178. Amy earns $50,000 of income ratably during the current year and her tax liability is $4,342. In order to avoid...

-

Slow Roll Drum Co. is evaluating the extension of credit to a new group of customers. Although these customers will provide $198,000 in additional credit sales, 13 percent are likely to be...

-

Wendell's Donut Shoppe is investigating the purchase of a new $39,600 conut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings...

-

1.Discuss the challenges faced with Valuing Stocks and Bonds. As part of this discussion, how will the selected item be implemented in an organization and its significance? 2. Discuss how Valuing...

Study smarter with the SolutionInn App