Sophie is a single taxpayer. For the first payroll period in July 2020, she is paid wages

Question:

Sophie is a single taxpayer. For the first payroll period in July 2020, she is paid wages of $2,200 monthly. Sophie claims one allowance on her pre-2020 Form W-4. .

.

Transcribed Image Text:

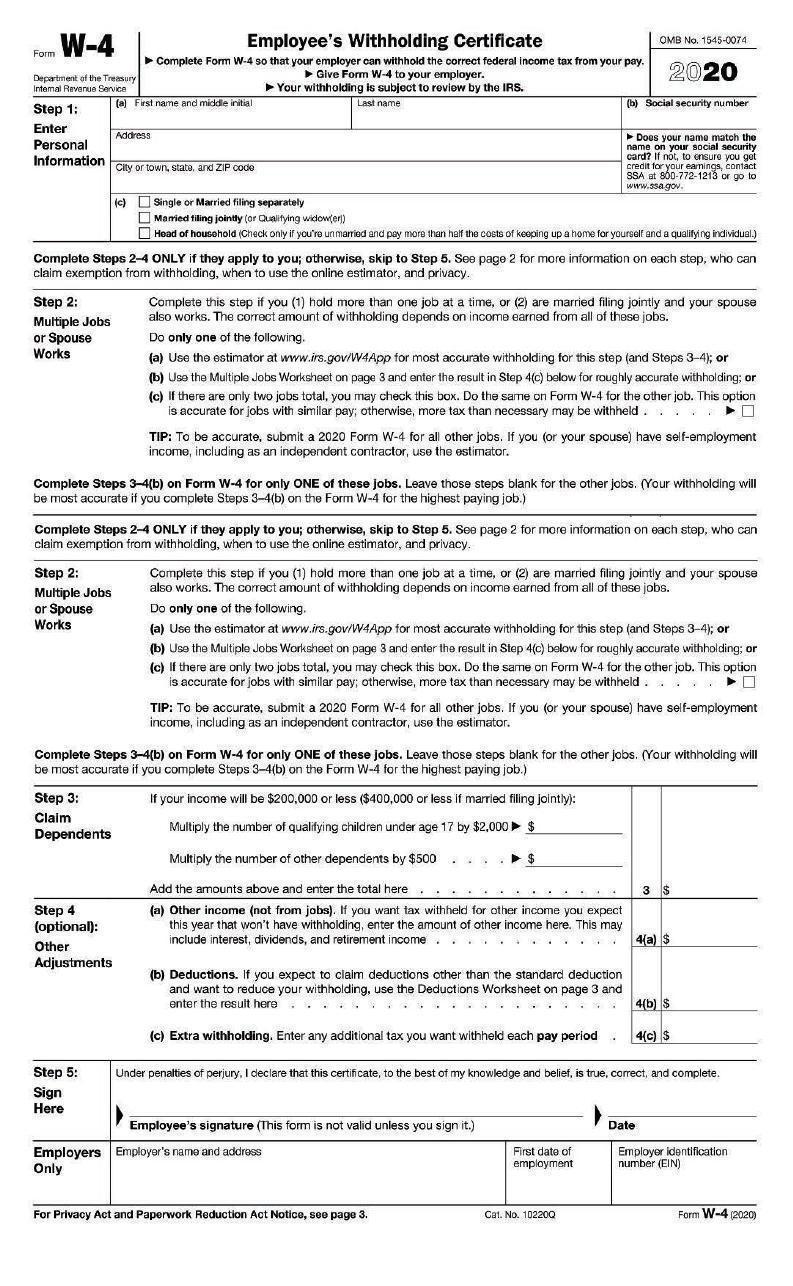

a. Use the percentage method to calculate the amount of Sophie's withholding for a monthly pay period. b. Use the wage bracket method to determine the amount of Sophie's withholding for the same period. $. c. Use the percentage method assuming Sophie completed a 2020 Form W-4 and checked only the single box in Step 1(c). d. Use the wage bracket method using the same assumptions in part c of this question.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 25% (4 reviews)

a Withholding from Percentage Method Tables for pre...View the full answer

Answered By

Grace Igiamoh-Livingwater

I am a qualified statistics lecturer and researcher with an excellent interpersonal writing and communication skills. I have seven years tutoring and lecturing experience in statistics. I am an expert in the use of computer software tools and statistical packages like Microsoft Office Word, Advanced Excel, SQL, Power Point, SPSS, STATA and Epi-Info.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Use the following summation formulas to simplify the expression for Ck in Example 9.19: ko (2k and 4

-

Sophie is a single taxpayer. For the first payroll period in October 2014, she is paid wages of $3,250 monthly. Sophie claims three allowances on her Form W-4. a. Use the percentage method to...

-

Sophie is a single taxpayer. For the first payroll period in October 2012, she is paid wages of $3,250 monthly. Sophie claims three allowances on her Form W-4. a. Use the percentage method to...

-

The MRP gross requirements for Item A are shown here for the next 10 weeks. Lead time for A is three weeks and setup cost is $ 10. There is a carrying cost of $ 0.01 per unit per week. Beginning...

-

Is the anti-taking provision of the ESA constitutional? The red wolf used to roam throughout the southeastern United States. Owing to wetlands drainage, dam construction, and hunting, this wolf is...

-

Learn when to use the various job analysis methods

-

Are we getting smarter? When the Stanford-Binet IQ test came into use in 1932, it was adjusted so that scores for each age group of children followed roughly the Normal distribution with mean 100 and...

-

Refer to Problem P22- 47B. Additional data for Beta Batting Company: a. Capital expenditures include $ 40,000 for new manufacturing equipment, to be purchased and paid in the first quarter. b. Cash...

-

please help!! A manufacturing company reports the following information Raw materials inventory, ending Raw materials used Current Year $ 175,000 2,013,000 1 Year Ago $ 191,000 2,528,500 2 Years ago...

-

In the file MajorSalary, data have been collected from 111 College of Business graduates on their monthly starting salaries. The graduates include students majoring in management, finance,...

-

Sherina Smith (Social Security number 785-23-9873) lives at 536 West Lapham Street, Milwaukee, WI 53204, and is self-employed for 2020. She estimates her required annual estimated income tax payment...

-

In 2020, Ben purchases and places in service a new auto for his business. The auto costs $57,000 and will be used 100 percent for business. Assuming the half-year convention applies and Ben does not...

-

A box must enclose 4 cubic feet of volume. You must choose the height, length, and width of the box. Top and bottom sides of the box cost 30 cents per square foot, and the other four sides of the box...

-

Administrators at International University are curious how students' GPAs after their first year compare to their high school GPAs. They plan on taking an SRS of 80 of the 900 freshmen to look up...

-

( 8 x - x ^ 2 ) / ( x ^ 4 ) what is the derivate.

-

Solve for x . log 1 0 ( 4 x ) log 1 0 ( x 3 ) = 1

-

Let f ( x ) = ( 8 x - 4 x ^ 2 ) It is ^ x . Find the inflection points

-

f ( x ) = sin ( x ) / ( 2 * x ^ 2 + 4 ) , differentiate using quotient with respect to x

-

Why is the fight against corruption a long-term battle?

-

Does log 81 (2401) = log 3 (7)? Verify the claim algebraically.

-

Which of the following is not true about FICA taxes? a. The FICA tax has two parts, Social Security (Old Age, Survivors, and Disability Insurance) and Medicare. b. In 2019, the maximum wage base for...

-

Terry worked for two employers during 2019. The amount of wages paid to Terry by both employers totaled $168,400 and the employers properly withheld both income and employment taxes. As a result of...

-

Rans wage income is $47,350 in 2019. The combined employer and employee FICA tax rates that apply to Rans wages are: a. 15.3% for Social Security and Medicare b. 6.2% for Social Security and Medicare...

-

Which of the following programs covers custodial care? A HMOs B Medicare Part B C PPOs D Medicare Part A E Medicaid

-

uppose a taxpayer has exhausted his lifetime exclusion amount and has $14 million. a. Assuming a flat 40% gift tax rate, what is the maximum amount a taxpayer can transfer to her daughter (and still...

-

Physical Units Method, Relative Sales Value Method Farleigh Petroleum, Inc., is a small company that acquires high - grade crude oil from low - volume production wells owned by individuals and small...

Study smarter with the SolutionInn App