Lamden Company paid its employee, Trudy, wages of $47,000 in 2018. Calculate the FICA tax: Withheld from

Question:

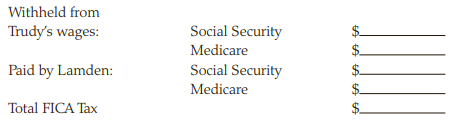

Lamden Company paid its employee, Trudy, wages of $47,000 in 2018. Calculate the FICA tax:

Transcribed Image Text:

Withheld from Trudy's wages: Social Security Medicare Paid by Lamden: Social Security $. Medicare Total FICA Tax

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (8 reviews)

Trudy Social Security 47000 x 62 2...View the full answer

Answered By

Poonam Chaudhary

I have 15 month+ Teaching Experience

5.00+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Mc Glaun Company pays its employees every two weeks. The rm last paid its employees on September 20. For the last ten days of the scal year ending September 30, company employees earned gross...

-

Jenny earns $34,500 in 2015. Calculate the FICA tax that must be paid by: Social Security Medicare Jenny ey's Employer Total FICA Tax Social Security Medicare

-

Jenny earns $44,500 in 2016. Calculate the FICA tax that must be paid by: Jenny: Jenny's Employer Total FICA Tax Social Security Medicare Social Security Medicare

-

The adjusted trial balance for Windsor Company, Ltd. is presented in E4-8. WINDSOR COMPANY, LTD. Adjusted Trial Balance July 31, 2017 Instructions (a) Prepare an income statement and a retained...

-

Sonic Corp. runs the largest chain of drive-in restaurants in the United States. In its 2010 10 K, Sonic reported the following changes in the Allowance for Doubtful Accounts (in thousands):...

-

Graph the system of linear inequalities. 2 + 2 0 2 + 2 2

-

8. What are the steps in the process of controlling?

-

Wayne Casting, Inc., produces a product made from a metal alloy. Wayne buys the alloy from two different suppliers, Chillicothe Metals and Ames Supply, in approximately equal amounts because of...

-

Why do we use the after-tax cost of long-term debt instead of the pre-tax cost of long-term debt to calculate the weighted average cost of capital?

-

Which of the graphs in Fig. Q25.12 best illustrates the current I in a real resistor as a function of the potential difference V across it? Explain. Figure Q25.12 (a) (b) (c) (d)

-

Amy is a single taxpayer. Her income tax liability in the prior year was $5,178. Amy earns $50,000 of income ratably during the current year and her tax liability is $4,372. In order to avoid...

-

Jane is a single taxpayer with a current year AGI of $181,000 and current year income tax liability of $39,610. Her AGI in the prior year was $150,400 and prior year tax liability was $32,182. Jane...

-

In American college football, Rivals.com constructs a widely followed index for rating colleges based on the high school players they recruit and Jeff Sagarin constructs a highly regarded system for...

-

A 447 gram cart (mA) slides along a very smooth track and collides with a stationary 475 gram cart (mB). A motion detector records the velocity of cart A, as shown in Figures 1 and 2. A force probe...

-

M8 Homework i Saved 1 Mayfair Company completed the following transactions and uses a perpetual inventory system. Help Save & Exit Submit Check my work 10 points eBook Print References June 4 Sold...

-

Free Response Table Problem x -6 -80 -4 -3 f(x) 1.948 1 0 -2 -2.005 -798 undefined -2 -1.995 0 1 1.995 2 2.005 6 80 802 4 3.333 3.001 undefined 2.998 2.5 2.048 23. The table above represents values...

-

5. [-/0 Points] DETAILS OSPRECALC1 2.2.106. Use algebra to find the point at which the line f(x) = -x 258 -X+ intersects the line h(x) = x+ 91 + 25 10 (x, y) = Additional Materiale MY N

-

What does the graph tells? from your own understanding. CoursHeroTranscribedText 136 DIVIDED ATTENTION COUNTED TIME BACKWARDS 134 1 2 3 130 136 UNDIVIDED ATTENTION COUNTED TIME BACKWARDS 134 5 132...

-

A certain molecule fluoresces at a wavelength of 400 nm with a half-life of 1.0 ns. It phosphoresces at 500 nm. If the ratio of the transition probabilities for stimulated emission for the S* S to...

-

For Problem estimate the change in y for the given change in x. y = f(x), f'(12) = 30, x increases from 12 to 12.2

-

Define income in respect of a decedent and provide an example of IRD.

-

The 3.8 percent Medicare tax on net investment income applies to: a. Tax-exempt interest income b. Interest and dividends c. IRA distributions d. Wages

-

The 3.8 percent Medicare tax on net investment income applies to: a. Tax-exempt interest income b. Interest and dividends c. IRA distributions d. Wages

-

Regarding research and experimental expenditures, which of the following are not qualified expenditures? 3 a. costs of ordinary testing of materials b. costs to develop a plant process c. costs of...

-

Port Ormond Carpet Company manufactures carpets. Fiber is placed in process in the Spinning Department, where it is spun into yarn. The output of the Spinning Department is transferred to the Tufting...

-

Oct. 31: Paid salaries, $45,000 ( 75% selling, 25% administrtive). Data table Data table them to retail stores. The company has three inventory items: and floor lamps. RLC uses a perpetual inventory...

Study smarter with the SolutionInn App